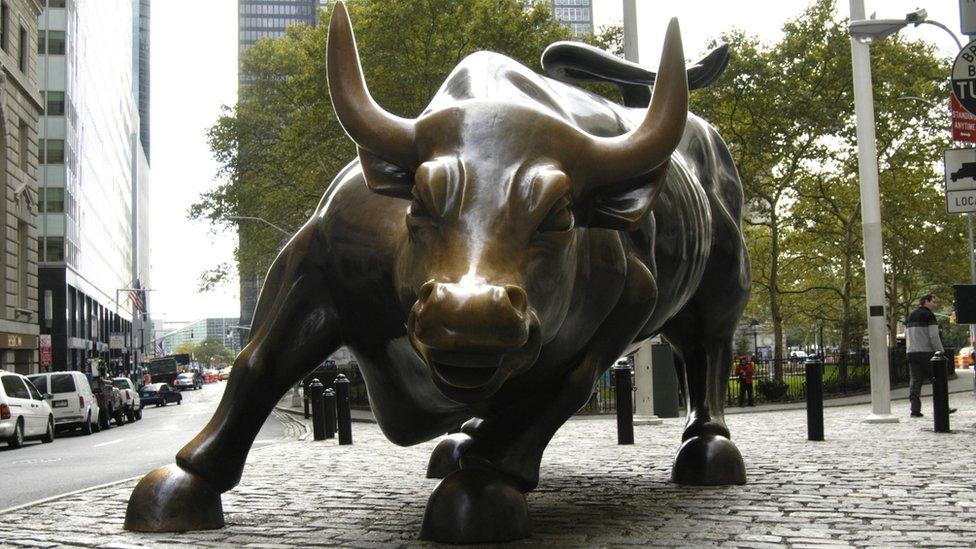

US shares suffer sharpest drop in months

- Published

US share markets have suffered their sharpest one-day falls in months, as fears about rising interest rates, inflation and trade tensions climbed.

The tech-heavy Nasdaq led the declines, sliding 4%, or 315.9 points, to 7,422.

The Dow Jones and S&P 500 also fell by more than 3%, with losses accelerating towards the end of the day. Netflix fell 8%, while Amazon slid 6%.

The slides extended declines in Europe, where exchanges in Germany and France ended the day down more than 2%.

The Dow fell 831.8 points, or 3.15% to 25,598.7. The S&P 500 dropped 94.6 or 3.29% to 2,785.6 - the biggest one-day fall since early February.

Trump's Fed criticism

US markets have done better than expected this year, bouncing back after turmoil early in the year to set new records over the summer.

But the Federal Reserve is raising interest rates, a move that tends to make it more expensive for companies to borrow, hurting bottom lines and turning stocks into a less attractive investment.

The White House issued a statement on Wednesday saying the economy remains healthy.

But US President Donald Trump also cast blame on the Fed, which he has repeatedly criticised for raising rates.

The central bank has "gone crazy", he told reporters.

The stock market fall came ahead of America's corporate earnings season, when companies will provide updates to investors about their outlook for the rest of the year.

"The big concern isn't really what third quarter earnings numbers are, but really what the outlook for the fourth quarter and first quarters are," Oliver Pursche, vice chairman and chief market strategist at Bruderman Asset Management, in New York, said.

Company costs, such as pay, are rising, and data on published on Wednesday showed a pick-up in inflation.

US tariffs on steel, aluminium and Chinese goods are another factor that could drive up costs and force companies to lower their forecasts, Mr Pursche said.

"I suspect that's one of the things underlying market concern," he said.

Market retreat?

Shares in the US energy sector saw some of the steepest declines on Wednesday, as investors reacted to shutdowns caused by Hurricane Michael in Florida and the Gulf of Mexico.

Oil exploration firms Hess Corp and Marathon Oil fell more than 7%, while Chevron was down about 3%.

Big tech companies also dropped, with shares in Google and Apple falling almost 5%.

The sell-off picked up late in the day, sending investors towards bonds. But for the most part, bond prices have remained relatively low.

Lindsey Bell, investment strategist at CFRA, said she thinks that is a sign that investors are not yet retreating from the stock market.

She predicted that shares would rebound as the earnings season gets underway, noting that strong results soothed investors when concerns about inflation triggered turmoil earlier in the year.

"You saw earnings season take off and really stabilise the market," she said, adding that underlying economic data remains healthy.

"We're optimistic that is going to happen here."

- Published22 August 2018

- Published25 August 2018