Klarna: The £1bn High Street giant you might not know

- Published

You may never have heard of Klarna.

But after doing deals with the like of Asos, JD Sports and Topshop in the last 12 months, it's up there with the biggest names in the High Street.

Last month it was reported, external that fashion retailer H&M spent $20m (£15.5m) buying slightly less than a 1% stake in the Swedish bank, making Klarna a unicorn: a private technology company valued at more than $1bn.

However, since it started trading in the UK in 2015, concerns have been raised about the easy access credit it offers shoppers at the checkout.

With many users in their teens or early 20s, critics are worried the firm encourages young shoppers to buy things they either don't really want or need - or ultimately can't afford.

So how does it work?

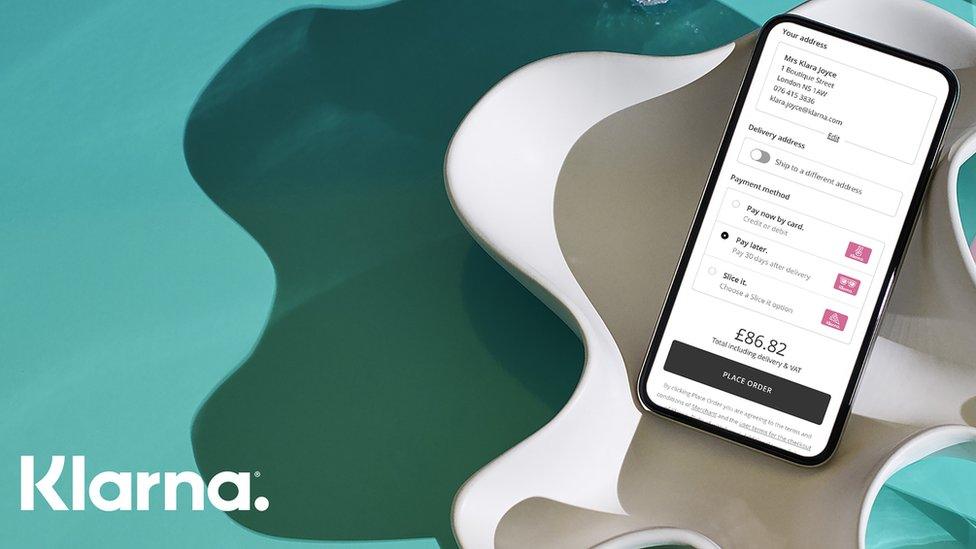

Klarna claims to offer online shoppers the ultimate "try before you buy" experience.

If you want to try on £200 of shoes or clothing, it offers you a way of having the goods delivered to you in one go and not having to pay anything upfront.

Instead, the shop or retailer gets paid by Klarna, which in turn takes on the debt.

Shoppers buying through Klarna get up to 30 days to make up their mind about what they want to keep and Klarna gets a percentage of the purchase from the retailer.

So long as the shopper sends back anything they don't want before 14 or 30 days have lapsed - depending on the retailer - then he or she simply pays for the purchases that are kept and there is no further charge or interest, and no fee.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

However, there are concerns about giving people such easy access to credit at the checkout.

Critics say this type of payment service could encourage consumers, especially younger ones, to take on dangerous levels of debt.

After the initial 30-day period, shoppers have an extra 120 days to pay their bill, after which it can then be passed to a debt collection agency.

That's when a person can face increased charges and debts, which can ultimately affect his or her credit rating.

'Soft' credit check

Klarna also only carries out what it calls a "soft" credit check for people wanting to use its service.

It asks for personal details, such as an email address, postcode and date of birth.

It then checks if the shopper's had any repayment problems with either itself or other retailers and, if not, instant credit is likely to be approved.

In the UK, about 70% to 80% of applicants - mainly people in their teens and 20s - are accepted and so far this year more than one million people have used Klarna's "pay later" service.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Jane Tully, director of external affairs at the Money Advice Trust - the charity that runs National Debtline - said that, while "buy now, pay later credit" offers some shoppers flexibility it can also cause financial problems.

"This can be an expensive way to borrow if the customer is unable to pay and if they exceed any interest-free time limit as charges can soon mount up," she said.

"For all customers, and particularly younger consumers, the check-out should never be a place for the hard-sell when it comes to credit."

'A good history'

Luke Griffiths, the UK managing director of Klarna, said his company's business model was different from traditional credit services, such as credit cards.

He said the firm has global ambitions.

"Our 'pay later' solution does not charge the consumer any interest, any fees, or anything associated with not paying on time.

"We encourage them to pay on time but if they're unable to pay at 30 days we do not charge them beyond that point."

He added: "So, as opposed to a credit card, if you go over a period when you were intended to repay and you start incurring charges and interest this service is different because we're working with the customer."

Klarna's UK managing director, Luke Griffiths, says Klarna has global ambitions

He also denied it encourages problem debt for people in their teens and 20s.

"Should they have any difficulty with repaying we're providing flexibility about the way they ultimately return that repayment to Klarna.

"Should they have any issues with repaying they won't be able to use our service in the future as well.

"So we're not going back to customers who've been struggling to repay and encouraging them to use us again.

"We're basing the access to our service on a good history of paying for our service and being able to repay."

You can hear more on BBC Radio 4's Money Box programme on Saturday at 12:00 BST or listen again here.

Follow Money Box, external and Dan, external on twitter.