Asos profits hit by fashion price-cutting

- Published

- comments

Online fashion retailer Asos has warned of weak profits this financial year after "unprecedented" discounting hit its trading in November.

After reports of dismal High Street activity last month, the Asos warning indicates the pain is spreading online.

The firm said cutting prices to match rivals had not shifted more clothes.

In fact, economic uncertainty plus weaker consumer confidence had led to "the weakest growth in online clothing sales in recent years".

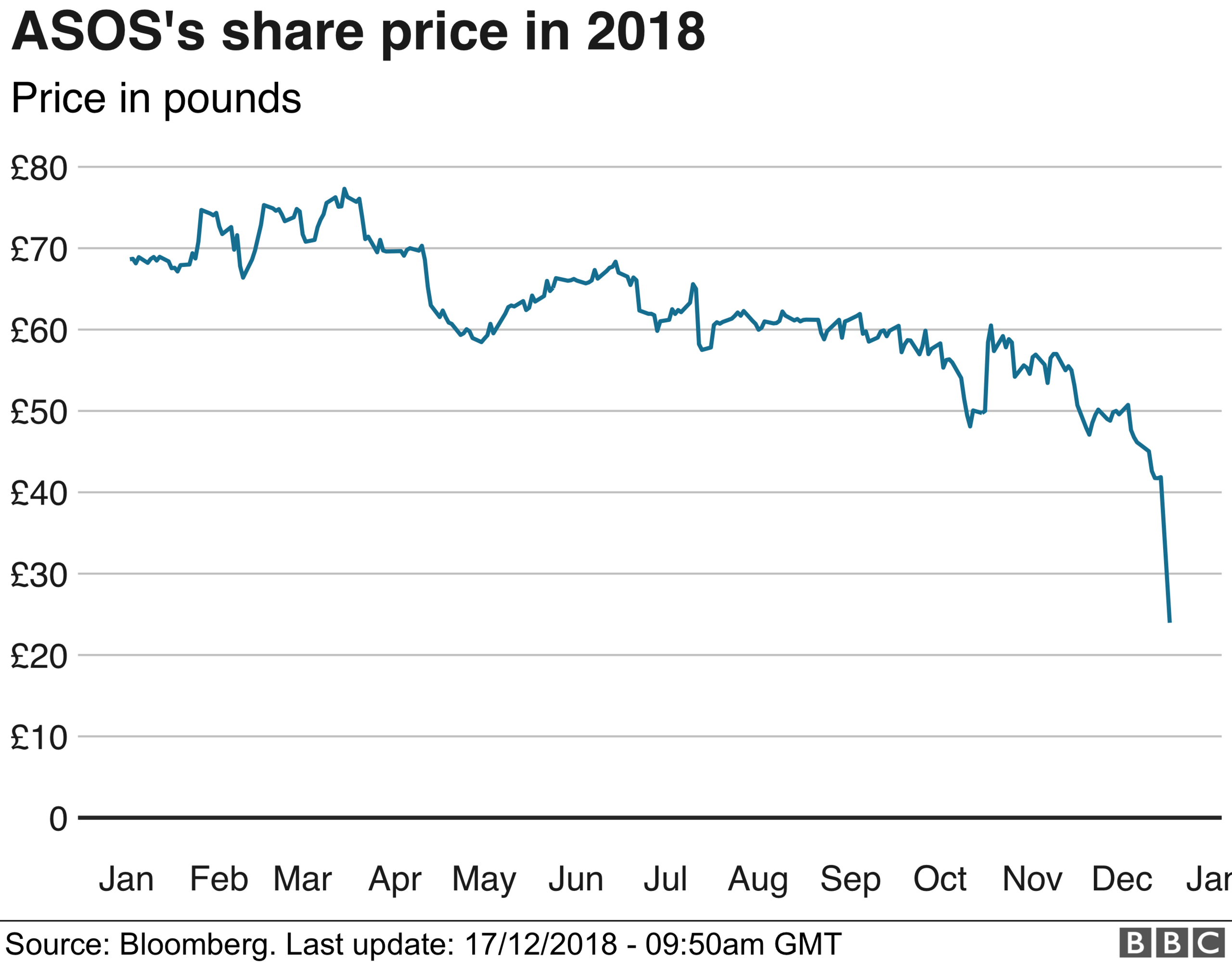

Asos shares fell nearly 40% in morning trading.

