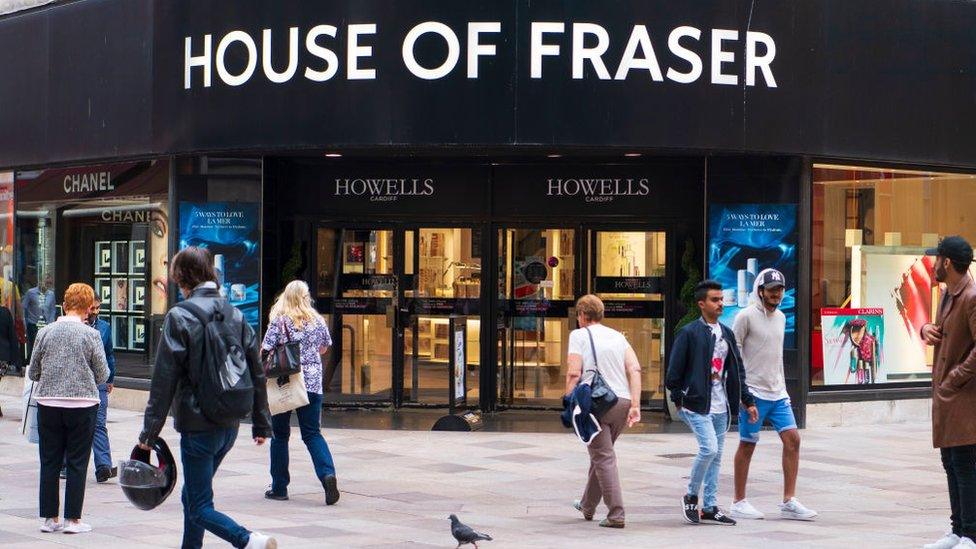

House of Fraser rescue deal falls through

- Published

- comments

The future of House of Fraser has been thrown into doubt after its potential new owner walked away from a rescue.

C.banner, which owns the toy store Hamley's, had planned to take control of the struggling department store chain and inject £70m of cash.

However, the Chinese firm said it would no longer proceed with its investment, plunging House of Fraser into crisis.

That deal would have involved closing 31 of its 59 stores, with the loss of 6,000 jobs.

House of Fraser agreed a controversial restructuring deal with its landlords in June to cut stores and save money. A legal challenge contesting the process has been made by landlords.

The retailer employs 17,500 people - 6,000 direct and 11,500 concession staff.

Analysis

By Emma Simpson, BBC business correspondent

Things have taken a sudden turn for the worse for House of Fraser.

A looming battle with some of its landlords over its controversial restructuring deal has now been overtaken by events.

C.Banner was not only taking a majority stake in the 169-year-old chain, but also providing a crucial £70m cash injection.

The question now is who would be willing to put money into this business in its current form.

House of Fraser is already heavily indebted with onerous interest payments every quarter.

That is one of the reasons it is struggling to make the sums add up in today's incredibly challenging climate for retailers.

House of Fraser has some big bills looming on the horizon, including quarterly rent and paying for Christmas stock.

The clock is ticking for this business to somehow come up with a solution.

Andrew Busby, of the consultancy Retail Reflections, said the chain's only hope for survival could be a merger with rival Debenhams.

"House of Debenhams is becoming more and more of a reality - that's the best outcome for House of Fraser," he said. "Unless you are Harrods or Selfridges the department store concept is not quite dead, but severely challenged."

Richard Lim of Retail Economics said: "This is a real blow to House of Fraser. They're in desperate need of a rescue deal and without this fresh injection of around £70m, it's almost inevitable that they'll fall in to administration. This could be within a matter of weeks."

Why is House of Fraser failing?

C.banner had been planning to raise the money needed to invest in House of Fraser by issuing new shares.

However, the Hong Kong-listed company's shares have fallen by 70% in the past two months and it issued a profit warning on Wednesday.

In a statement to the Hong Kong stock exchange, C.banner said the share placing had been "rendered impracticable and inadvisable" and the agreement was therefore being terminated immediately.

House of Fraser's flagship store on Oxford Street had been threatened with closure under the rescue deal

In response, House of Fraser said it was in talks with other investors and was exploring other financing options: "Discussions are ongoing and a further announcement will be made as and when appropriate."

The loss-making department store chain is now understood to be talking to new potential buyers.

On Monday, it emerged that House of Fraser had been approached by Sports Direct founder Mike Ashley over a fresh investment deal.

He controls an 11.1% stake in House of Fraser and a near-30% stake in Debenhams.

- Published30 July 2018

- Published20 July 2018

- Published22 June 2018

- Published7 June 2018