Half of twenty-somethings have no savings

- Published

Candace Wilson says she has only managed to save by living with members of her family

Young people in the UK are losing the savings habit - with more than half of 22 to 29-year-olds living with no savings at all, official figures show.

Some 53% of this age group have nothing in a savings account or Individual Savings Account (Isa), the Office for National Statistics (ONS) said.

The squeeze on pay and the prevalence of insecure work mean many cannot put money aside.

Ten years ago, 41% of the equivalent age group had no savings.

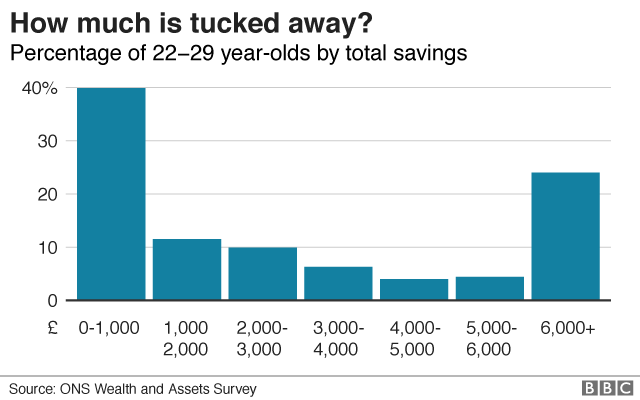

Among those who are saving now, seen in the chart below, nearly four in 10 have no more than £1,000 tucked away.

On average, those in this age group who do save have £1,600 in the bank - up from £900 a decade ago.

However, a savings gap has also emerged with the top 10% of savers having £15,000 or more set aside, according to the latest figures from 2014 to 2016, compared with the bottom 10% who had less than £100.

Savings tips: Andy Webb, blogger - Be Clever With Your Cash

Pay your savings first - set up a standing order to move money after payday.

Automate your savings - link your bank account to a smart app. The app analyses your spending habits and decides how much you can afford to save, and automatically moves the money into a savings account.

Round up your spending - some banks have a feature where you can round up transactions to the nearest pound. So spend £1.30 and 70p will be moved to a separate pot.

Make it difficult to spend your savings - if you are likely to dip into your savings for impulse purchases, keep the money in an account which is hard to access.

Spend in cash - if you're going on a night out, take cash with you and leave your cards at home. Then dump any change you have left to gradually build up a pot of notes and coins.

