Bob Diamond defends risk-taking banks

- Published

- comments

Barclays' former boss Bob Diamond defends the bank

Former Barclays boss Bob Diamond has said he fears banks have become too cautious about taking risks.

Mr Diamond told me the risk-averse culture means they can't support the economy and generate jobs and growth.

Ten years on from the collapse of Lehman Brothers he believes the appetite for risk taking within banking may have swung too far the other way.

"If they are totally without risk, they are not helping create jobs and economic growth," he said.

"The culture of banking now is that if anyone makes a mistake they get fined - or the bank is in trouble.

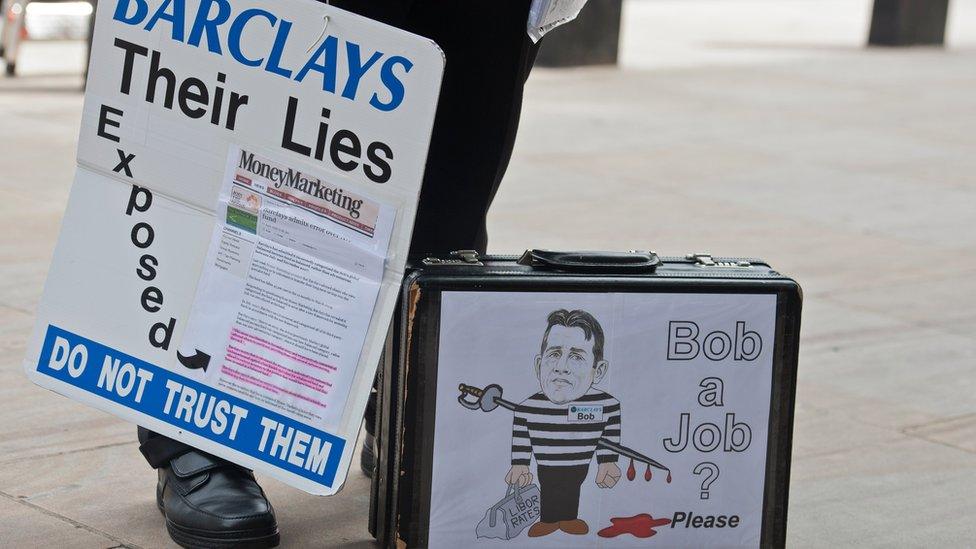

Once dubbed the unacceptable face of banking, Mr Diamond mounted a spirited defence of the culture and behaviour of crisis-era Barclays.

He told me that critics of the banking industry's behaviour in the run up to the financial crisis should distinguish between those that ultimately needed government bailouts and those that didn't.

Defending a culture

Barclays raised money from Middle East investors to stay afloat while RBS needed a £45bn taxpayer bailout.

"I think HSBC and Barclays deserve credit for raising capital privately," said Mr Diamond. "People should be angry with RBS for failing in the way it did - ten years later people still haven't got their money back. Private investors who put money into Barclays have seen very good returns."

Bob Diamond: "I think HSBC and Barclays deserve credit for raising capital privately"

He also defended the culture that prevailed at Barclays during the time he ran the investment bank and subsequently took over as chief executive in 2011. In these years, Barclays employees - along with those of other banks - were found to have rigged markets including interest rate benchmarks, precious metals, foreign exchange and energy prices.

"I don't think the reprehensible behaviour of a few people out of 160,000 employees is representative of the culture we had at Barclays - I think we had a very strong culture".

Really? I asked.

"Yes Really", he replied tartly.

Not for the first time since the financial crisis, Mr Diamond seemed in no mood for insincere apologies. This is the man who transformed Barclays from a sleepy but profitable retail bank into a trading and investment powerhouse - becoming the poster child of buccaneering, risk taking, highly paid bankers in the process.

More risk

Was there never a point when he privately thought the bank was taking too much risk?

"After every earnings report up to 2007 I would have investors and shareholders saying - can't you take more risk, get higher returns and there was no regulatory pressure. But with 20/20 hindsight any banker working at that time will now say we didn't have enough capital."

As well as being called the "unacceptable face of banking" by Peter (now Lord) Mandelson, Mr Diamond was branded a casino banker by Liberal Democrat leader Vince Cable and eventually lost the confidence of the governor of the Bank of England in the wake of the Libor scandal - forcing him to resign in 2012.

How does he look back on the barrage of personal criticism that came his way.

Mr Diamond was pilloried for saying the time for banker remorse was over

"I called Lord Mandelson after that. We'd never met and his response was telling. He said - it certainly worked for me politically."

Pejorative labels

As for the charge that he was engaged in casino banking he is, once again, not having any of it.

"Labels like casino banking are very pejorative and very unhelpful and don't describe the reality. Vince Cable was wrong. We have asset managers managing pension funds who need access to liquidity. We have companies hedging their foreign exchange exposure. Sit on a trading floor and you'll see the real value this brings to the economy."

In 2011, Mr Diamond was pilloried for saying he thought "the time for banker remorse was over". He insists that comment was misunderstood.

Mr Diamond after giving evidence to the British Treasury Select Committee on the financial crisis

"What I meant then - as I've been saying now - was that we have to let banks be banks - and that means taking risks. The mantle of risk now has to pass to the private sector."

There are many who will scream it's no wonder the bankers are happy to take the risks and pocket the rewards ten years after they helped blow up the world.

They will add that Barclays may not have been bailed out directly by UK taxpayers but they benefited from the life support provided by government and central banks around the world to the system as a whole.

They will point out that Bob Diamond was lucky disgraced RBS chief Fred Goodwin outbid him for the Dutch bank ABN Amro just as the crisis hit.

If Barclays had bought it - it's very unlikely Qatari investors could have plugged the bigger hole in its finances that Barclays would have been faced with, and would have had to join the queue for taxpayer help.

Peter Mandelson called Mr Diamond the "unacceptable face of banking"

But what's clear is that Bob Diamond certainly doesn't feel any special personal responsibility for what economic wise heads at central banks and regulators around the world failed to see coming or prevent - or the conduct of Barclays employees.

He's unlikely to succeed in revising the collective memory of what happened during the worst financial crisis in a generation.

But for what it's worth to him - and anyone else - his detractor in chief - Peter Mandelson - has had a change of heart. 'I went to Barclays one morning," he said. "I pretty quickly realised that what I had said was pretty dumb. He is an impressive fellow.'

- Published13 September 2018

- Published13 September 2018

- Published13 September 2018

- Published12 September 2018