Chief executive Nick Beighton said the fashion industry was currently experiencing an "unprecedented level of discounting, something I've not seen before".

In a conference call with industry analysts, he said consumer confidence was "fragile".

Despite sales growth of 14% from September to November, Asos saw "a significant deterioration" in November.

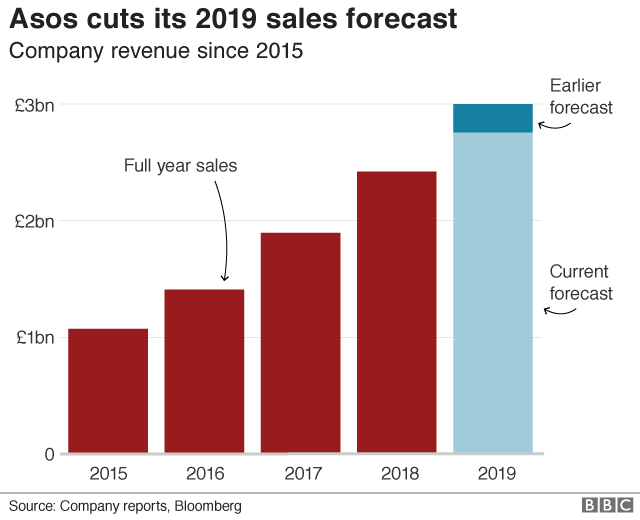

It had previously forecast sales growth of 20-25% in the year to August 2019. However, it now expects just 15% growth.

Its anticipated profit margin was also revised down, from 4% to 2%.

Worried voices of retail are becoming a deafening chorus and the lyrics are simple. November was bad - really bad - and not just on the High Street.

Online retail darling Asos saw its shares plunge 35% this morning after warning that its profits would undershoot expectations. Comments from chief executive Nick Beighton describing an "unprecedented level of discounting" saw other retailers' share prices slump, including those of Boohoo, Next and JD Sports.

Last week, Sports Direct tycoon Mike Ashley said November had been the "worst November in living memory" and predicted some retailers would be "smashed to pieces".

The woes of predominantly bricks-and-mortar retailers (like clothing retailer Bonmarché, which saw its shares halve as it lurched to a £4m loss last week) have been well chronicled, but the significance of the Asos update is that it shows the fight for every last pound and every last percentage point of profit margin has spread online.

There may yet be a late rush, but evidence so far suggests retailers' annus horribilis is not ending well.

"Whilst trading in September and October was broadly in line with our expectations, November, a very material month for us from both a sales and cash margin perspective, was significantly behind expectations," Asos said.

"There has been a high level of discounting and promotional activity across the market. We have increased our own level of promotional activity, leading to a higher discount and continued high clearance mix.

"This increased discounting, coupled with the unseasonably warm weather during the last three months has reduced our ASP [average selling price], which has not been compensated by higher units per basket."

Outside the UK, Asos said trading conditions in Germany and France, which account for about 60% of its EU sales, had become "significantly more challenging".

Over the three months to 30 November, total group revenue was £656m, up from £576.7m in the same period last year.

Rival firm Boohoo saw its shares tumble 10% in the wake of the Asos announcement.

However, it said it was "pleased to confirm" that its trading performance remained strong, "with record Black Friday sales across the group", and that it continued to trade "comfortably in line with market expectations".

Asos's bleak assessment comes after Sports Direct boss Mike Ashley described trading in November as "the worst on record, unbelievably bad".

"Retailers just cannot take that kind of November," Mr Ashley told analysts last week. "It will literally smash them to pieces."

Confidence knocked

George Salmon, equity analyst at Hargreaves Lansdown, said: "After making impressive strides in recent years, a challenging consumer backdrop has finally tripped Asos up.

"Recent data revealed a huge decline in UK retail footfall, which it would have been easy to assume was due to online players taking share at a faster rate. These numbers show it's more complicated, and more worrying, than that.

"It looks like consumer confidence has been knocked to the extent people aren't spending much anywhere, be it in physical stores or online."

Mr Salmon said "uncertainty around Brexit" would also be playing a major role.

He added: "It's probably no coincidence Asos's key demographic of 20-somethings generally harbour more concerns over the future of the economy post-Brexit than their parents."

- Published14 December 2018

- Published13 December 2018

- Published16 December 2018

- Published17 October 2018

- Published5 July 2018