Tax on pensioners proposed to heal inter-generational divide

- Published

- comments

Inter-generational fairness: One family, three voices

A £10,000 payment should be given to the young and pensioners taxed more, a new report into inter-generational fairness in the UK suggests.

The research and policy organisation, the Resolution Foundation, says these radical moves are needed to better fund the NHS and maintain social cohesion.

Its chairman, Lord Willetts, said the contract between young and old had "broken down".

Without action, young people would become "increasingly angry", he said.

The Resolution Foundation says its goal is to improve outcomes for people on low and modest incomes.

Recommendations include:

Give £10,000 to all young adults at the age of 25, funded by a new "lifetime receipts tax" that would replace inheritance tax

Scrap council tax and replace it with a new property tax targeting wealthier homeowners

Use the proceeds from property tax reform to halve stamp duty for first-time buyers and increase public funding for social care

Make earnings of those above state pension age subject to National Insurance contributions

Lord Willetts, the former universities minister under David Cameron, argued that young people were being locked out of the housing market and older people were worried about the demands of healthcare.

Lord Willetts was speaking as the Resolution Foundation, which he heads, published a report calling for tax changes, external to help heal the growing economic tensions between the generations.

Windfall for young

The foundation's Intergenerational Commission report calls for an NHS "levy" of £2.3bn paid for by increased national insurance contributions by those over the age of 65.

It says that all young people should receive a £10,000 windfall at the age of 25 to help pay for a deposit on a home, start a business or improve their education or skills.

The report proposes that this money be raised by abolishing inheritance tax and replacing it with a lifetime limit for recipients of £125,000 before taxes kick in.

The commission estimates this would raise £5bn.

"We've got a very serious problem of ensuring there's a fair deal across the generations," Lord Willetts told me.

"Older people are worried about a properly funded healthcare system, people in middle age still haven't been able to buy their own home, and for younger people their pay is no better than it was 10 or 15 years ago.

"So the different generations in the UK all face different pressures.

"But we can tackle them, we can do something about it."

Lord Willetts says there is a divide between older and younger people

The report calls for the scrapping of the council tax system, replacing it with a new property tax which would raise more money from wealthier homeowners.

The proceeds would be used to halve stamp duty for first-time buyers.

The cross-party commission, which included input from the heads of the CBI business lobby group and the Trades Union Congress, also demands more secure tenancies for renters.

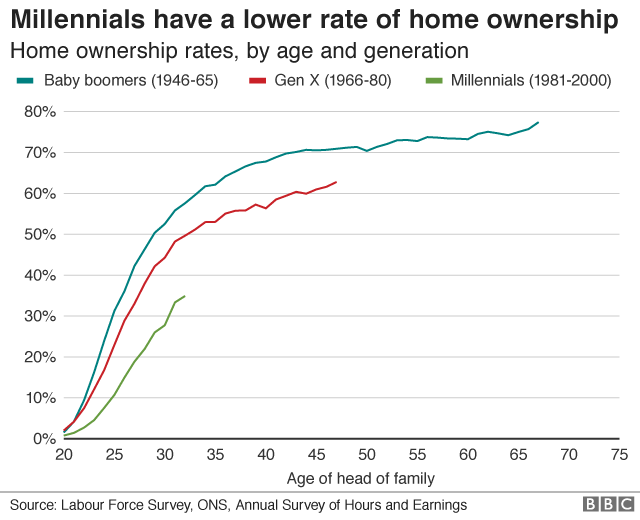

Millennials - people born between 1981 and 2000 - are half as likely as baby boomers - born between 1946 and 1965 - to own their own home by 30.

Lord Willetts said that a lot of the problems had been created by political inertia by a series of governments.

'Broken down'

"I think we still care about it," Lord Willetts said.

"We still feel the obligations that generations have to each other, and families are incredibly important in discharging those obligations.

"But when you look at public policy, sadly when it comes to a properly funded healthcare system, houses available so that people can achieve their goal of owner-occupation and a fair deal in pay for younger people - in all those ways, that contract between the generations has not been maintained.

