Patisserie Valerie faces winding-up order from HMRC

- Published

The owner of Patisserie Valerie has uncovered "significant, and potentially fraudulent, accounting irregularities" and discovered HMRC has filed a winding-up petition against one of its subsidiaries.

HMRC is seeking £1.14m in taxes, the company said.

It said earlier that finance director Chris Marsh had been suspended.

Shares in the company, 37% owned by entrepreneur Luke Johnson, have also been suspended.

Mr Johnson said: "We are all deeply concerned about this news and the potential impact on the business. We are determined to understand the full details of what has happened and will communicate these to investors and stakeholders as soon as possible."

The company said that the board of directors had been notified of the potential fraud on Tuesday and announced it to the stock market just before its shares were due to start trading on Wednesday.

'Material change'

Then, hours later, it made the fresh announcement that its board had just become aware of the winding-up petition by HMRC for £1.14m.

The winding-up petition is against Stonebeach, its principal trading subsidiary, and had been filed at the High Court of Justice on 14 September. It was listed in the London Gazette, the official government bulletin, on 5 October. A hearing is scheduled for 31 October, the company said.

The company said it was "in communication with HMRC with the objective of addressing the petition".

"The company continues to engage with its professional advisers to understand better the financial position of the group and will make further announcements in due course," it said.

Patisserie Holdings, which was listed on the stock market in 2014, had earlier warned that the discovery of the accounting irregularities could led to "potential material mis-statement" of its accounts.

It also said that its cash position could be affected and "this may lead to a material change in its overall financial position".

Patisserie Holdings

It has five brands: Patisserie Valerie, Druckers - Vienna Patisserie, Philpotts, Baker & Spice and Flour Power City.

The first first Patisserie Valerie café was opened on Frith Street in London's Soho district in 1926 by Belgian-born Madame Valerie. It was destroyed in World War II and a new site opened at nearby Old Compton Street.

In 1987 the Scalzo family bought the Old Compton Street store and ran the business.

In 2006, Luke Johnson's Risk Capital Partners bought a majority stake when it had eight stores.

Now, there are 206 stores across the chain and about 2,000 staff.

It was floated on the AIM stock market, for smaller companies, in 2014.

The last trading update was in May, when Patisserie Valerie said its half-year profits were 14.2% up on the previous year at £11.1m and it had cash reserves of £28.8m.

Its auditors, Grant Thornton, said: "We are aware of the news released by Patisserie Valerie. Given our duty of client confidentiality it would be inappropriate for us to comment".

The first Patisserie Valerie store was opened in the Soho district of London in 1926 by a Belgian woman, Madame Valerie. It is now part of a chain with 206 stores and also trades in the supermarket chain Sainsbury's.

Earlier this year, it was linked with a possible bid for artisan bread chain Gail's, owned by Bread Holdings in which Mr Johnson has a majority stake.

Patisserie Valerie - which is known as CAKE on the stock market - was floated at 170p a share and was trading at 429p before its shares were suspended.

Mr Johnson bought into Patisserie Valerie in 2006, one of a number of business ventures by the entrepreneur, who built his reputation taking control of Pizza Express in 1993 before selling out in 1999.

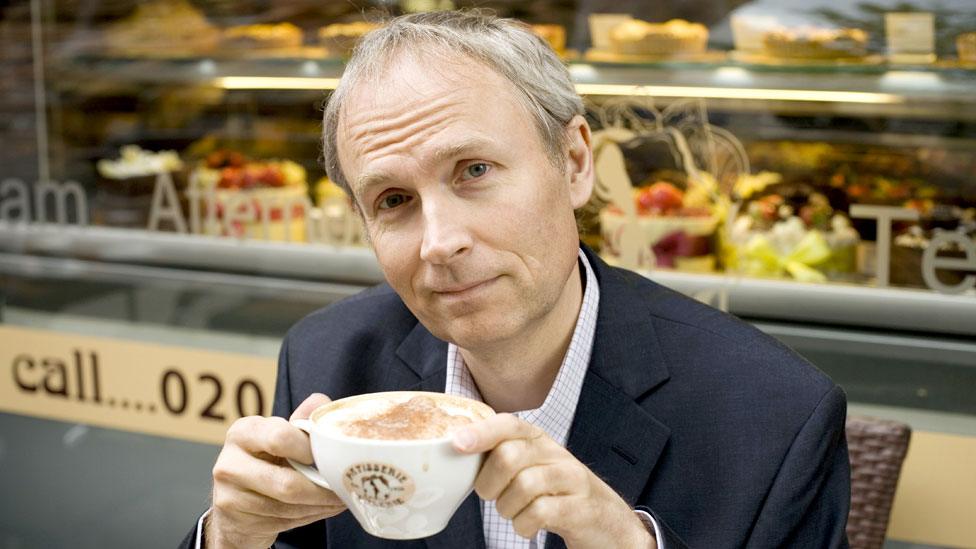

Entrepreneur Luke Johnson has a 37% stake in Patisserie Valerie

He then started and later sold Signature Restaurants - owner of the Ivy, J. Sheekey and Le Caprice, as well as the Belgo and Strada restaurant chains. He has also been involved in dental surgeries and bingo clubs.

He served as chairman of Channel 4 for six years until January 2010 and set up private equity company Risk Capital Partners in 2001.

As well as the stakes in Patisserie Valerie and Gail's, Mr Johnson's website also lists stakes in Neilson Active Holidays and Elegant Hotels Group, the largest hotel business in Barbados, and Xstrahl, a medical devices specialist.

His website also says he is a board member of sporting goods company Zoggs and Brompton Bicycles. He is chairman of the Brighton Pier Group, Majestic Bingo and Small Batch Coffee.

Among the major investors in Patisserie Holdings are Octopus Investments, which owns 8%. It declined to comment.

Aberdeen Standard Investments, which owns 2.9%, said: "This is an entirely unforeseen situation upon which we are unable to comment until the results of the investigation become known".

- Published23 April 2014