Blind customers locked out by bank web upgrades

- Published

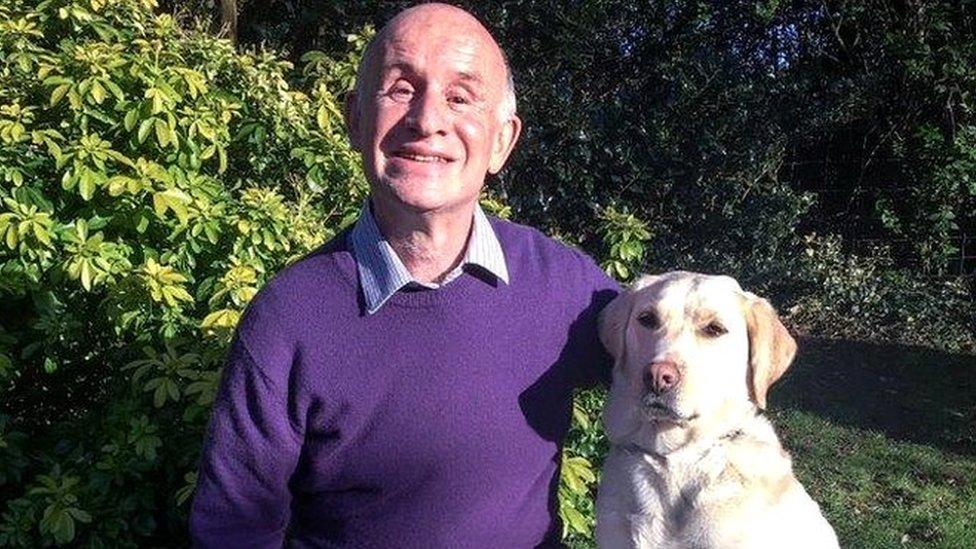

From the "point of view of someone who can't see" his bank's upgrade is "appalling", says Jeff

HSBC, Metro Bank and Halifax have all admitted to failings after redesigning websites that made it hard for their blind or visually impaired customers to access full services online.

When Jeff Bashton needs to transfer cash or pay a bill, he logs on to his bank's website, clicks a few buttons and the job is done. It's quick, easy and efficient. Or at least it used to be - before the bank, HSBC, upgraded its website, with elaborate headings, mortgage offers and banners advertising insurance or foreign currency.

"HSBC, in their infinite wisdom, decided to design an all-singing, all-dancing website," he tells BBC Radio 4's Money Box programme.

"They think they've done a good job," he says, but "from the point of view of someone who can't see, it's an appalling job".

New obstacles

It might look good - but all the extra text on the site makes it almost impossible for Jeff, who is blind, to do his banking on his own.

Jeff uses a screen reader - software with a synthesised voice that reads aloud what's on the screen. So he can find headings, click on links and read bank statements. But the pages must be carefully designed with screen readers in mind.

And if there's too much information scattered throughout, it means basic headings like "transfer money" or "make a payment" get lost in the website's clutter.

Jeff is frustrated that what used to be a simple process has now become unreliable. He's been forced to do telephone banking, which he says takes him longer.

"In the past, I would have given HSBC eight or nine out of 10. Now I wouldn't give it higher than two or three," he laments.

How do screen readers work?

Jeff is not alone. Andy Godfrey, who is also blind, has been struggling to find his bank statements online since HSBC made the changes. Yet when he told the bank about the problem, they replied: "Oh, don't worry, we'll send you a video". He has now changed banks.

In a statement, HSBC told Money Box it has just finished upgrading the site again, and saying "we apologise to those who may have experienced problems accessing the site during this update". Jeff Bashton says now he detects a slight improvement.

No prompts

But HSBC has not been the only bank to cause problems for its blind customers. Metro Bank recently altered its online login page. So instead of one box to type in a full password, the new system introduced three separate boxes, each requiring a single character from the password.

His bank's website upgrades locked Darren Paskell out of his bank account

Because there was no information announcing the changes that the screen reader could pick up, the new process totally stumped Metro Bank customer, Darren Paskell.

"I was typing my whole password in the first box and then going to the login button and obviously it was rejecting it because it was invalid data," he says.

It meant he was locked out of his account, unable to log in or manage his finances independently. It was something Mr Paskell says he found insulting and disempowering.

"It was basically set up to allow me to fail, again and again and again," he asserts.

Metro Bank says its update was not tested "with sufficient accessibility technology"

Darren, who works in IT, spent half an hour on the phone trying to make Metro Bank understand the issue, without success. Eventually, he used his own technical expertise to work out a way of logging into his account.

Metro Bank said: "We have reviewed Mr Paskell's case and would like to apologise for letting him down. The new update wasn't tested with sufficient accessibility technology, meaning screen readers were not able to interpret all fields on the login page."

The bank says it is committed to getting it fixed.

Legal requirement

More than two million people in the UK have vision problems that can't be corrected with prescription glasses. And over a third of a million are registered blind or partially sighted.

Under the Equality Act, firms must not discriminate against anyone by failing to provide them with a service. And that includes banking services. Companies that don't comply could face a claim for damages.

"If you're blind and can't access your banking online then you risk handing over a lot of control to others," says the BBC's Lee Kumutat

In February, Halifax bank altered its website leaving customers like Richard Godfrey-McKay (who is blind, like his brother Andy) unable to read his bank statements online. It took the bank more than two months to rectify the problem and it has left Richard feeling like a second-class citizen.

"If it had been sighted people who couldn't access the website, I'm bloomin' sure that Halifax would have done something about it, pretty darn quick. That 'delay' is totally unacceptable.

"Banks have an anticipatory duty, to ensure that their website offering is accessible to its blind and partially-sighted customers."

Halifax acknowledges there has been a problem and says it was fixed quickly.

UK Finance, which represents the banks, says: "The industry is committed to ensuring services are accessible to everyone and any temporary issues that do arise are resolved as soon as possible."

Early consultation

One bank that claims it's getting things right for blind customers is Barclays. According to its head of digital banking, Paul Smyth, the company involves disabled people right from the start, as part of its development and testing process.

Including them early, he says, makes it easier and cheaper - as illustrated three years ago, when the bank redesigned its mobile banking app.

Including accessibility from the start, Barclays says, is much cheaper than correcting mistakes later on

"We were aware of a number of disabled customer issues with it," Paul Smyth explains.

"To fix those at the time would have cost hundreds of thousands of pounds. But by considering accessibility right from the start and involving disabled customers, it was a fraction - a tenth - of the cost."

So it seems banks can make new and complex websites accessible - if they approach it in the right way.