Price cap plan for rent-to-own sector

- Published

- comments

Michele Jacques found rent-to-own meant paying over the odds for her cooker

Plans to cap the costs of buying domestic goods such as TVs and fridges through rent-to-own shops have been welcomed by the stores' customers.

Michele Jacques, from Droylsden in Manchester, ended up spending £700 on a cooker as a result of interest rates that can reach 99% a year.

Had she gone to a High Street shop, it could have cost her as little as £250.

The proposals from the Financial Conduct Authority (FCA) mean rent-to-own customers would pay much less.

Rent-to-own customers make monthly payments, in effect renting goods until they have paid in full.

"Interest rates should be capped. They shouldn't be allowed to make so much profit from vulnerable people," said Ms Jacques.

"It does make you frustrated. It makes you angry."

She said the cap proposed by the FCA was "the correct thing to do".

How will the proposed cap work?

First, the FCA will limit the amount of interest that customers pay.

From April 2019, they will pay no more in interest than the cost of the product itself. So if a cooker costs £300, they will pay no more than £600 in total, including the cost of credit.

However, rent-to-own shops will still be able to charge for insurance and warranties on top of that.

Second, the cost of the goods themselves will be limited.

Shops will be able to charge no more than the median - i.e the middle price - of three mainstream retailers.

Andrew Bailey, chief executive of the FCA said: "Today's measures are designed to bring down very high prices in the rent-to-own sector, which is used by some of the most financially vulnerable in our society.

"A cap will prevent firms charging over the odds for essential everyday items like cookers or washing machines. We believe a cap is the only intervention that will effectively tackle the highest prices."

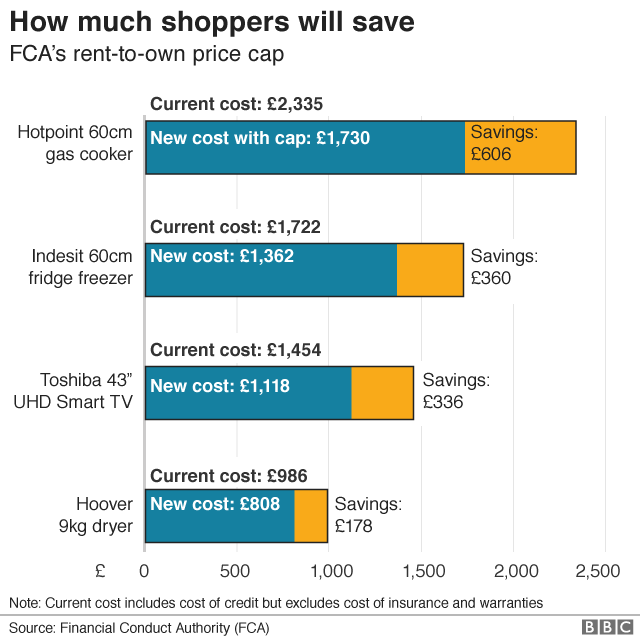

How much will consumers save?

The FCA says the cap could save about 400,000 consumers up to £22.7m a year.

In a series of examples, someone who buys a Hotpoint cooker on a rent-to-own basis could save as much as £606 over a three-year period, or £3.88 a week.

Someone buying an Indesit fridge freezer through rent-to-own could save £360 a year, or £2.31 a week.

How have rent-to-own shops reacted?

The main providers of rent-to-own goods are Brighthouse and PerfectHome.

A BrightHouse spokesman said: "BrightHouse has been working closely and constructively with the FCA over a number of years. This comprehensive process has led to many changes in the way we operate as a business and serve our customers.

"We're going to carefully consider today's announcement, while continuing to offer those excluded from mainstream credit ways to get the household goods they need."

PerfectHome said it too would consider the plans in detail.

What do consumer groups say?

The proposed cap was welcomed by the debt charity StepChange, The Money Advice Trust, and by Citizens Advice.

"This cap is a victory for people who struggle with the runaway costs of rent-to-own agreements," said Gillian Guy, chief executive of Citizens Advice.

"A cap gets to the heart of the problem by stopping costs from spiralling out of control and pushing people into further debt.

"Our evidence has repeatedly shown that well-designed caps can reduce the harm high-cost credit can cause, as they have done in the payday loan market."

However Andrew Hagger, a personal finance expert at Moneycomms, said rent-to-own goods will remain expensive.

"The measures are long overdue and will help, but you have to question whether a 100% mark up is acceptable.

It's a big shift in the right direction, but in essence customers can end up paying double the retail price which still seems excessive."

- Published31 May 2018