Budget 2018: Big spender Hammond

- Published

- comments

There was one big challenge for the chancellor today - map out a plan for "ending austerity" as demanded by the prime minister.

Ending rather than ended is probably the most accurate analysis - with plans for many billions of pounds of extra spending.

Some might say Philip Hammond has discovered his inner Gordon Brown.

The public finances are in better shape - borrowing is £11.9bn lower this year than expected.

But as the official watchdog, the Office for Budget Responsibility, put it: "The Budget spends the fiscal windfall rather than saving it."

This is the largest "fiscal loosening" - extra spending by the government not matched by tax rises - since 2010.

The chancellor said that public spending would increase by 1.2% a year over five years from 2020.

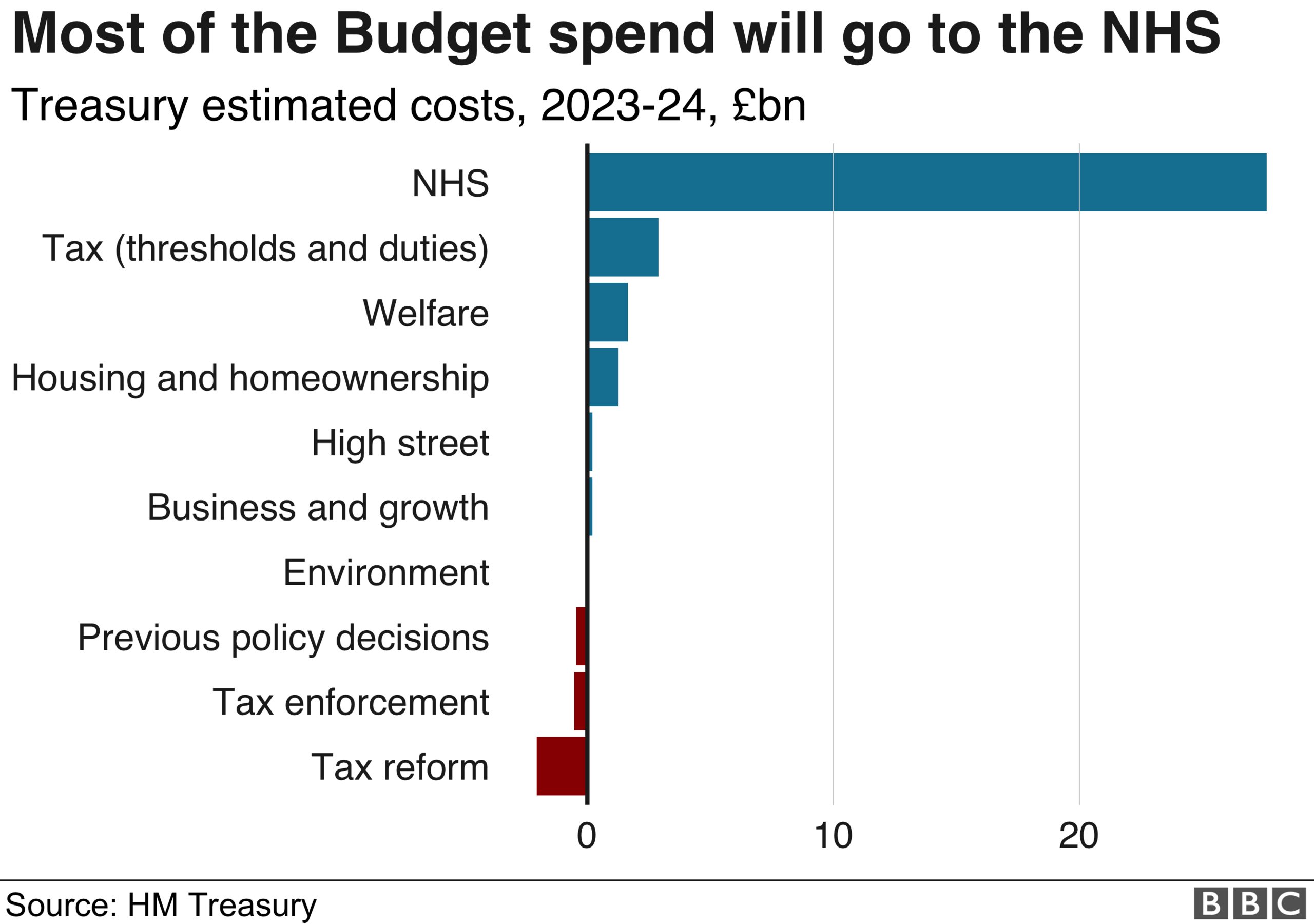

Public spending will rise by £30bn by 2023-24, a significant stimulus to be spent on the NHS and on raising the amount people can earn before they start paying tax.

That is in sharp contrast to the five year "austerity" plan announced in 2010, which saw cuts of 3% a year, and 2015, which included cuts of 1.3% a year.

To pay for that, Mr Hammond will allow borrowing to to be sustained at around £20bn a year.

Little talk today of "balancing the books" or the risk of a bad Brexit deal.

There is better news on the economy.

The OBR upgraded its forecast for growth for the next two years, which means the government is likely to enjoy higher tax revenues.

But growth is still relatively weak, falling back to levels low by historic standards from 2020.

The test for Mr Hammond is this.

Will the better news on the public finances and high levels of employment be maintained? If it isn't then the plans for extra spending will look very heroic indeed.

- Published29 October 2018

- Published29 October 2018