Will Opec defy Trump's call for low oil prices?

- Published

Saudi Arabia is said to be leading the call for Opec members to cut production

Initially it is difficult see what President Donald Trump and Usman Ahsan, a taxi driver in Islamabad, the capital of Pakistan, have in common.

One is the leader of the US, with an estimated personal fortune of $3.1bn (£2.4bn), the other is struggling to support his wife and eight-month-old daughter.

Yet both are this week hoping that the Opec oil producers' cartel doesn't decide to cut production in an attempt to increase global crude prices.

Representatives of Opec's current 15 member states meet at its headquarters in Vienna, Austria on Thursday, 6 December, for their latest biannual meeting, where they will set production levels for the next six months.

Usman Ahsan says that the high cost of petrol makes it difficult for him to support his family

The expectations are that at the urging of Opec's de facto leader, Saudi Arabia, output will indeed be cut to help boost prices, which fell to their lowest levels in more than a year at the end of November

Saudi Arabia argues that output needs to be trimmed because it fears that otherwise prices could fall further next year due to a predicted slowing in demand for oil.

Both Mr Ahsan and President Trump will not be happy if Opec - which accounts for more than a third of oil supplies - does indeed cut production.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

"The price of petrol is already way too high," Mr Ahsan, 28, tells the BBC over the telephone. "I sometimes have to work 16 hours a day, for 30 days in a row, to provide for my family."

Meanwhile, President Trump tweeted last month: "Hopefully, Saudi Arabia and Opec will not be cutting oil production." In another tweet in November in response to falling oil prices he wrote: "Thank you to Saudi Arabia, but let's go lower!"

President Trump wants prices to remain low at US petrol stations

Like the rest of us Mr Ahsan doesn't have any clout with Opec, but President Trump certainly does. And he wants petrol prices to stay low to help US drivers and the country's economy.

So what exactly should we expect to be announced following the Opec meeting and why?

And what are the other issues that Saudi Arabia and Opec have to consider?

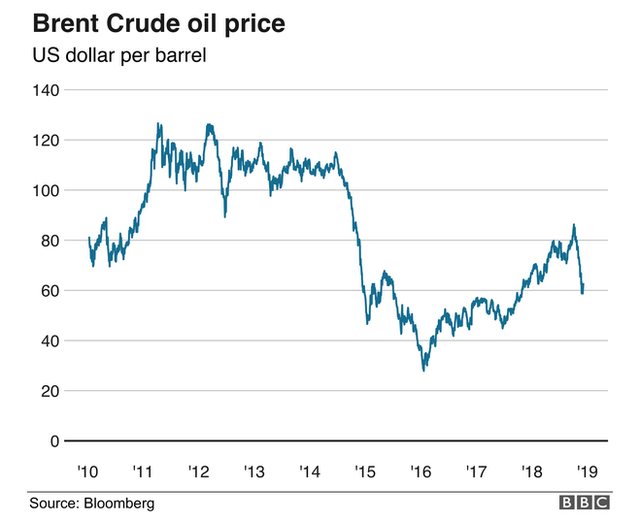

If we look at the current oil prices and how they compare with the past decade, they are undeniably low. Brent Crude, widely used as a benchmark for global oil prices, fell to $58.76 a barrel on 28 November, its lowest level since October 2017.

Even though the price has subsequently risen above $63, on growing agreement among analysts that Opec will announce some production cuts, this is still less than half the highs reached in March 2012 of more than $128. Prices soared then due to fears over supplies from Iraq because of continuing instability in the country.

Opec wants to cut production because it forecasts that the rate of growth in the worldwide demand for oil will slow in 2019 as the global economy cools slightly.

It said last month it now expects worldwide demand for crude will increase by an average 1.29 million barrels per day in 2019,, external compared with 2018, to a total of 100 million barrels a day. Earlier, in July it was predicting an increase of 1.45 million barrels a day.

Ann-Louise Hittle, vice president in charge of oil at research group Wood Mackenzie, agrees demand will cool next year. Like many she predicts that Opec will announce production cuts, but only modest ones due to pressure from President Trump.

Saudi Arabia and Russia have developed much closer ties in recent years

"We expect a production restraint agreement to emerge from the meeting and have had this in our base case 2019 forecast. We have expected this for some months because without it, there will be a large scale oversupply."

But by how much is Opec likely to cut supplies? Ms Hittle suggests around 800,000 barrels a day, that would "stabilise prices and prevent further declines". She adds that a cut of one million barrels a day would mean price rises of "several dollars a barrel".

Qatar to leave Opec oil producers' group

Fellow oil industry analyst Rachel Ziemba from the Center for a New American Security predicts a cut of "up to 500,000 barrels a day".

However, she cautions that "this meeting is still tricky to call". She says that as the US and China now appear to be trying to patch up their trade dispute, the global economy may actually be stronger than previously predicted next year.

The big growth in US oil production is said to have spooked Opec

Other commentators speculate that Saudi Arabia may be more willing than usual to pay heed to President Trump's call, after the reputational damage it suffered following the death of Saudi journalist Jamal Khashoggi inside the country's consulate in Istanbul.

Saudi Arabia has actually already increased its production slightly since the summer, in response to urging from Mr Trump.

This was to make up for a fall in global supply following the US reinstating sanctions on Iran, and led to the recent yearly lows.

Jim Krane, energy research fellow at Rice University's Baker Institute in Houston, says that an Opec production cut is "looking likely" despite the pressure from President Trump.

"A lot of producers need $60-80 [per barrel of] oil to balance their national budgets," he says. "When oil falls much below $60, they get nervous."

He adds that what has strengthened Opec's hand is the organisation's close ties with Russia, and that if Opec trims production, Russia will probably do the same.

Global Trade

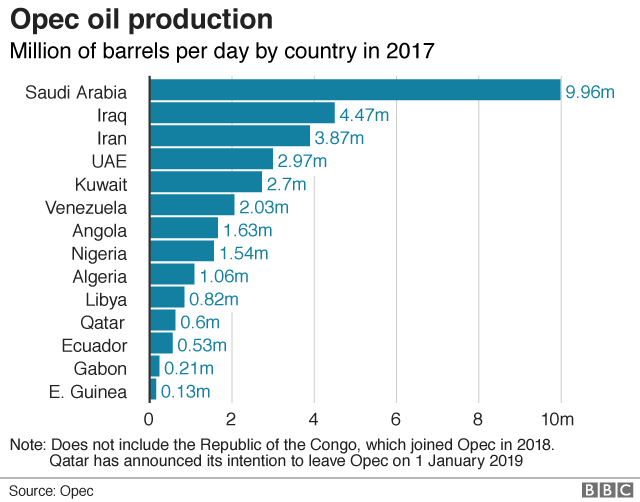

What has brought Opec and Russia together in recent years has been their mutual concern at the vast growth of the US shale oil industry. The resulting rise in its oil production means the US is now the world's largest oil producer, according to some estimates., external This puts it ahead of Saudi Arabia and Russia in second and third place.

So despite President Trump's tweets, Opec is widely predicted to announce a production cut, if only a small one, to try to raise global oil prices.

For Mr Ahsan, in Islamabad, it won't be welcome news. "Life is tough, if I try to do normal hours of driving, like eight hours, I don't make a profit because of the cost of fuel," he says.