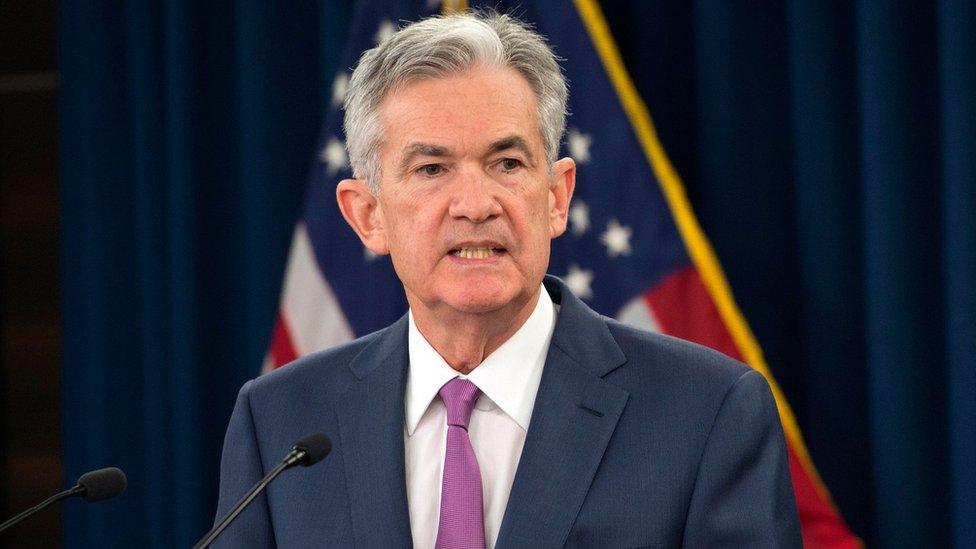

US Fed chair Jerome Powell backs cautious path on rates

- Published

The "consensus view" at the US Federal Reserve is that gradual interest rate rises remain the best policy, the head of the US central bank has said.

Federal Reserve chair Jerome "Jay" Powell made the remarks at an annual economic conference in Wyoming.

He said the difficulties of interpreting data suggest the wisdom of a conservative approach.

However, he added, policymakers will act decisively in a crisis.

"I am confident that the [Fed] would resolutely 'do whatever it takes'," he said, according to a transcript of the speech, external at the Jackson Hole symposium.

The Federal Reserve has been slowly raising rates since 2015, including two increases so far this year.

Analysts expect one or two additional rate rises, with the next one anticipated at the bank's September meeting.

'Smaller dose'

Some analysts worry that the bank is moving too slowly, citing unemployment that has fallen to near record lows. Others warn its actions risk becoming too aggressive, pointing to relatively weak price inflation so far.

US President Donald Trump, who appointed Mr Powell as chair, is among those who have spoken against the rate increases, which he argues will dampen economic activity and push the dollar higher, hurting exports.

But Mr Powell said he saw the slow and steady approach to rate rises adopted by the Fed as the best way to avoid both of the risks.

"When you are uncertain about the effects of your actions, you should move conservatively," he said. "In other words, when unsure of the potency of a medicine, start with a somewhat smaller dose."

Mr Powell said the bank had a responsibility to set expectations about inflation.

It is also important for officials to consider data beyond unemployment and inflation, including froth in the financial markets, he added.

"In the run-up to the past two recessions, destabilising excesses appeared mainly in financial markets rather than in inflation," he noted. "Thus, risk management suggests looking beyond inflation for signs of excesses."

In his remarks, Mr Powell said that the US economy - which grew at an annualised pace of 4.1% in the most recent quarter - is strong and does not appear at "elevated" risk of overheating.

Many of the most significant challenges facing the US economy - such as slow wage growth and rising government debt - remain outside the powers of the Fed to address, he added.

US shares increased and the dollar index fell after Mr Powell's remarks were published - a sign of diminished concern among investors that the pace of rate increases would suddenly accelerate.

- Published27 July 2018

- Published13 June 2018

- Published25 August 2017