"That contract has broken down. Families are doing their best, the bank of mum and dad helping out the kids, younger people caring about their grandparents, but when you look at public policy, there are older people worried about their social care, there are people of middle age who still aren't owner-occupiers, and that's what they want to be, and there are younger people whose pay is no higher than it was 10 or 15 years ago, so there's a problem in public policy."

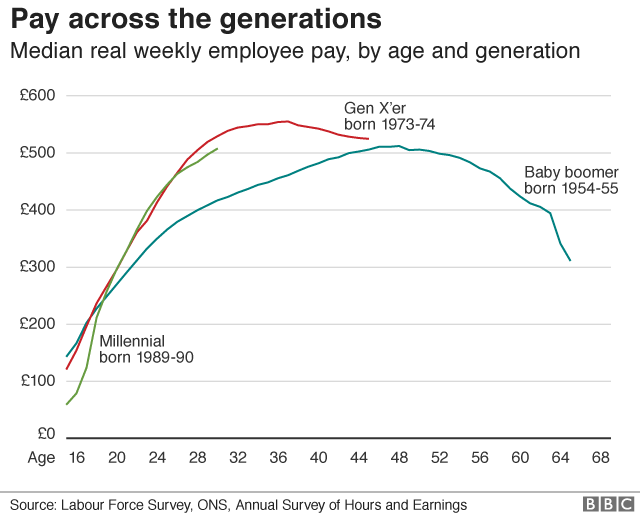

New research produced by the Resolution Foundation revealed that young people are earning less today than the generation before them was earning at the same age.

It showed that home ownership levels are far lower.

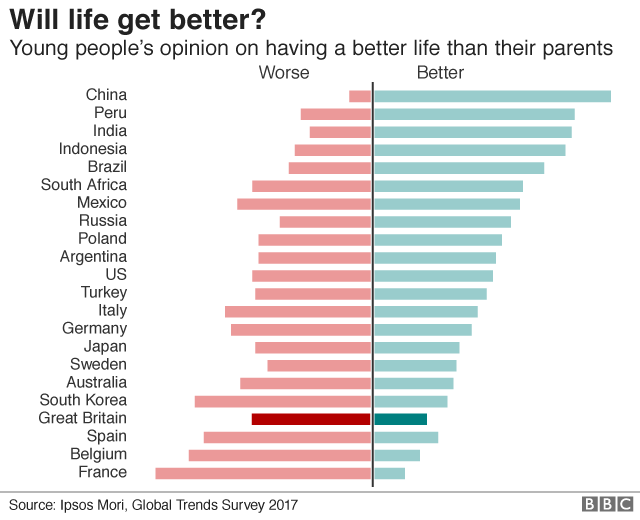

And a poll undertaken for the Intergenerational Commission also suggested people were more pessimistic in Britain about the chances of the next generation having "better lives" than the one before it - compared with almost any other country.

I asked Lord Willetts whether any government would have the stomach for increasing taxes on pensioners, for example, given that Theresa May was unable to push through a tax increase for the self-employed last year because of a public and Parliamentary backlash.

"There's no avoiding the pressures for more spending on healthcare and social care, the question is how we meet those pressures," he replied.

"Extra borrowing is unfair on the younger generation.

"Extra taxes on the working population - when especially younger workers have not really seen any increase in their pay - will be very unfair.

"It so happens that the older people who will benefit most from extra spending on health care have got some resources, so at low rates, it's reasonable to expect them to contribute.

"It is better than any of the alternatives."

Private contributions

The foundation also suggests that wealthier people should contribute privately to a social insurance system to help pay for social care in older age.

The system would mirror elements of compulsory health insurance policies in Germany.

"We do think that there needs to be some element of private payment into social care costs when people can afford it," Lord Willetts said.

"But we're absolutely clear there should be a limit on those contributions, so that people don't face a very large bill that could wipe out their wealth.

"There should be an upper limit on it, and everybody should expect some contribution from the state.

"We want everything to be fair and affordable."

- Published8 May 2018

- Published13 February 2018

- Published4 January 2018