Vodafone makes €18bn swoop on Liberty Global cable networks

- Published

Vodafone will pay €18.4bn (£16.1bn) for cable networks in Germany and eastern Europe owned by US firm Liberty Global.

The deal will allow Vodafone to expand its mobile, TV and broadband services in Hungary, Romania and Czech Republic.

It will also create a stronger "quad play" competitor for Deutsche Telekom in Germany.

The long-expected deal with Liberty Global, which also owns Virgin Media, is Vodafone's biggest since its £112bn takeover of Mannesmann in 2000.

Vodafone said the transaction, which includes Unitymedia in Germany, would create a "converged national challenger" in the country.

Deutsche Telekom, which is Europe's biggest telecoms operator by revenue and owns T-Mobile, has voiced strong objections to the move.

Its chief executive, Timotheus Höttges, said it would distort competition: "I personally will fight for fair competition for our customers, to ensure that we do not face a disadvantage."

He has also questioned whether regulators would approve the tie-up.

However, Vodafone chief executive Vittorio Colao said that deal "creates a strong competitor to Deutsche".

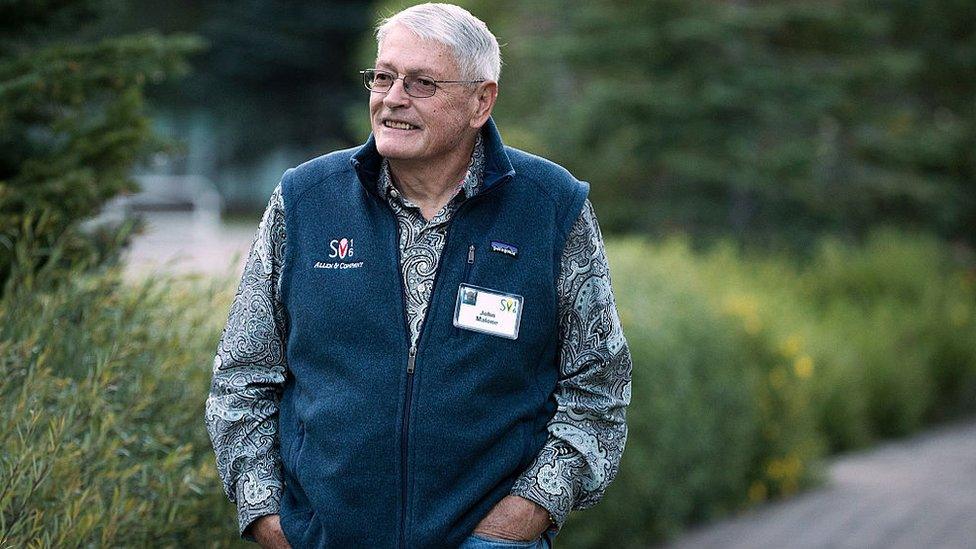

John Malone controls Liberty Global

Vodafone already owns the largest cable business in Germany after it acquired Kabel Deutschland for €7.7bn five years ago.

Unitymedia is the second-largest cable network, operating in the three of Germany's 16 states that Vodafone does not already cover.

Mr Colao said that there was "no geographical overlap" between the two businesses.

Mike Fries, chief executive of Liberty Global, said: "Even together, Liberty Global and Vodafone, whose cable networks don't compete or overlap, will be half the size of the incumbent operator. It's time to alter market dynamics by unleashing greater investment and competition."

Vodafone offers only mobile services in Hungary, Romania and the Czech Republic, but buying Liberty's cable business will allow to expand into TV and broadband in those markets.

As part of the deal, the company will pay Liberty Global €10.6bn in cash, which the US business said would "provide significant additional flexibility to optimise growth and shareholder returns".

Vodafone has also agreed to a €250m break fee if the acquisition does not complete.

Shares in Vodafone rose 1.2% to 210.1p in morning trading in London.

- Published24 April 2018

- Published2 February 2018