How to give your finances a spring clean to save money

- Published

Spring is a time of new life, longer days, and - for those who really know how to celebrate the end of a long winter - a moment to review your investment portfolio.

Better known as a season to spring clean around the house, this time of year is also offers an opportunity to dust off the paperwork and spruce up the family finances. It is, after all, the start of the financial year.

The BBC News website asked a range of commentators to suggest the one thing they are doing, or to suggest others consider, to straighten up finances for the year ahead.

Brush up, say bloggers

Lee Balders, Homely Economics blogger

"We have had a spring clean forced upon us by a recent house move. It has been a great motivation to sell lots of our neglected possessions on internet auction sites and turn the clutter into cash, as well as create more space in the house."

Andy Webb, Be Clever With Your Cash blogger

"Gather up all your paperwork, especially any unopened envelopes, and check it all. Look for any payments you do not recognise or direct debits you thought you had cancelled.

"Challenge anything that seems wrong, and claim back any money that could be owed to you, for example from an old energy supplier you have switched away from."

'Get the house in order'

David Hollingworth, London and Country mortgage broker

"Not everyone will keep as close an eye on mortgage rates as perhaps they'd like, so [this] could be a good time to review your mortgage and give it a health check. There is already talk of an impending base rate rise and those paying a high standard variable rate are likely to be the ones most vulnerable to any increase.

"Mortgage rates have been nudging up already, but there are still some extremely attractive deals on offer. These could not only slash your monthly costs now, but also protect against any rate rises to come from the Bank of England."

Kate Faulkner, property market analyst

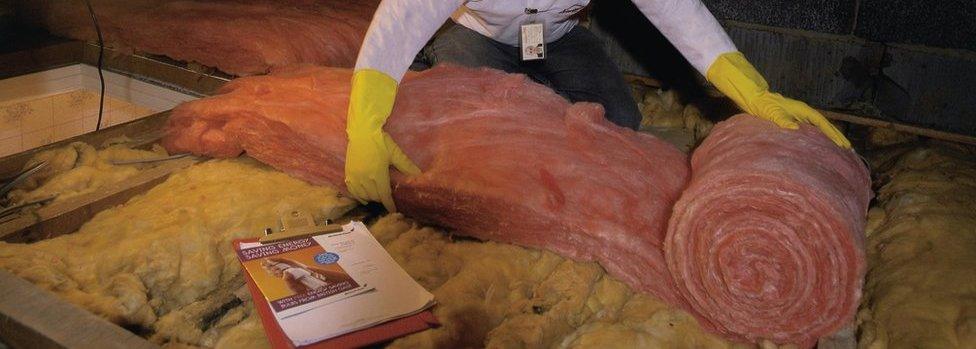

"We have an ageing population and an ageing housing stock. Energy costs are likely to go up. So anyone considering buying a home or renovation work should look at ways of insulating that home. This may be insulating the loft or, if redoing the floor, considering what goes under it. A local surveyor can advise you."

She points out that, since 1 April, landlords can no longer rent out a property with an energy rating of F or G to new tenants. The same will be the case for existing tenants from April 2020.

Dealing with debt

Jonathan Chesterman, debt advice policy manager at StepChange debt charity

"When debt becomes a worry, it can become a habit to avoid opening envelopes or logging in to accounts, so you may not have a full and complete picture of your finances to hand.

"One useful step to help you move forward is to get all the information together in one place. For anyone worried about debt, the most useful action to take is to get some advice. It's straightforward."

If you are really fed up

Jo Causon, chief executive of the Institute of Customer Service

"There is £28bn of lost revenue in a year as a result of poor customer service, such as calling during work time to get something sorted out.

"So when you switch, look in the round rather than just at the price. Is the organisation one that you can trust and is easy to do business with?"

Saving and investing

Richard Stone, chief executive of The Share Centre

"Once you have made sure you have prioritised paying off any credit cards or high interest loans, sit down and work out how much money you have left each month after the bills are paid. Then work out an amount to save each month, and treat that as if it were another bill to be paid each month. Even consider setting it up as a direct debit.

"It is probably best to save into a cash account first but once you have enough put aside for a rainy day - say a few months expenditure covered in cash - then you may want to start investing the money in the stock market with a longer time horizon and an opportunity for capital gains as well as income, although of course the amount you save is at risk.

"Review the amount being saved each month as any pay rises for example may enable you to save a little more."

Anna Sofat, founder of Addidi Wealth

"Check your tax code to ensure it is correct especially if you have made one-off pension contributions.

"Review investments with a view to reviewing risk - it is good practice, once a year, to rebalance your investments back to the recommended asset allocation [how your money is divided up between stocks, bonds and short-term deposits].

"Also review costs - all fund managers and advisers now have to provide greater transparency so check and see what you are paying and whether you can save money by moving to another provider or adviser."

Longer-term pension saving

Patrick Bloomfield, partner and actuary at Hymans Robertson

"Check if your employer will match your contributions if you paid more into your pension. Lots of people just accept a "default" level of contributions, but could choose to pay in a bit more which many companies will match. Not making the most of the contributions your company offers is like forgetting to take part of your pay packet home with you each month.

"Check if your company gives the option of paying pension contributions by salary sacrifice. If you can do this it could save a decent amount in National Insurance contributions and top-up your take home pay.

"Get a quotation of what your pension could be when you retire. Then think about how much you will really need to be able to live on. Most of us are not saving enough, so figure out what your plan should be. Be realistic and think about a combination of things like retiring later perhaps by going part-time or downsizing your home, as well as starting to saving more. The longer you leave it the harder it will be to get back on track."

The material is for general information only and does not constitute investment, tax, legal or other form of advice. You should not rely on this information to make (or refrain from making) any decisions. Always obtain independent, professional advice for your own particular situation.

- Published31 March 2018

- Published2 August 2018