Banks close 2,900 branches in three years, says Which?

- Published

- comments

Branches are shutting at an alarming rate, says Which?

About 60 bank branches are closing every month with RBS shutting the most, consumer group Which? has warned.

It found that 2,868 branches will have closed between 2015 and the end of 2018, with the number accelerating this year.

It called the trend "alarming" and said many people were left without proper access to services.

But banks said their branches were losing customers as more people banked online.

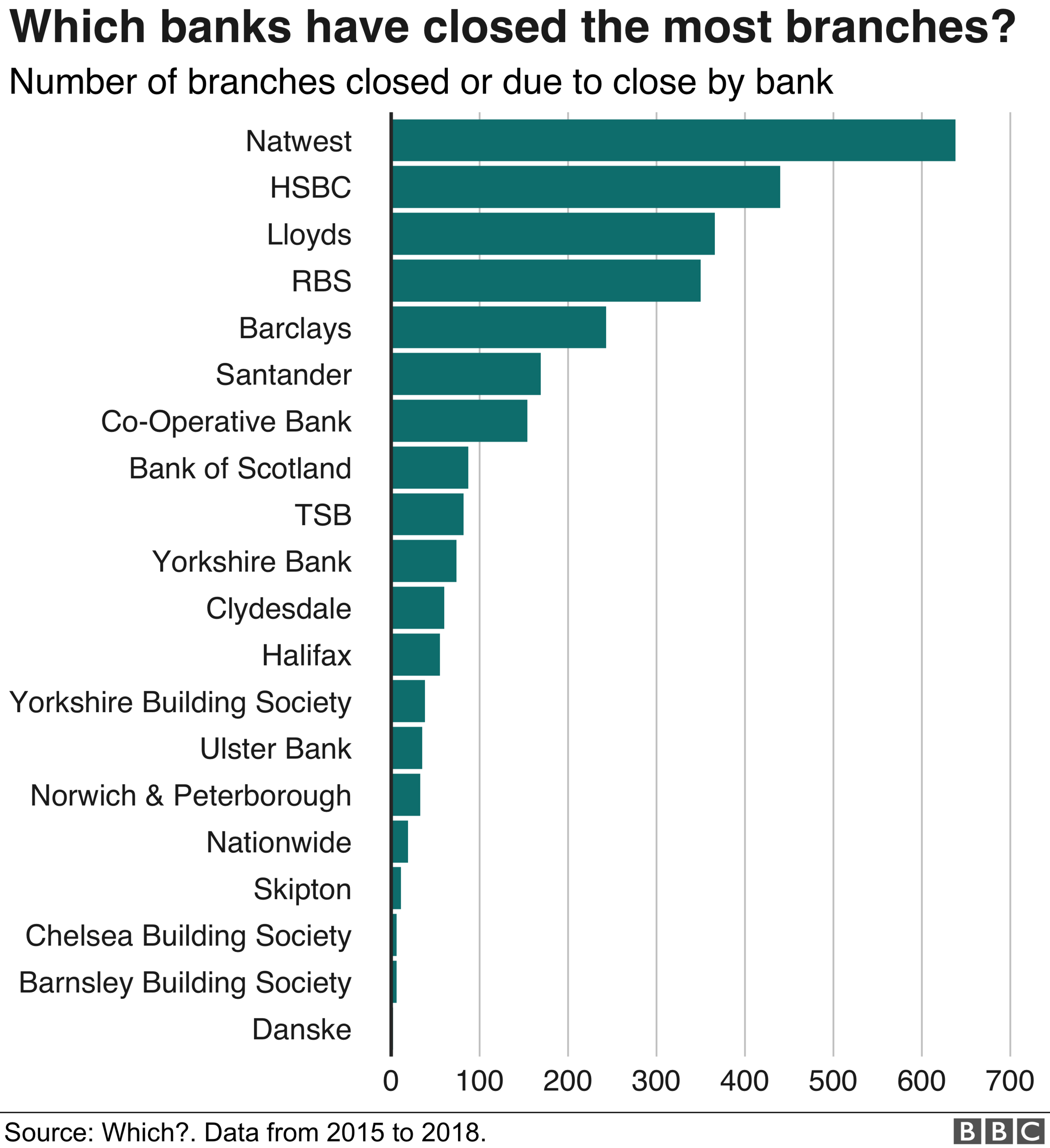

According to Which?, the worst offenders are:

RBS, which will close 350 of its own branches in 2015-2018, as well as 638 NatWest branches and 35 Ulster Bank branches

Lloyds, which is closing 366 of its own branches, 87 Bank of Scotland branches and 55 Halifax branches

And HSBC, which will close 440.

