What does it take to be a billionaire?

- Published

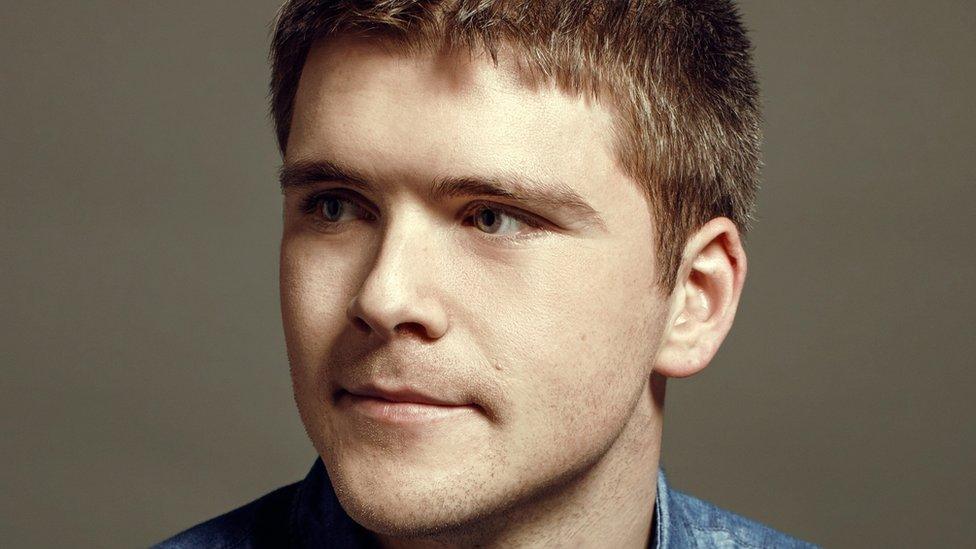

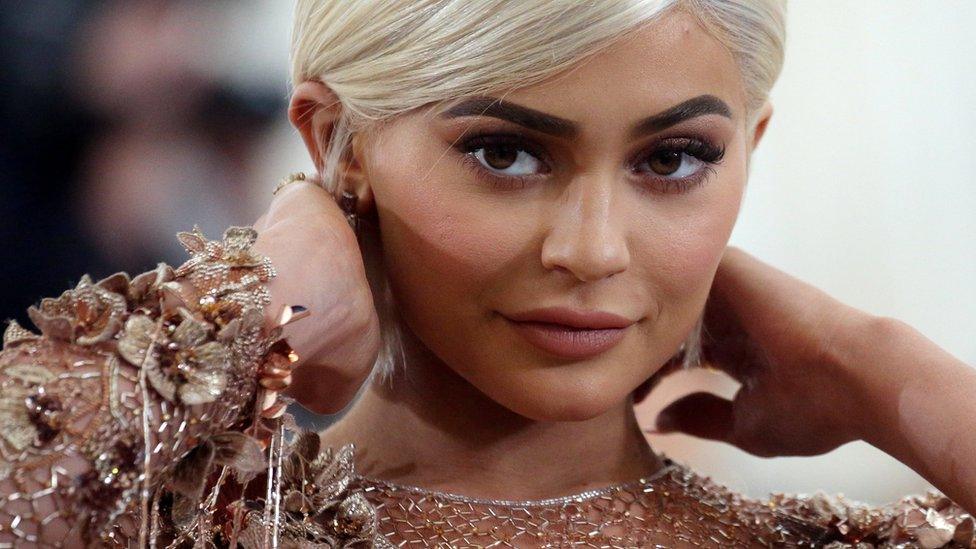

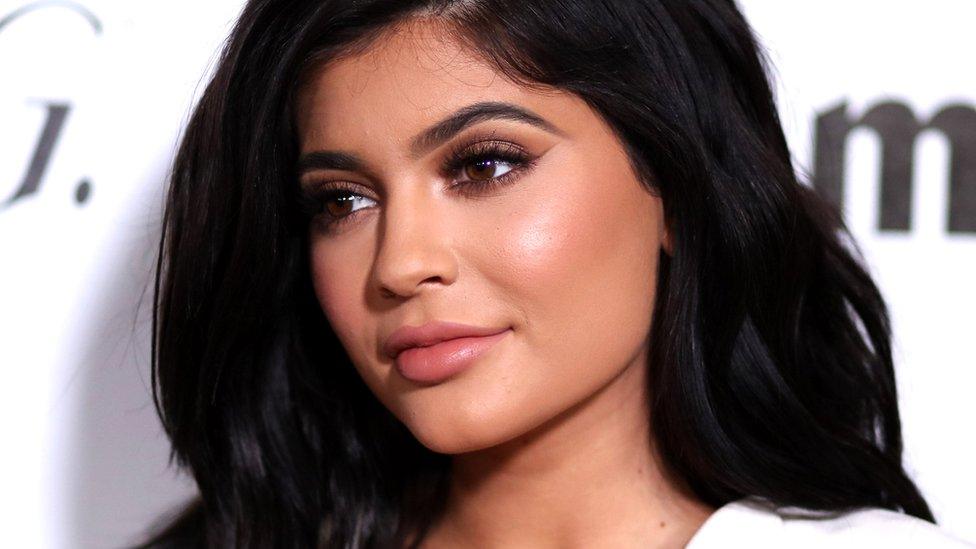

Forbes estimated Kylie Jenner's net worth at nearly $1bn, based largely on its $800m valuation of her cosmetics firm

Forbes caused a stir this week when it reported that social media star Kylie Jenner had a self-made fortune worth nearly $1bn.

