Cheaper food drives UK inflation lower in September

- Published

The UK inflation rate fell more than expected in September after hitting a six-month high in August.

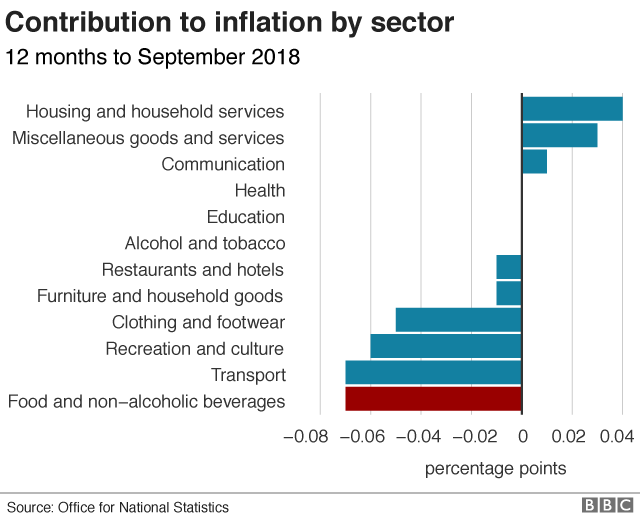

The Office for National Statistics said the fall to 2.4%, down from 2.7%, was largely driven by lower prices for food and non-alcoholic drinks.

The Consumer Prices Index figure surprised economists who had been expecting inflation to fall to 2.6%.

The result is expected to ease pressure on the Bank of England to raise interest rates in the near future.

Andrew Wishart, UK economist at Capital Economics, said: "With inflation in line with the Bank of England's forecast, and measures of domestically generated cost pressures, such as core inflation and services inflation falling back, this reduces any pressure on the MPC to act again before it can assess the likely impact of the Brexit negotiations."

However, Samuel Tombs at Pantheon Macroeconomics, said: "Unless services inflation strengthens markedly over the next six months, CPI inflation will undershoot the [Bank of England's] 2% target."

He argued that further falls in food prices and a cap on standard variable tariffs for gas and electricity would keep a lid on inflation.

