UK holidaymakers hit with £1bn of card fees

- Published

Holiday credit card charges - and how to avoid them

UK holidaymakers are being collectively charged £1bn a year by their banks for paying by credit or debit card while they are abroad.

Standard credit and debit cards slap fees of nearly 3% on all spending, plus extra costs for using cash machines.

Customers are being encouraged to apply for cards with zero charges to make their holiday money go further.

But banks say using cards overseas is a safe, flexible and cost-effective way of paying.

Holidaymakers we spoke to in Malaga were shocked to be told about the billion pound figure, which has been calculated exclusively for BBC News.

"That is outrageous! They are surcharging us for going on our holidays," said Val Pollard who was sunning herself on the beach.

"You are likely to be spending €500-€800 a week. 3% of that is a lot of money."

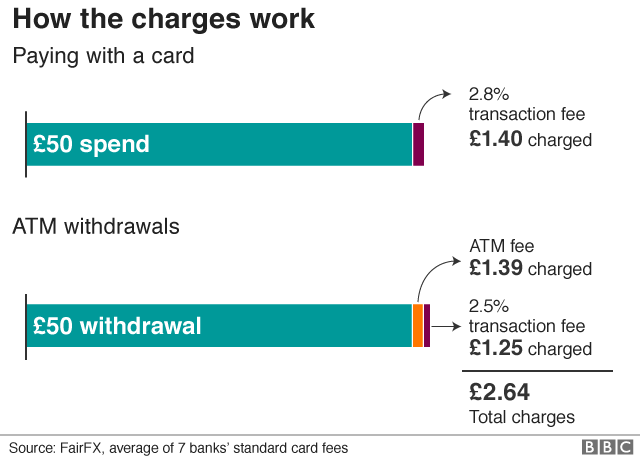

For those using a standard credit card, the average "non-sterling transaction fee" is 2.8%, added to the amount you have spent, with some banks charging 2.99%.

The average fee on standard debit cards is nearly as much.

And there are multiple charges if you use a debit card to withdraw cash: an average of 2.5% on the whole amount, plus an extra fee of £1.39 on average just for using a foreign cash machine.

The charges appear on your bank statements when you return home.

'Rip off'

Alan and Marie Carman from King's Lynn, taking Malaga's open-top bus tour, told me that banks are "on to a winner" because people use their cards without thinking.

"I don't think they should do that charge," says Marie, "I don't think they should rip people off, because nowadays everybody uses cards."

Even the proprietor of the Shakespeare Pub, a British outpost in the centre of Malaga, believes he is affected.

"It has a knock-on effect on me," explained Peter Edgerton, "The customer is less likely to spend here if they know they're likely to be charged 3% every time they use their card."

The most recent figures from the banks themselves show that UK holidaymakers are spending a total of more than £32bn a year on their cards while overseas.

The charges on that spending are having a "huge impact on consumers' pockets", according to the foreign exchange specialists, FairFX, which analysed the charges for BBC News.

"When we're on holiday it's easy to turn a blind eye to what we think is just a few quid," said Ian Strafford-Taylor, FairFX's chief executive.

Cards do have advantages. A spokeswoman for UK Finance, the body which represents banks, describes them as an "extremely safe, flexible and cost-effective way to pay".

"If you do not get what you paid for, if the goods or services turn out to be faulty or you are a victim of card fraud, you will get your money back".

UK Finance points out that some banks offer alternative credit cards which have no fees when you spend overseas.

Among them are cards from Halifax, Santander, Nationwide and Barclays, though there is no guarantee that you will be accepted for one of these if you apply.

Savings

You can also buy pre-paid currency cards which have zero charges, though the exchange rates they use can vary.

Joanna Styles, who runs a tourist website guidetomalaga.com, wants banks to be forced to text customers whenever they levy a foreign currency charge, to encourage them to shop around.

"I know for a fact that in Malaga you could have several good meals out for the amount that you have effectively given to the bank," she said.

Most people do not shop around. They obtain their credit cards from the bank which handles their current accounts.

So FairFX also looked at what annual charges would be if all customers at least switched to the lowest-cost card which their own bank had on offer.

The result? Charges for foreign spending would be lower, by nearly £300m. But the total would still add up to £738m a year.