Cryptocurrencies continue to tumble on Goldman reports

- Published

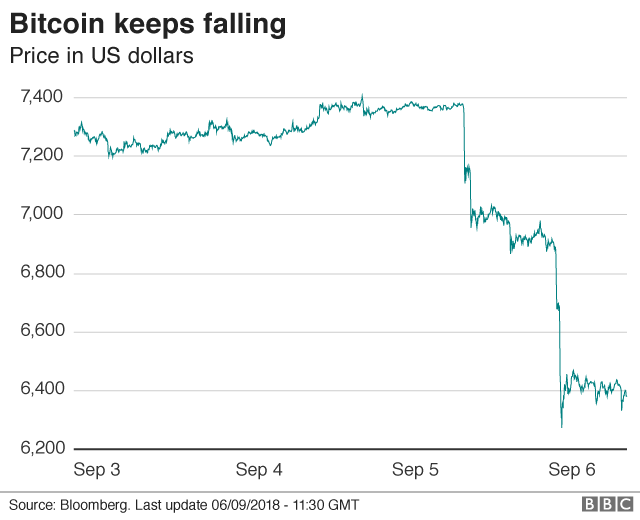

Bitcoin's price has been extremely volatile over the last few months

Bitcoin and other digital currencies have continued to tumble in value, amid concerns that Wall Street institutions are shunning cryptocurrencies.

It follows media reports, originally in Business Insider, external, that Goldman Sachs is shelving plans to set up a cryptocurrency trading desk.

Mainstream lenders have largely kept their distance from digital currencies.

A Goldman spokesman said the bank had yet to decide on the scope of its "digital asset offering".

On Thursday, Bitcoin was trading down 4.45%, or $300 on the day, at $6,382.

The cryptocurrency has lost two-thirds of its value in the past nine months. It was trading above $19,000 in mid-December, and if its falls continue it could threaten this year's low of $5,887.

Meanwhile other coins were also losing value on Thursday - with Ethereum down 12%, Litecoin losing 11%, and XRP behind by 7%.

'Rough 24 hours'

The future regulatory framework for digital coins remains unclear, and the US Securities and Exchange Commission (SEC) has warned some coins issued in initial coin offerings might be regarded as securities.

That means that dealing in them would be subject to federal law.

Other issues of concern around cryptocurrencies include potential money-laundering and market manipulation.

The overall market capitalisation of virtual currencies has lost three-quarters of its value since its January peak, according to Coinmarketcap, external, slumping from $800bn to around $200bn now.

Craig Erlam, senior market analyst at FX firm Oanda, said: "It's been a rough 24 hours for Bitcoin and its peers, with reports that Goldman Sachs has postponed launching a cryptocurrency trading desk due to the uncertain regulatory landscape."

He added: "The regulatory environment is going to be key to all of this and the fact that Goldman Sachs remains so concerned is clearly a blow."

- Published31 August 2018

- Published21 August 2018