It's a distinction very few can claim.

There were only about 5,700 people in the world worth more than $500 million last year, according to Credit Suisse's annual Global Wealth Report.

True billionaires are even rarer.

So what does it take to become a billionaire?

1. Start your own company

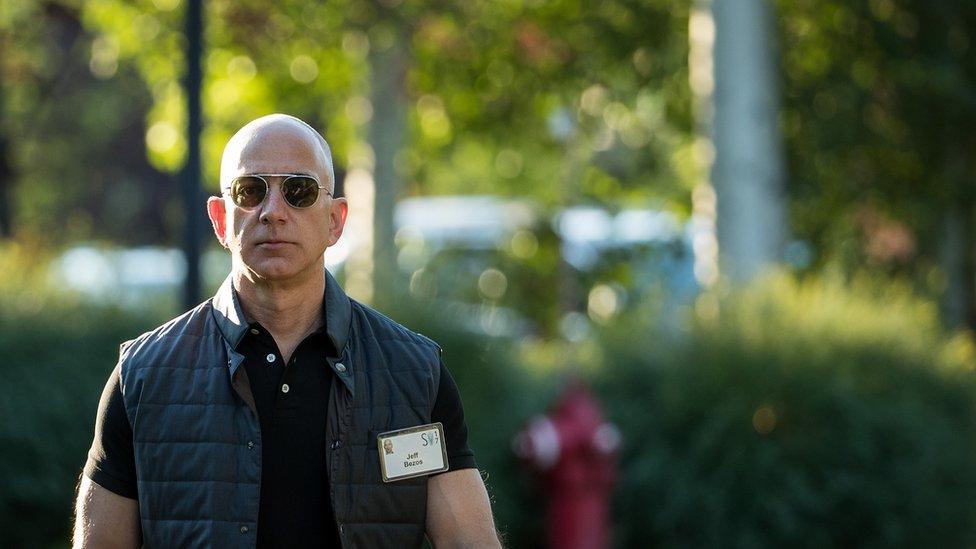

Looking at the top tier, big names such as Amazon's Jeff Bezos, Facebook's Mark Zuckerberg, Zara's Amancio Ortega and Alibaba's Jack Ma dominate.

And the trend holds: Forbes identifies about two-thirds of the 2,208 people on its 2018 billionaires list as self-made - a share has increased over time.

It's true that self-made can be tricky to define. The magazine's characterisation of Kylie Jenner - born into a rich and famous family - as "self-made" raised some eyebrows this week.

But no matter how easily you got there, studies confirm that it pays to be the boss.

On average, chief executives at the biggest 500 public companies in the US earned more than 361 times the typical pay at the company last year, according to analysis of government filings by the AFL-CIO labour union, external.

Jeff Bezos, founder of Amazon, was the number one ranked billionaire on the 2018 Forbes list

2. Inherit money

About one third of the people on the Forbes list inherited their money.

That includes seven members of the Walton family, heirs to the Walmart fortune, and Francoise Bettencourt-Meyers, whose family started L'Oreal.

Inheritance is especially important in Europe, where it factored into the fortunes of about half of billionaires, according to analysis of Forbes' 2014 list by the Peterson Institute for International Economics.

There are plenty of reasons why people with a head start maintain their lead.

For one thing, the value of financial assets like stocks and bonds has risen more rapidly than other kinds of assets in recent years.

Those kinds of assets are also often taxed at a lower rate - if they're taxed at all. An academic study, external last year estimated that 25%-35% of personal taxes are evaded each year by those in the top 0.01%.

3. Be a hedge funder

There were more than 140 people in the finance sector with fortunes greater than $2.5bn on the 2018 Forbes list - more than in any other industry.

Many of them hail from the US, where 25% of billionaires source their riches from finance.

But don't expect to simply rise through the ranks. JP Morgan Chase boss Jamie Dimon is the rare billionaire banker who took that path.

Most financiers entered the billionaire club like people in other industries - by striking out on their own.

Abigail Johnson, who heads the US money management firm founded by her grandfather, Fidelity Investments, is one of only about 250 women on the Forbes list

And many of the financiers - almost one-fifth of the richest 143 - have ties to a hedge fund.

Of course, if you're set on breaking into the top ranks of billionaires, odds favour those in the tech industry, which claims four of the top 10 spots.

4. Get out of the UK

The number of billionaires in the UK declined last year - one of the only places in the world where that happened, according to Forbes and other surveys.

The fast-growing Asia Pacific region is more fertile territory.

About 29% of the world's new billionaires last year came from the region, according to an annual survey by WealthX, which estimates that there are about 2,750 billionaires globally, a bit more than Forbes.

China alone claimed 29 of the 259 newcomers on Forbes' list - more than any other country.

Despite gains in other parts of the world, the US remains home to the highest number of billionaires at 585.

Alibaba founder Jack Ma is one of China's richest men

5. Don't worry too much about following the rules

Billionaires are no strangers to legal battles.

Take Bill Gates. He might be known as a philanthropist now, but his reputation wasn't always so squeaky clean.

In the 1990s, the US sued Microsoft for anti-competitive practices.

The US won the initial suit and Microsoft appealed. The fight ultimately ended in a settlement. The European Commission has also fined the firm.

Mr Gates is in good company.

Regulators have fined a slew of billionaire-making companies over matters that range from bribery payments to price fixing and other competitive practices.

Those include Google and Samsung, as well as firms outside of tech, like casino company Las Vegas Sands, external.

- Published13 July 2018

- Published20 November 2017