Students risk overdraft debt spiral

- Published

Consumer groups have highlighted their concern over the "significant minority" of students facing overdraft debts on a regular basis.

Two separate reports are alerting undergraduates to the risks of a debt spiral, although they also note many are confident managing their money.

After A-level and vocational results in recent days, many teenagers will now be considering further education funding.

That means choosing from an array of student bank accounts.

Consumer group Which? said that providers were tempting new students with perks ranging from railcards and Amazon vouchers to more traditional competition between interest rates.

Using student recommendations and its own product analysis, the consumer group judged Santander and Nationwide as providing the best student accounts.

Which? said that, however suitable the chosen account was, many soon found themselves in personal debt for the first time regardless.

"It is concerning to see that a fifth of students relied on their overdraft to manage their living costs, while just under a half said they had asked their parents or family for extra money," said Harry Rose, of Which?.

Separate research by the government-backed Money Advice Service also found that a fifth of students found themselves frequently overdrawn.

Of those who had gone overdrawn, 40% had used an unauthorised overdraft leading to additional charges and fees.

Where to go for help

Student finance: What you need to know, external, from the independent Money Advice Service

Save The Student, external website

Maintenance loans and grants information in England, external, Wales, external, Scotland, external, and Northern Ireland, external

Money and funding, external, from the National Union of Students

The survey of 5,000 students, conducted with the National Association of Student Money Advisers, found that 38% of existing students had some form of outstanding non-student loan debt.

Some 18% of those asked had debts of 1,000 or more, with some turning to payday loans to cover living costs.

While some faced financial difficulties, there was some optimism in the report over how well many students deal with their finances.

Eight in 10 said that they kept track of their personal expenditure, with three in five setting a budget.

Joe Surtees, from the Money Advice Service, said: "Our research challenges the idea that students are financially irresponsible. Most seem to show signs of being financially capable, keeping a close track of their money and frequently putting savings aside for a rainy day.

"However, a significant minority are still struggling with their finances, which may increase the chances of falling into a spiral of debt in the future. Most importantly if you're struggling, don't be afraid to seek help."

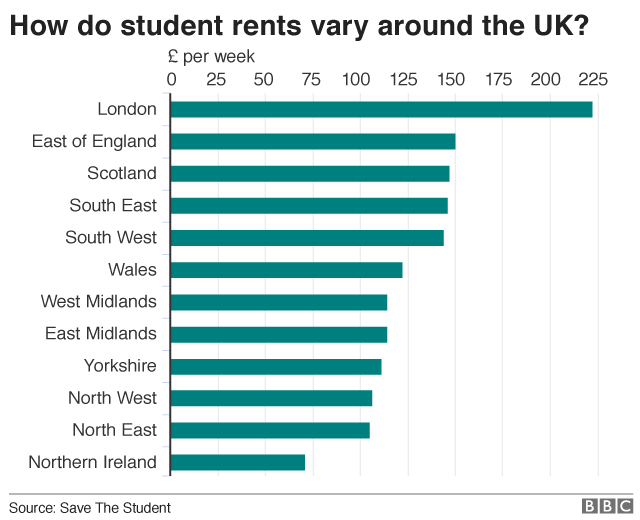

The reports come after previous research revealed the extent to which rent is responsible for draining student finances.

A survey earlier this year, by student finance website Save The Student, claimed that average rent for student accommodation totalled £131 a week, eating up nearly all of a typical maintenance loan or grant, even before a typical £509 in upfront letting fees and deposit were taken into account.

The average award left a typical UK student with only £8 a week for all other living costs such as food, travel and toiletries, after the rent has been paid.

The maintenance loan is designed to cover living costs, is separate from the student loan to pay for tuition fees, and is dependent on family household income.

- Published16 August 2018

- Published16 August 2018

- Published24 February 2018