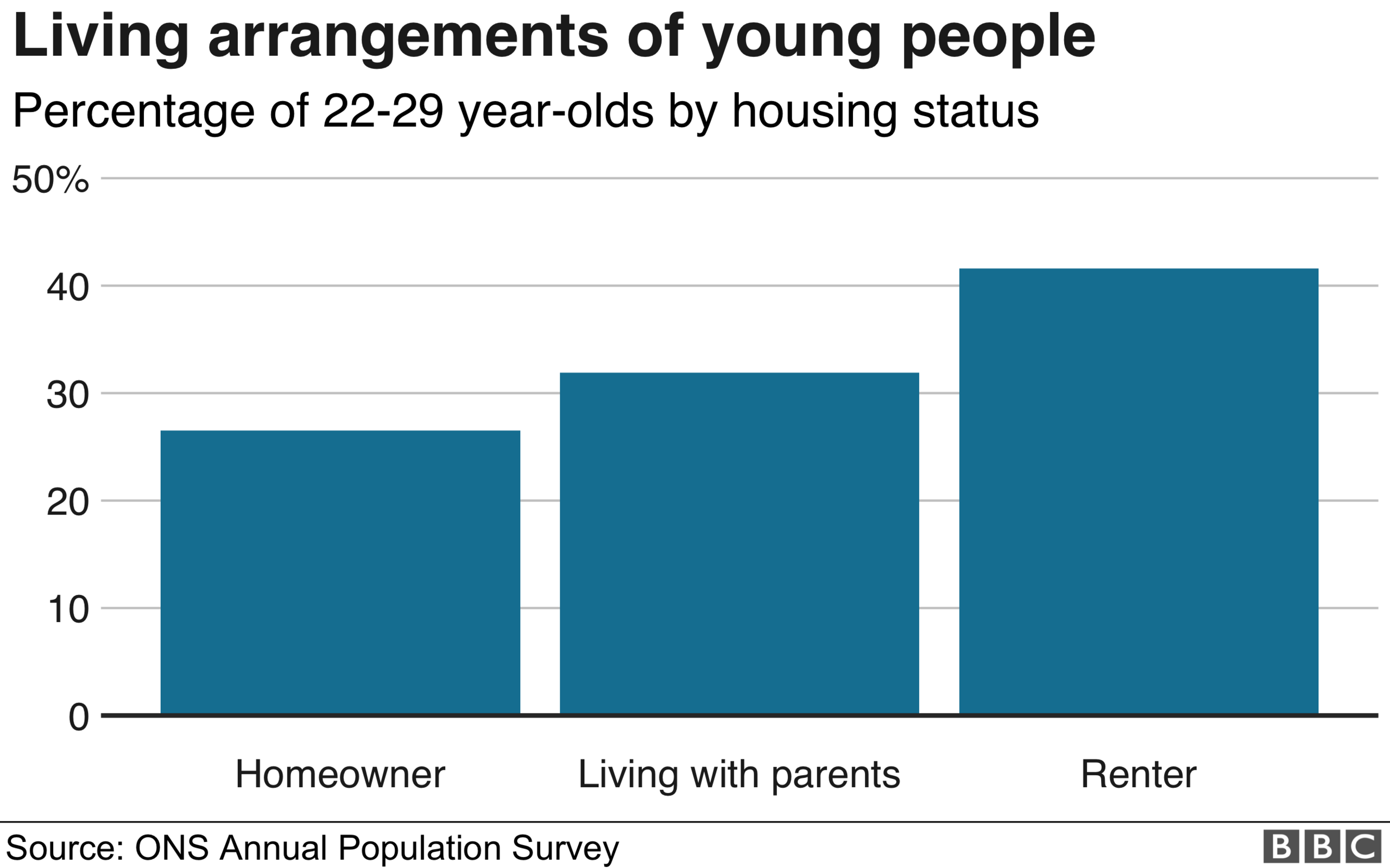

Home ownership has also fallen since the financial crisis, with the proportion of 22 to 29-year-olds with their own property falling by 10 percentage points between 2008 and 2017, according to the ONS.

As a result, more were living at home or renting, primarily from private landlords, since the financial crisis.

The cost of renting is putting pressure on many young people who want to live on their own, according to BBC research.

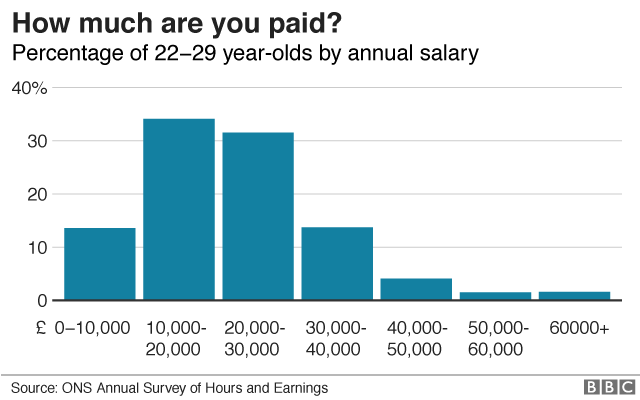

The pay gap in this age group sees the highest earning 10% of 22 to 29-year-olds paid at least 4.3 times as much per week as the lowest earners, according to the latest figures from 2017.

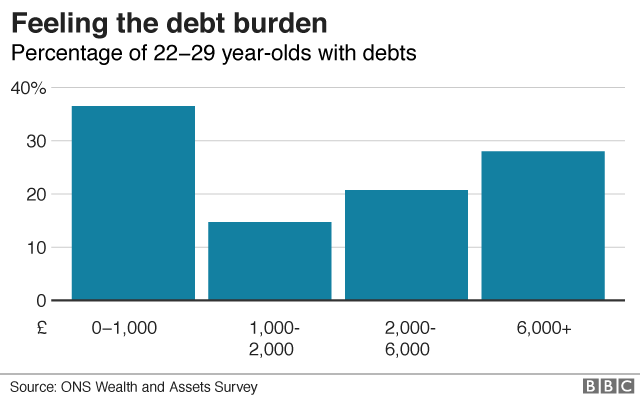

However, there is some cheer for young adults in the data, which shows 37% of this age group were in debt compared with 49% a decade ago.

Significantly, this debt does not include student loans.

Those with debts, seen in the chart below, owe an average of £1,900 - some £100 more than the typical debt 10 years earlier.

The 10% most indebted owed at least £14,200, the latest data shows.

- Published3 October 2018

- Published13 September 2018

- Published25 July 2018

- Published16 October 2017