Travellers hit by hidden currency fees

- Published

- comments

UK travellers are paying thousands in hidden fees when buying foreign cash, according to three technology companies including currency firm Transferwise.

Their survey of 8,000 customers has highlighted failings in the foreign exchange market that were flagged up by the government's own research unit in a recent report.

Fewer than half of those surveyed were able to pick the best of four foreign exchange deals using the information typically provided by suppliers such as banks, post offices and bureaux de change.

That finding comes from analysis by the Behavioural Insights Team - better known as the government's "nudge unit".

Most suppliers provide a fee or commission charge as well as an exchange rate. Most of the money they make does not come from commissions or fees but by offering a poor exchange rate.

Where can I find the cheapest travel money?

What they fail to reveal is the rate at which they purchase the currency sold to customers - the market or wholesale rate.

While this number can be found online at sites such as xe.com, external, most customers fail to do so. The difference between the two essentially represent hidden costs to the consumer - and hidden profits for the providers.

The report found that many providers stressed features like 0% commission or zero fees, which deflect consumer attention from the actual exchange rate they are being offered.

Capital Economics estimate that individuals and businesses are being charged nearly £6bn a year in fees without realising it.

Elisabeth Costa from the government's Behavioural Insights Team said: "Small businesses and consumers in the UK are charged billions each year in hidden foreign exchange transaction fees. We found that adding clearer information, particularly total costs in pounds, greatly increased consumers' ability to identify the best value deal."

The Behavioural Insights trial found that more information led to better decision making. When all fees were broken down and expressed in a total amount paid in pounds, the number of people who identified the best deal rose from less than half to two thirds.

But hang on a minute: consumers are not used to paying wholesale prices for bread milk or cheese - so is it unrealistic to expect to pay wholesale prices for foreign currency?

That may be true, says Kristo Käärmann from Transferwise, which matches buyers and sellers of currency online and competes with banks and bureaux de change for foreign exchange business.

However, he says customers are not getting the same level of transparency that users of other financial products, such as loans or credit cards, are presented with to make an informed choice. Even utility bills show the wholesale cost of the energy and breakdown other charges.

"It's fine to charge a fee for the service but people should know what that fee is rather than hiding it from customers who think they are paying zero or negligible fees," Käärmann says.

Worst rates

Transferwise is one of three tech companies that commissioned research by Yougov and Consumer Intelligence. It calculated that the average Brit will pay more than £5,000 in hidden fees over their lifetime, with people who retire abroad or own holiday homes paying far more.

When inflation is factored in over a lifetime of travel, that figure rises to nearly £17,000.

Transferwise clearly has an interest in disrupting the traditional suppliers, but the problem is real according to the government's own analysis.

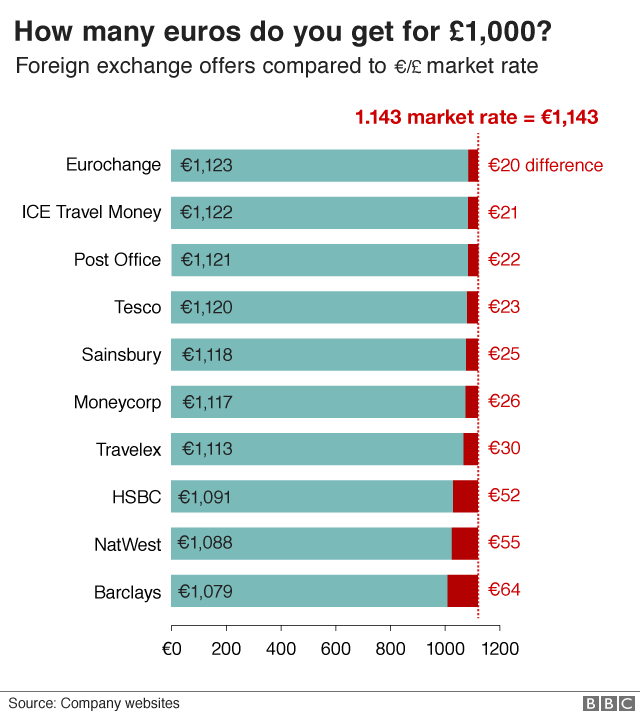

A snapshot of foreign exchange fees from a variety of suppliers show that banks offer some of the worst rates. That is important because many businesses will routinely use their banks to complete transactions in foreign currency.

Holidaymakers will also often tend to use card payments or take money out of ATMs abroad rather than take large amounts of cash.