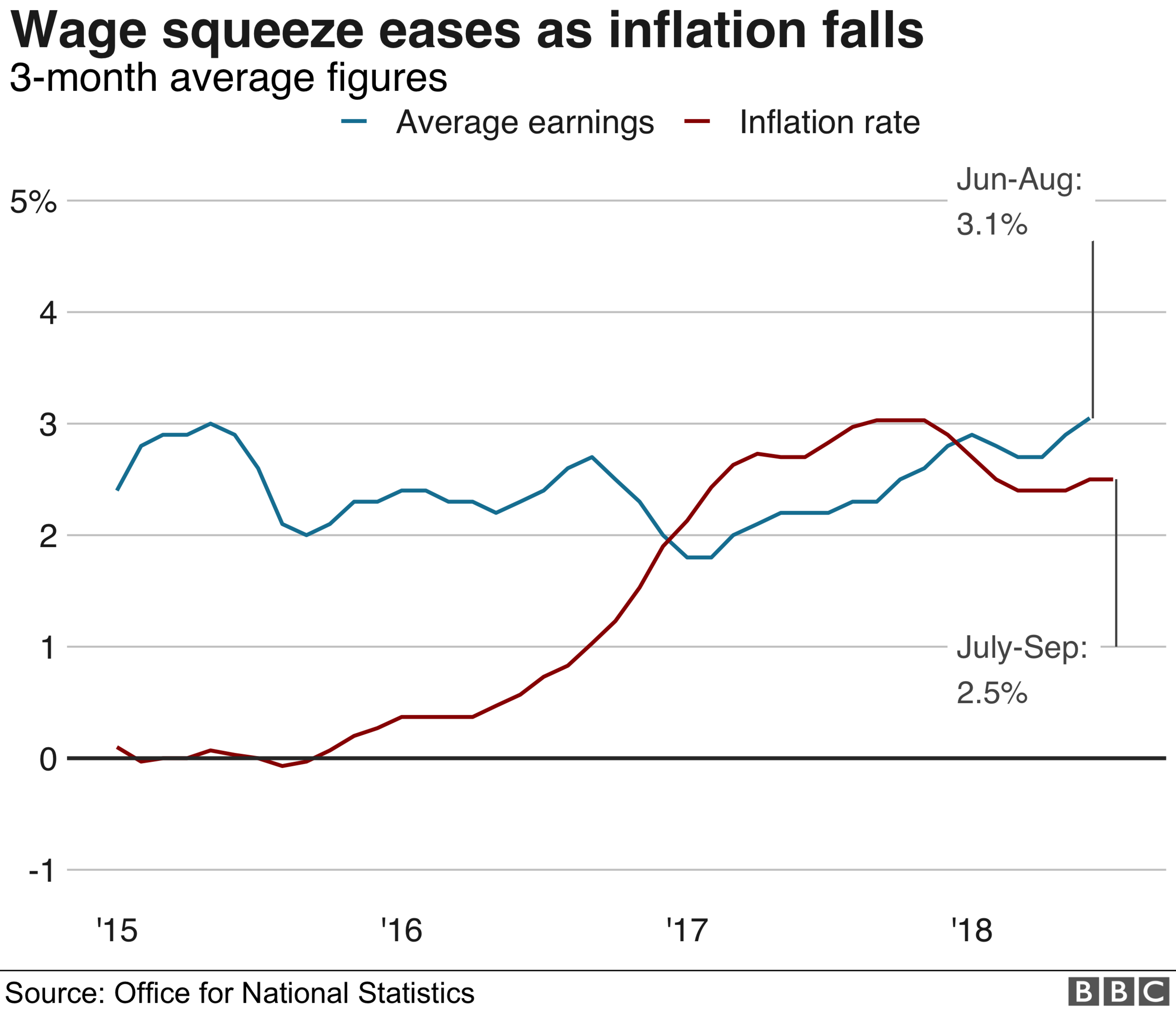

September's fall in inflation comes a day after figures showed that wages were rising by 3.1% - the fastest pace in nearly a decade - easing pressure on consumer spending power.

September's inflation figure is important as it will be used to set state pensions, which are expected to rise by about £4.25 a week.

It will also be used to determine business rates for the coming year, with the British Retail Consortium forecasting a £180m increase in retailers' costs.

Mike Hardie, head of inflation at the ONS, said: "Food was the main downward pull on inflation as last year's September price rises failed to reappear, while ferry prices dropped after their surprisingly high summer peak.

"However, it wasn't all one-way traffic with energy suppliers pushing up their prices."

The ONS said food prices, particularly of meat and chocolate, represented the biggest drag on September's inflation rate.

The price of cultural services, which includes theatre tickets, fell 2.5% while the cost of games, toys and hobbies rose just 1.6%, compared with a 4.4% rise in September last year.

However, the ONS said transport prices were up 5.5% compared with September 2017, partly due to higher fuel costs.

Electricity prices soared by 9.3%, the highest September figure since 2011.

Chocolate prices have fallen

Interest rates

In August the Bank of England raised interest rates for only the second time in a decade, following a recovery in economic growth.

Yael Selfin, chief economist at KPMG UK, said the inflation figure would ease the pressure on the Monetary Policy Committee to make further hikes.

"However, the relatively strong wage data released yesterday is likely to keep the Bank of England vigilant to any further signs of increasing inflationary pressures," she said.

Mike Jakeman, senior economist at PwC, said: "On balance we expect the central bank to maintain its current monetary policy stance until there is greater clarity over the circumstances of the UK's withdrawal from the EU."

Businesses warned the CPI figure, used to set business rates, would push up costs for struggling high street retailers.

A slowdown in consumer spending and rising overheads have led to numerous store closures across the UK over the last 12 months.

Helen Dickinson, chief executive of the British Retail Consortium, said: "These [inflation] figures confirm that the retail industry ... will face yet another eye-watering rise in business rates next April.

"Ministers need to act to address this £180m increase in retailers' already unsustainable business rates bill, along with other public policy burdens which retailers are struggling to absorb the cost of."

Pension rise on the cards

By Kevin Peachey, BBC personal finance reporter

The full state pension is set to rise by about £4.25 a week to £168.60 in April, with confirmation expected in the Budget later this month. This is the equivalent of £8,767 a year.

However, most pensioners get the older basic state pension, which is likely to rise by £3.25 a week to £129.20. They may get a Pension Credit top-up.

The triple-lock system means that the state pension rises in line with inflation, earnings or 2.5% - whichever is the highest.

The benchmark for inflation is the Consumer Prices Index inflation figure for September, which was 2.4%. However, the rise in earnings of 2.6% (based on earnings growth including bonuses in July) is higher.

There has been some debate over the future of the triple-lock and its sustainability, particularly during the public sector pay cap and a time of low average wage growth. However, the government has said it would keep the triple-lock for the rest of this parliament.

Some other benefits, unaffected by a cap, such as bereavement benefits, carers' allowance, disability benefits, and maternity and paternity allowances, are set to rise in April in line with the latest inflation figure.

There is a freeze on most working-age benefits, such as jobseeker's allowance and income support. The Institute for Fiscal Studies (IFS) said that, without the freeze, more than 10 million households would have been an average of £150 a year better off in 2019-20.

NHS workers, teachers and police staff will see their pension contributions up-rated based partly on these latest figures.

- Published19 September 2018

- Published15 August 2018