China 'shocked' by US actions in trade dispute

- Published

China said it is "shocked" after the US announced plans for fresh tariffs, escalating a trade war between the two countries.

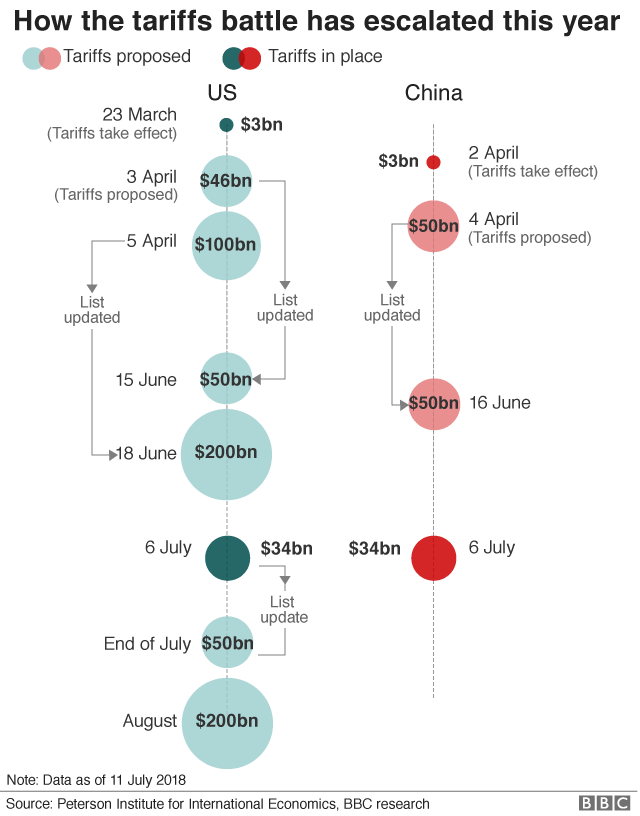

The US listed $200bn (£150bn) worth of additional products it intends to place tariffs on as soon as September.

The move comes just days after the two countries imposed tit-for-tat tariffs of $34bn on each other's goods.

Beijing described Washington's latest threat as "totally unacceptable," saying it would harm the world.

"The behaviour of the US is hurting China, hurting the world and hurting itself," a spokesperson for China's commerce ministry said in a statement.

The spokesperson also said the government would have to take the "necessary counter-measures".

The list names more than 6,000 items, external including food products, minerals and consumer goods such as handbags.

The public will have until the end of August to comment on the list before the new tariffs - to be imposed at 10% - come into effect.

Analysis: Andrew Walker, economics correspondent

China says it will respond to the new tariffs that President Trump has asked his administration to prepare. But how?

It cannot directly match the total of $234bn worth of goods that the US has in its sights, because it does not import enough American goods (another fact which the US president complains about). Last year, US goods exports to China were worth $130bn.

What Beijing could do instead is to make life more difficult for American business interests, with more aggressive action by regulators, such as safety inspections or financial investigations. China could also try to force its currency lower to gain competitiveness.

There has even been speculation that China could sell some of the $1 trillion worth of US government debt (or bonds) that it holds. If it sold enough, that could drive up the cost of borrowing in the US, but it would also inflict losses on China, by forcing down the value of those bonds.

Asian stock markets fell sharply on Wednesday as investors shunned risk amid escalating trade tensions between the two economic giants.

In China, Hong Kong's Hang Seng index dropped 1.5%, while the Shanghai Composite fell 1.8%. Japan's benchmark Nikkei 225 index shed 1.2%.

The White House says the tariffs are a response to unfair trade practices by China.

The US wants China to stop practices that allegedly encourage transfer of intellectual property - design and product ideas - to Chinese companies, such as requirements that foreign firms share ownership with local partners to access the Chinese market.

US Trade Representative Robert Lighthizer said there was "no justification" for China's retaliation.

"As in the past, the United States is willing to engage in efforts that could lead to a resolution of our concerns about China's unfair trade practices and to China opening its market to US goods and services," he said.

"In the meantime, we will remain vigilant in defending the ability of our workers and businesses to compete on a fair and reciprocal basis."

Why the US-China trade war will hit most of our pockets

'Increasingly worried'

Many companies in the US are opposed to the administration's use of tariffs against China, saying they risk hurting business and the economy without being likely to change behaviour.

On top of the $34bn worth of tariffs that came into effect on Friday last week, the White House has said it would consult on tariffs on another $16bn of products. US President Donald Trump has suggested these could come into effect later this month.

In total, the new import taxes that President Trump is threatening to impose are almost equal to the value of China's entire goods exports to the US, worth more than $500bn last year.

"It's a difficult situation for a number of our companies. They're getting increasingly worried about where this is all going," Ed Brzytwa, director of international trade for the American Chemistry Council, which represents chemical companies, told the BBC on Tuesday before the latest measures were announced.

"They can't figure out what the endgame is."

- Published6 July 2018

- Published5 July 2018

- Published5 July 2018