US jobs growth slows in March

- Published

The manufacturing sector added jobs in March

US job growth slowed sharply in March, as employers added 103,000 positions over the month.

The figure was lower than expected, and left the unemployment rate unchanged at 4.1%.

Analysts said the cold weather may have contributed to the slowdown, which was anticipated to some degree after February's blockbuster gains.

The low unemployment rate may also be making it hard to find workers, they said.

Mark Hamrick, senior economic analyst for interest rate tracking website Bankrate.com, said that the March report from the US Labor Department, looked at in isolation, was "on the disappointing side".

"Broader context is appropriate, however," he added. "The job market is widely regarded to be close to full employment. So, hiring gains should be slowing at this point in the expansion."

Wage growth picks up

The US economy has been adding jobs consistently since 2010, one of the longest expansions on record. The growth has pushed the unemployment rate to its lowest level since 2000.

Over the last three months, employers have created an average of 202,000 jobs, the Labor Department said. The number of jobs increased by 326,000 in February, 13,000 more than previously reported.

Job openings remain plentiful, but hiring has lagged.

Sophia Koropeckyj of Moody's Analytics said firms will have to offer a combination of better wages and more flexible practices, conditions and training if they want to continue to bring on workers.

The average hourly wage for private sector workers was $26.82 in March, up 2.7% from a year ago.

That was a slight acceleration from the previous month, but still below the rate of increase when the unemployment rate was last at this level.

Job openings remain plentiful but the rate of hiring has not kept pace

Manufacturing and health care firms drove the job gains last month, while most industries saw little change. The construction sector shed jobs.

The labour force participation rate - the share of the population working or looking for work - slipped to 62.9%. It remains well below the pre-recession rate, a trend expected to persist given the aging of the US population.

The jobs report did little to alter consensus opinion that the labour market remains solid and the Federal Reserve will stick to its plan to raise interest rates gradually.

In a speech in Chicago on Friday, Federal Reserve Chair Jerome Powell appeared to confirm that view, saying he expects inflation to pick up in coming months.

If "the economy continues broadly on its current path, further gradual increases in the federal funds rate will best promote" employment and stable inflation, he said.

Mr Powell noted that wage growth has been modest, but told the audience: "The labour market has been strong, and my colleagues and I ... expect it to remain strong."

Wall Street shares, which tend to benefit from the lower borrowing costs that accompany lower interest rates, tumbled during and after Mr Powell's remarks.

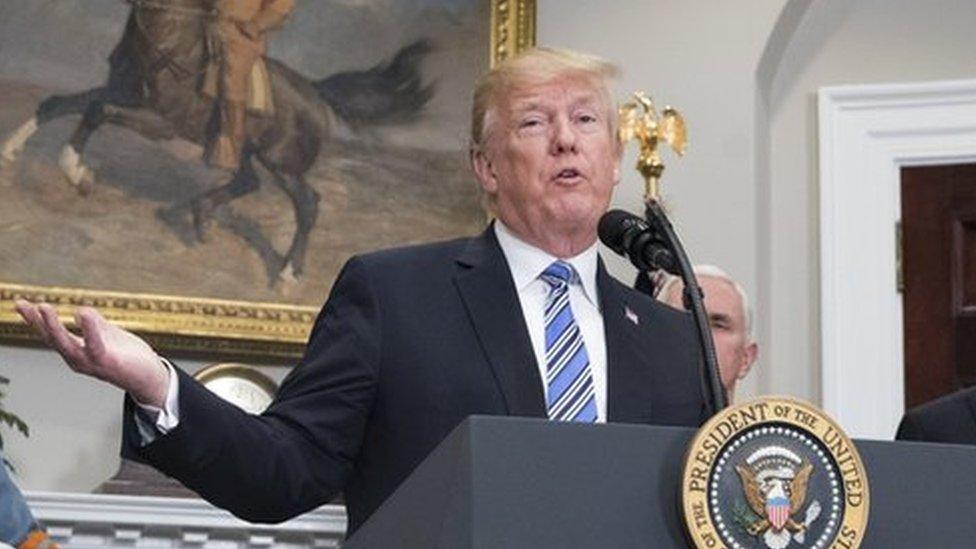

They also started the day lower after US President Donald Trump threatened additional tariffs on Chinese-made goods.

Analysts said the trade tension could disrupt some of the growth in the months ahead, as uncertainty weighs on business activity. Manufacturers and farmers are particularly vulnerable.

- Published5 April 2018

- Published10 March 2018