Goldman Sachs's Marcus could boost UK savings rates

- Published

Goldman Sachs' new European HQ in London

Long-suffering UK savers could soon see higher returns, as one of Wall Street's swankiest banks boosts its presence on this side of the Atlantic.

Goldman Sachs is well-known for its investment bank in London, but from Thursday it will also offer a savings account to members of the public.

It will be known as Marcus by Goldman Sachs, after the bank's founder, Marcus Goldman.

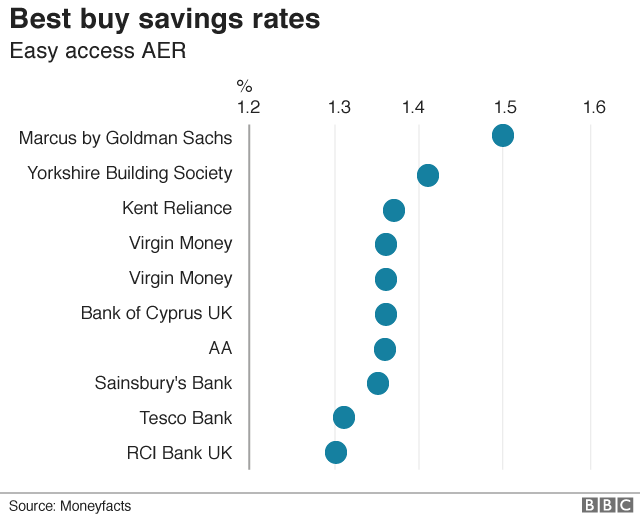

Savers will be offered 1.5% a year, currently the best rate on the market.

That is also the highest return that UK savers have seen in the last two and a half years.

Experts predict that such a competitive rate could force other banks and building societies to offer better returns as well.

"I definitely think that it will mean other providers will think about upping their rates, but only time will tell," said Charlotte Nelson of Moneyfacts.

"With them launching at such a high rate it's likely to make the challenger banks sit up and take notice."

The next nearest easy access savings rate is currently 1.41%, offered by Yorkshire Building Society.

However the Marcus account includes a bonus of 0.15%, which is only guaranteed for 12 months.

Nevertheless best-buy tables change frequently, as new entrants seek to get a foothold in the market, or raise money quickly.

The news could provide some relief for savers, who have complained that returns have not risen in line with two increases in the Bank of England base rate, in November last year and August this year.

Some High Street banks are still paying as little as 0.15% interest a year.

Anna Bowes, co-founder of Savings Champion, said: "Savers who fail to move their money from the shockingly low-paying easy access accounts on the high street are allowing themselves to be robbed.

"By moving from some of the lowest paying accounts with the likes of HSBC, to a top-paying account such as the new account from Marcus, you can get up to 10 times more interest in a year."

However many providers have had no need to offer competitive rates, as over the last few years they have been able to raise money very cheaply through Bank of England lending schemes.

If successful in the UK, it's thought that Goldman Sachs may launch the Marcus savings brand elsewhere in Europe.

It has been available in the US since 2016.

- Published21 September 2018

- Published17 July 2018