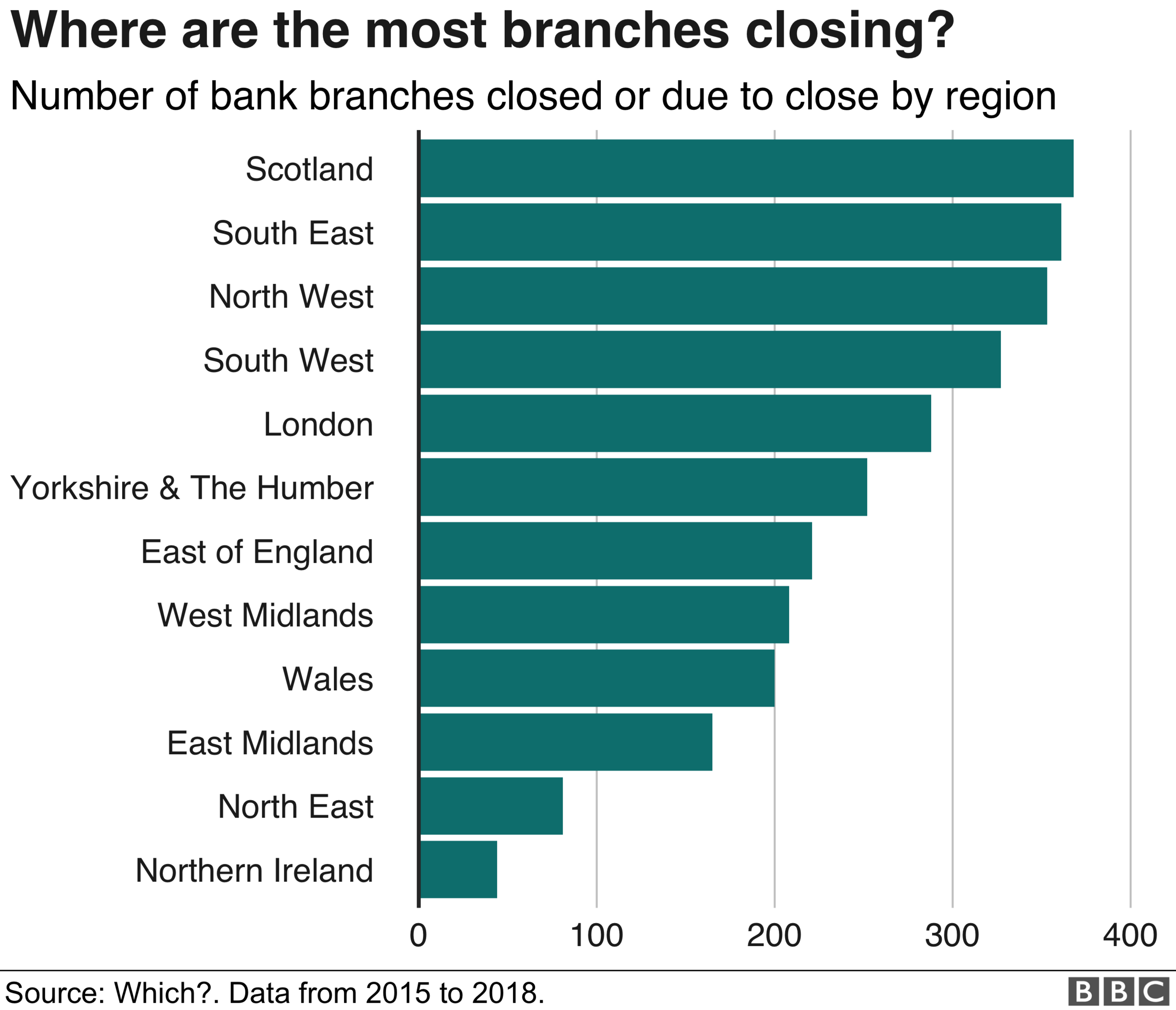

By region, Which? said Scotland had been worst hit, with 368 branches due to have shut by the end of 2018.

That was followed by the South East (361), the North West (353) and South West (327)

Which? money expert Gareth Shaw said: "While the decision is clearly a commercial one for a bank to take, it is also crucial that banks do recognise the needs of their customers and the communities they serve, before simply shutting their doors - and their customers out."

In 2015 banks signed up to the Access to Banking Standard - an industry-wide agreement that they must must engage with customers about closures and inform them of alternative services.

But Which? said that while Post Offices and mobile banking trucks were often suggested, they did not offer the same range of services or convenience as branches.

Meanwhile it said many people "cannot" or do not want to use online services.

An RBS spokesman said: "Since 2014 the number of customers using our branches across the UK has fallen by 40% and mobile transactions have increased by 73% over the same period.

"As customers continue to change the way they bank with us, we must change the way we serve them, so we are investing in our branches and re-shaping our network, replacing traditional bricks and mortar branches with alternative ways to bank."

Rose Ainsworth, 83, sometimes has to walk for an hour to collect her pension

Llandysul: The 'ghost town' with no banks

Until recently, Rose Ainsworth had four banks and a post office within a five-minute stroll of her front door in Llandysul, Wales.

Today, they have all gone.

Unable to drive, 83-year-old Mrs Ainsworth, who has osteoporosis, now has a 30 mile (48km) round trip via multiple buses to access her nearest banking services.

The other alternative is to grab her walking sticks and attempt the long walk to the relocated post office - a 4 sq m (43 sq ft) plastic kiosk next to the check-out tills at an edge-of-town supermarket.

A Lloyds spokesman said branches played an important role in customers' lives, but added: "It is important to have branches in the right places, where there is customer demand."

A spokesman for UK Finance, a banking industry group, said decisions to close branches were only ever taken after all other options - like reducing opening hours and staff numbers - had been exhausted.

"Technology is not for everyone which is why all the major banks offer day-to-day banking services through 11,500 Post Office branches," it added.

Banks have also been shutting cash machines at a rapid rate.

In January, Which? identified more than 200 communities in Britain with poor ATM provision, or no cash machines at all.

It comes as banks seek to cut costs and the industry argues there are too many ATMs in places they are not needed.

- Published2 January 2018

- Published5 January 2018