How JD Sports became a £5bn company

- Published

JD Sports has continued its stellar rise after reporting record half-year profits on Tuesday.

The retailer, which also owns Size, Blacks and Go Outdoors, said pre-tax profits rose by a fifth to £121.9m for the six months to 4 August.

The results sent shares in Britain's biggest sportswear retailer 6% higher to 518p, leaving the company worth close to £5bn.

JD has about 500 stores in the UK and owns a further 1,700 outlets worldwide.

Peter Cowgill, executive chairman of JD Sports, said its higher profits in the UK and Ireland were "extremely reassuring" despite the challenges facing the retail sector.

"This reflects the value of the investments that we have made over a number of years in developing a dynamic multichannel proposition, which marries the best of physical and digital retail," he said.

While JD is listed on the FTSE 250 index of mid-market companies, Hargreaves Lansdown analyst Laith Khalaf said it was was now knocking on the door of the FTSE 100 index of leading stocks to join M&S.

Its rising fortunes are in contrast to rivals such as Footaslyum, whose shares plunged last week after issuing an unexpected profit warning.

JD is now more than twice as valuable as rival retailer Sports Direct, which is worth £1.9bn - and more than High Street stalwart Marks & Spencer, which has a value of about £4.75bn.

Amy Higginbotham, retail analyst at GlobalData, said JD's success was partly due to the popularity of "athleisure", as well as offering exclusive products from premium brands such as Nike and Adidas.

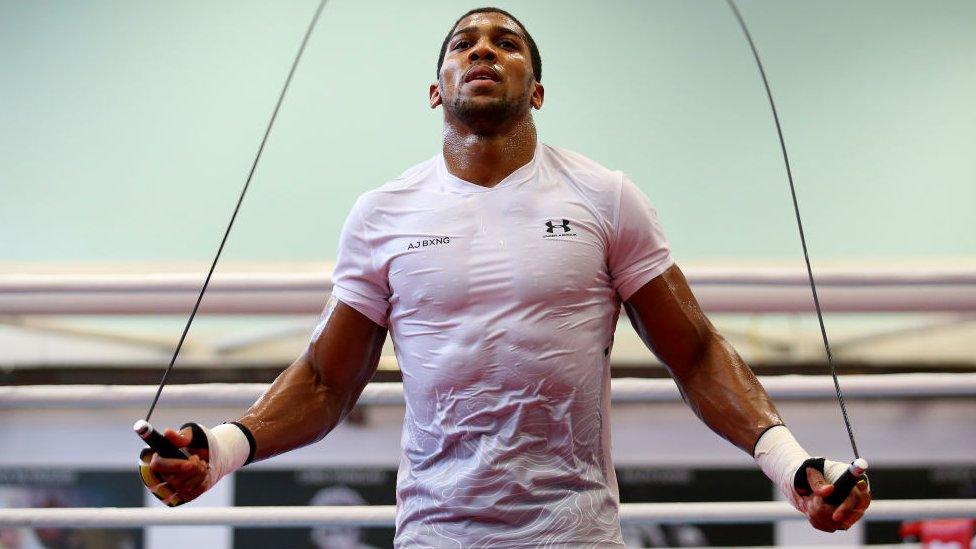

"This, as well as its ability to remain relevant and engage with customers through the sponsorship of athletes like Anthony Joshua, sets it apart from emerging online competitors such as Gymshark, Asos and boohoo.com," she said.

"In addition, continued investment in its physical stores makes JD Sports more resilient to the challenges threatening the UK High Street and having a significant impact on competitors like Mike Ashley's Sports Direct."

JD Sports is one of boxer Anthony Joshua's sponsors

In its latest results, JD explained why stores were still crucial despite the rise of online sales: "The often social nature of consumers' shopping trips and impulsive nature of their buying decisions combined with the importance of cash to a high proportion of our demographic, means that we expect physical retail to retain most of its current level of importance.

"The store base remains essential to brand awareness, the customer's desire to see, handle and try the product, and our ability to provide multiple delivery points."

JD Sports recently made its biggest acquisition, paying $558m for US footwear retailer The Finish Line, which has more than 550 stores and 375 concessions in Macy's department stores.

The takeover is a big bet that it can continue its close relationships with Nike and Adidas, despite a growing desire by the two sportswear giants to sell directly to consumers through their own stores or websites.

"The Finish Line has historically under-invested in its stores and because of that, they have not had the same access to products," said JD chief financial officer Brian Small.

"We believe that our approach to retailing means that we can improve the results of the Finish Line stores by introducing more concentration on the detail of the business and better visual merchandising standards."

JD is also worth more than Foot Locker, the New York-listed footwear chain, which is valued at $5.67bn (£4.36bn).

The retailer traces its origins back to a single store, John David Sports, in Bury that opened in 1981.

Two years after it had expanded into the Arndale Centre in Manchester with further openings in the North and Midlands in the 1980s.

The first London store followed on Oxford Street in 1989 and JD had 56 stores when it listed in 1996 at just under 15p a share.

In 2002, it acquired almost 200 more stores by taking over the First Sport chain.

Since 2005, JD has been controlled by the private Pentland Group, which owns sports and fashion brands including Speedo.

- Published22 May 2018

- Published17 April 2018