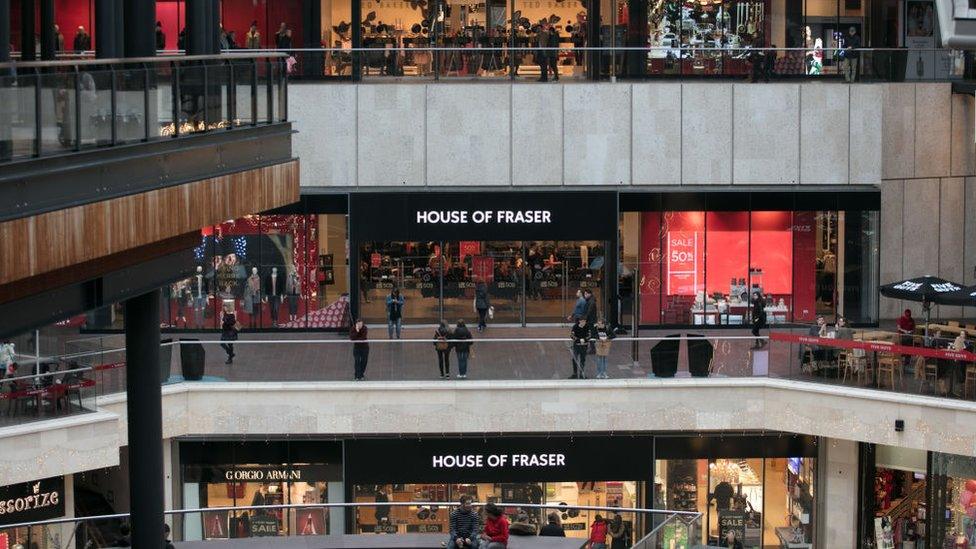

House of Fraser calls in KPMG to draw up turnaround plan

- Published

Department store chain House of Fraser has appointed turnaround specialists to advise it on a restructuring plan which could involve store closures and job losses.

The retailer has called in KPMG to examine all options, including an insolvency process called a Company Voluntary Arrangement (CVA).

House of Fraser has 59 stores, 6,000 staff and 11,500 concession staff.

In January it asked landlords to cut rents, after poor Christmas trading.

Under a CVA House of Fraser would again try to get agreement from landlords to reduce rents and maybe shut some of its 59 stores.

No decision has yet been made on the turnaround route it will pursue.

In a statement a spokesperson said the chain could only confirm that they had appointed KPMG and were "working closely with them to look at options that best support our transformation programme".

Several big High Street names have struggled in the face of online competition, a decline in consumer confidence and rising overheads.

Toys R Us and Maplin went into administration on the same day in February, while New Look and Carpetright have both entered into CVAs,

Mothercare, Debenhams and Homebase are also feeling the pressure.

House of Fraser was acquired by Chinese conglomerate Sanpower in 2014.

In December, the Moody's credit agency downgraded its credit rating for House of Fraser.

It pointed to the company's weak results for the first three quarters of 2017, which it said were due to "both challenging market conditions and company-specific factors".

Disruption while House of Fraser introduced a new web platform and the underperformance of its in-house brands had weighed on the business, Moody's said.

"A recovery in HoF's profitability is dependent upon either an improvement in the company's product offering or in cost-savings initiatives, which each involve execution risks," it added.

- Published12 April 2018

- Published28 February 2018

- Published19 January 2018

- Published5 January 2018