Should tech companies be paying more tax?

- Published

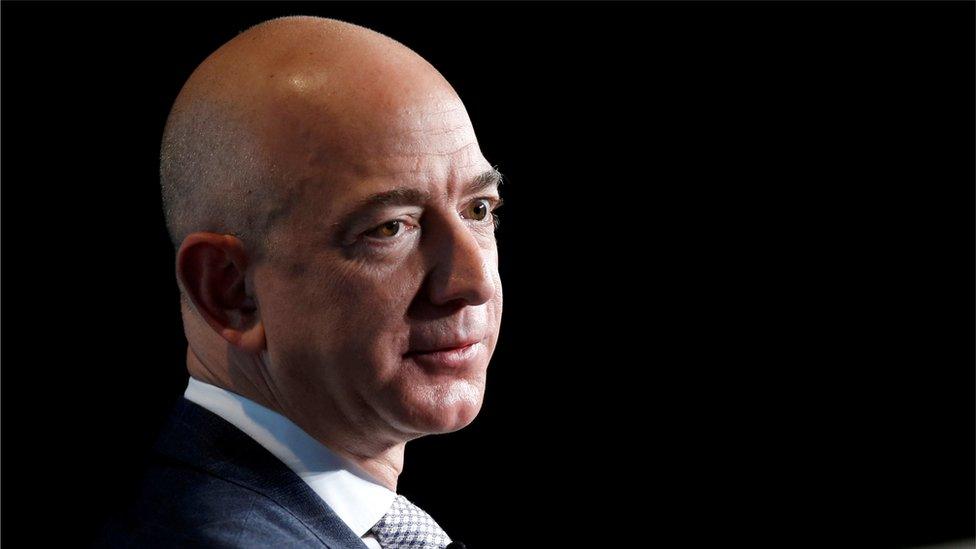

Amazon, Facebook and other tech giants are regularly accused of not paying enough tax.

Amazon Services UK's latest response to such allegations is typical. A spokesman said it paid all the tax it was required to "in the UK and every country where we operate".

Other companies that have faced controversy have also made it clear that they abide by the present tax rules.

And yet Amazon's UK tax bill for last year is widely regarded as too low - and at a time when High Street shops are suffering.

That doesn't feel right. So is the tax system itself at fault?

As that Amazon spokesperson points out, corporation tax is based on profits, not revenues.

"Our profits have remained low, given retail is a highly competitive, low-margin business and our continued heavy investment," the spokesperson added.

If the aim is to make tech companies pay more, then the basis of taxation would have to be changed.

And is there any chance of that happening?

Well, the UK Treasury and the European Commission have both been talking about a shift that would make a big difference.

Instead of just taxing profits, they would bring in a new tax for tech firms based on revenues.

The EU has actually unveiled a plan for this "digital tax". Under its proposals, there would be a 3% levy on the likes of Google and Apple, with the object of raising up to €5bn (£4.5bn) a year.

What are the advantages of that?

Financial experts say that under the current system, a lot of tech companies' activity is not being taxed at all.

Social media platforms, online marketplaces and internet search engines are creating a lot of value for their owners, without any money being collected by the government.

Think of Facebook's advertising revenues or Apple's App Store subscriber fees. And what about the money that firms make by harvesting and selling your personal data? All that would be fairly taxed for the first time.

That sounds like a nice, simple solution, doesn't it?

Actually, no. For one thing, it's being touted as an "interim" policy: in other words, something hastily cobbled together in Brussels as a knee-jerk response to political pressure.

For another, it would have to be approved by all 28 EU member states to come into effect. That may prove hard to achieve.

Ireland, in particular, is strongly opposed to the idea. It's probably no coincidence that Facebook, Twitter and Google have a significant presence in Dublin's Silicon Docks area.

If not everyone buys into the idea, there is a risk of "tax wars", with different countries acting unilaterally and digital firms facing the prospect of being taxed more than once across the globe on the same activity.

Since the tech giants operate across borders, there is a real risk of that happening, which would make a mockery of the idea of a "fair" taxation system.

So if the short-term solution is a non-starter, what longer-term options are there?

Arguably, the only way to solve the problem once and for all is to have a comprehensive international agreement.

As the UK government says in its latest position paper, external: "The preferred and most sustainable solution to this challenge is reform of the international corporate tax framework to reflect the value of user participation."

The ultimate aim, then, is to tax digital companies on the basis of where their users are based, rather than where they have their physical infrastructure.

The Organisation for Economic Co-operation and Development has shown willingness to take up the challenge of co-ordinating international efforts to make this happen.

However, it doesn't intend to publish its proposals until 2020.

That's a long way off. What can be done in the meantime?

The UK is looking into the question of whether big technology firms are affecting competition in the UK..

After all, if their dominance in the economy can be reduced by greater competition, their profits will be less of a problem.

A former adviser to former US president Barack Obama, Jason Furman, will head a panel of experts looking at how the UK's digital market operates.

The panel's conclusions, expected early next year, are likely to include policy recommendations over how to handle mergers in the sector and the control of personal data, as well as broader competition issues.

- Published3 August 2018

- Published26 July 2018

- Published27 July 2018