Government loses £2.1bn on RBS stake sale

- Published

- comments

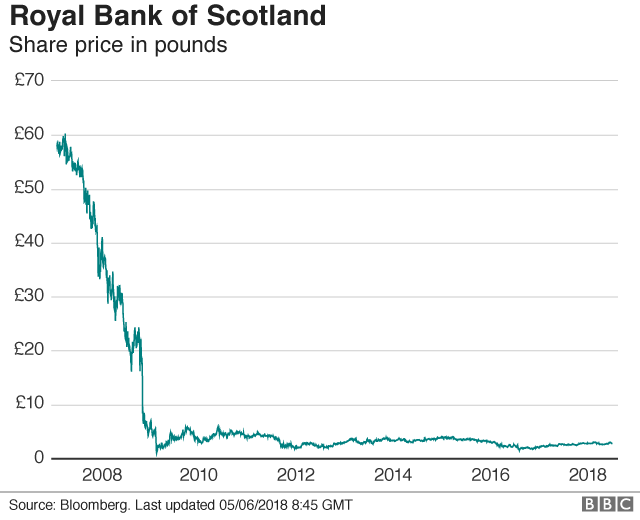

The government has incurred a loss of £2.1bn after selling another tranche of shares in Royal Bank of Scotland.

The shares were sold at 271p each, almost half the 502p a share paid in the government's bailout of RBS a decade ago when it rescued the bank at the height of the financial crisis.

The return was "based on the reality of the situation that RBS is now in", said Treasury Economic Secretary John Glen.

The taxpayers' holding in RBS will fall to 62.4% from 70.1% due to the sale.

Mr Glen told the BBC's Today programme that the bank was in a "much healthier position... and the taxpayer needs to receive some of that money back".

"I would love it if we could sell the shares at a much higher price. Obviously that is what everyone would like to do, but we need to be realistic and look at the market conditions."

He said RBS was "a completely different institution to where it was 10 years ago".

"They've gone from operating in 38 countries to nine, their total assets have fallen significantly."

Analysis

By Simon Jack, BBC business editor

The government has proved a lousy investor - but that misses the point. This was not an investment it was a rescue. The government had no choice - without the government buying shares, RBS would have collapsed taking the UK economy with it.

Does it matter that we are selling at a loss? Well, yes, it would be nice to have made a few pounds. Does that mean it's a mistake to start selling now? Not necessarily.

The government does not want to be the majority shareholder in a High Street bank. Waiting for the RBS share price to rise back to £5 could take another 10 years and, in the meantime, other investors would be put off investing because the know that one day there is going to be a massive seller of the shares - pushing the price down.

The hope is that over time, the gradual reduction in the government stake will make the shares more attractive and subsequent sales will be at higher prices. The other hope is that the government never has to get into the business of buying bank shares again

Value 'destroyed'

UK Government Investments, which manages the government's RBS stake, said the sale had raised £2.5bn.

The sale is the first time that the government has cut its stake in RBS since 2015, when a 5.4% stake was sold at a price of 330p a share.

The government has said it intends to sell £15bn worth of RBS shares by 2023.

After the details of the latest share sale were announced, RBS shares fell by about 3% to 271p.

Investec analyst Ian Gordon said the timing of the share sale was "not unreasonable", pointing out that the shares had been trading at close to their highest level for two years.

He said a combination of bad debts and restructuring costs had "destroyed the value of the business".

Labour's shadow chancellor, John McDonnell, had earlier criticised the government's sale plans, saying there was "no economic justification" for selling the shares due to the "large loss" to the taxpayer.

But Chancellor Philip Hammond said the sale was "a significant step in returning RBS to full private ownership and putting the financial crisis behind us".

"The government should not be in the business of owning banks. The proceeds of this sale will go towards reducing our national debt - this is the right thing to do for taxpayers as we build an economy that is fit for the future," he added.

RBS chief executive Ross McEwan said the sale was "an important moment for RBS".

"It also reflects the progress we have made in building a much simpler, safer bank that is focused on delivering for its customers and its shareholders," he added.

In February, the bank reported an annual profit of £752m - its first for a decade and a sharp turnaround from the £6.95bn loss seen the previous year.

- Published10 May 2018

- Published1 May 2018

- Published27 April 2018

- Published23 February 2018