Mortgage misery: The homeowners facing repossession

- Published

He used to be a London cabbie, while she ran a shop.

But ten years after they took out a mortgage, Peter and Lisa King are now in debt by £500,000, and are due to have their home in Essex repossessed.

They fell behind with their repayments after chronic illness struck the household.

At one stage the stress drove Mr King to attempt suicide.

"The worst bit is not knowing your future; not knowing from one day to the next where you're going to live; how you're going to survive; how you're going to care for your family," says Mrs King.

"It's hard to not know, one day to the next, am I still going to have a home? Or are we going to be evicted?"

In five years of campaigning to stay in their home, Mrs King even tried addressing the Lloyds annual general meeting, to tell the company's shareholders about their woe.

But so far there has been no resolution, and the day when they have to pack their suitcases is getting closer.

'Mis-sold'

Like hundreds of thousands of other homeowners, the Kings appear to be a victim of the excessive lending that took place in the years before the financial crisis.

It was a time when rising house prices seemed to be part of the brickwork, and banks thought lending was relatively low risk.

As a result many people took out interest-only mortgages, knowing they were cheap, and believing that their rapidly growing housing equity would eventually help pay off the loan.

Furthermore, for self-employed people like the Kings, there was a product called a "self-certified" mortgage.

Affordability checks in such cases were minimal, which is why they were banned in 2011.

Nevertheless in 2008 Mr and Mrs King took out an interest-only, self-certified mortgage of £337,500, sold to them by an Independent Financial Adviser (IFA).

At the time they already had debts of £58,000. And they were apparently unaware they needed to save up to pay off the capital when the loan matured.

"We weren't told we had to have a repayment vehicle, but at the time I was desperate. So we were mis-sold the mortgage," says Mr King.

Instead of paying off the debt, the couple planned to downsize.

According to the Financial Conduct Authority (FCA), there are 1.67 million homeowners in the UK on some form of interest-only mortgage. That accounts for over 17% of all borrowers.

The FCA says, external many of those borrowers are at risk of not having enough money to pay off their loans when they mature. Many might be forced to downsize. Some could face repossession.

But as if their mortgage itself wasn't burden enough, the Kings were also hit by ill health.

'Locked in'

In January 2013 Mr King was diagnosed with ME - otherwise known as Chronic Fatigue Syndrome (CFS), a disabling illness that forced both him and his wife Lisa to give up work.

The disease also brought on depression.

Under FCA rules, external, banks are obliged to consider a range of alternatives in such cases, including changing the type of mortgage the borrower has.

Mr King phoned the Halifax - part of the Lloyds Banking Group - to tell them he could no longer afford to make repayments. He was given two choices - to extend the term of the mortgage, or take a short "payment holiday."

He chose the latter.

But Mr King believes the bank should also have offered him a switch to a lower interest rate.

"They conducted themselves in such a way as to restrict my options to one option, knowing full well that I was a vulnerable customer," says Mr King.

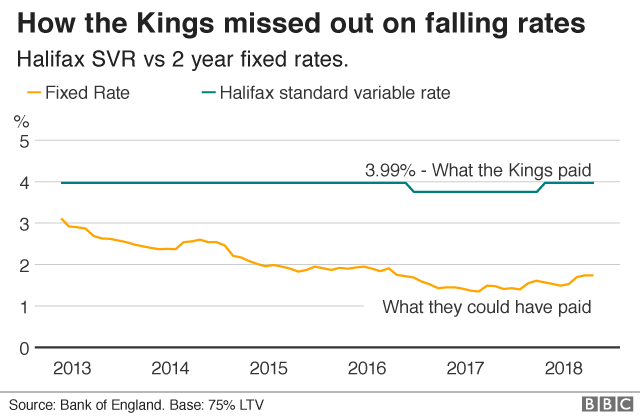

As a result, the Kings had to pay the Halifax's Standard Variable Rate (SVR) of 3.99% for most of the remaining five years of their mortgage.

By contrast, fixed mortgage rates, which the Halifax also offers, have since fallen to as low as 1.35% - see the chart above.

Paul Carlier, of the financial consultancy Jupiter 87, which has been helping the Kings, says moving to a fixed rate mortgage would have saved the Kings a fortune.

"They should have been able to switch mortgage product, and save £500 per month, and they wouldn't have been in the position they're currently in," he told the BBC.

Support

However Lloyds says it was under no obligation to offer Mr King a cheaper mortgage product.

But had he restarted payments after his mortgage holiday, he could have applied for a product transfer then.

It also points out that the Halifax was nothing to do with the sale of the mortgage, and says Mr King was treated sympathetically throughout.

Lloyds says Mr King was treated as a vulnerable customer

"We have a specialist team dedicated to supporting vulnerable customers, and ensuring we understand their individual circumstances," it said.

"The team has provided support to Mr King at appropriate times since he fell into financial difficulty."

The King's case has twice been rejected by the independent adjudicator, the Financial Ombudsman Service (FOS).

In its final decision, in July 2016, the FOS confirmed that Lloyds was not obliged to offer a cheaper mortgage, and said it could not see what else the bank could have done to help the Kings.

Lloyds has not yet repossessed the King's home, although it obtained the legal right to do so a year ago.

It says it is still willing to consider any reasonable proposal.

'Mortgage misery'

In its advice to borrowers, the FCA recommends, external people with interest-only loans to switch to a repayment mortgage where possible, or extend the mortgage term.

Citizens Advice says anyone with either an interest-only or a self-certified mortgage could also try and change provider, or sell their home and move to somewhere smaller.

But given that the value of their home barely exceeds the size of their debts, that is not a realistic option for the Kings.

They are now living on benefits, with poor health, and in nothing short of mortgage misery.

- Published30 January 2018

- Published4 May 2018