Pound falls on weak economic figures

- Published

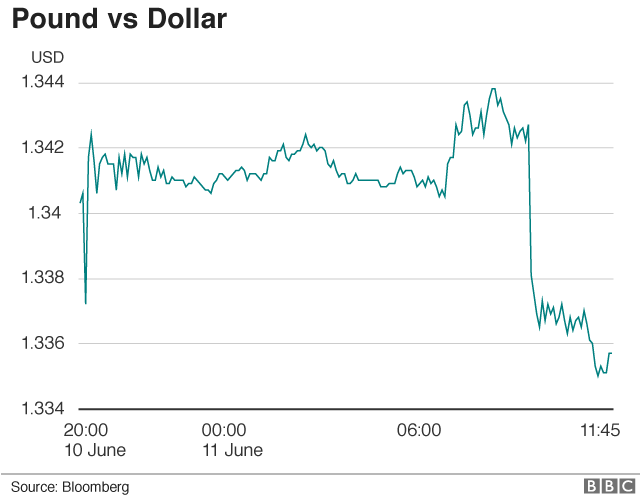

The pound has fallen sharply following data suggesting a sluggish economy.

Manufacturing output fell 1.4% in April, the biggest fall for nearly six years, according to the Office for National Statistics (ONS)., external

Another ONS report showed only a modest rebound in construction output, after a sharp contraction in March.

The pound fell three quarters of a cent after the data was released to $1.3350. Analysts say the data has eased pressure for a rise interest rates.

"This data could fuel Bank of England concerns and uncertainties over the economy and there can be very little doubt that the Monetary Policy Committee (MPC) will leave interest rates unchanged at their June meeting next week," said Howard Archer, chief economic advisor to the EY ITEM Club.

"The data also makes an August interest rate hike by the Bank of England look a lot more questionable," he added.

Manufacturing output fell by 1.4% in April compared with March, the biggest month-on-month fall since October 2012.

The wider measure of industrial output also fell, dropping by 0.8% in April.

"International demand continued to slow and the domestic market remained subdued," said ONS statistician Rob Kent-Smith.

Construction output rose by 0.5% month-on-month in April, having fallen by 2.3% in March.

Trade data was also released on Monday.

The UK's trade deficit in April was the widest since September 2016 driven in particular by falls in exports of aircraft, pharmaceuticals and machinery.

The deficit in goods and services widened to £5.28bn from £3.22bn in March.

The goods trade deficit widened to £14.04bn in April - the biggest since September 2016.

'Early days'

Last week Bank of England deputy governor Dave Ramsden said recent data had supported the bank's view that the economy's weak start to 2018 would be temporary.

Mr Ramsden said it was still "early days" but pointed to a pickup in consumer confidence and borrowing, and to a rebound in retail sales and business surveys.

The banker, who voted against a rate rise at the last Monetary Policy Committee meeting in May, said he now supported the view that an "ongoing tightening of monetary policy over the forecast period" will be necessary if the economy behaves as expected.

The MPC voted 7-2 in May to keep rates on hold while they waited to see whether the weak growth of the first quarter, when the country was hit by heavy snow, was only temporary.

The Bank of England said in May that it did not intend to raise interest rates until it saw proof that the economy was on a firmer footing.

- Published11 April 2018

- Published9 March 2018