Inflation eases as petrol prices fall

- Published

- comments

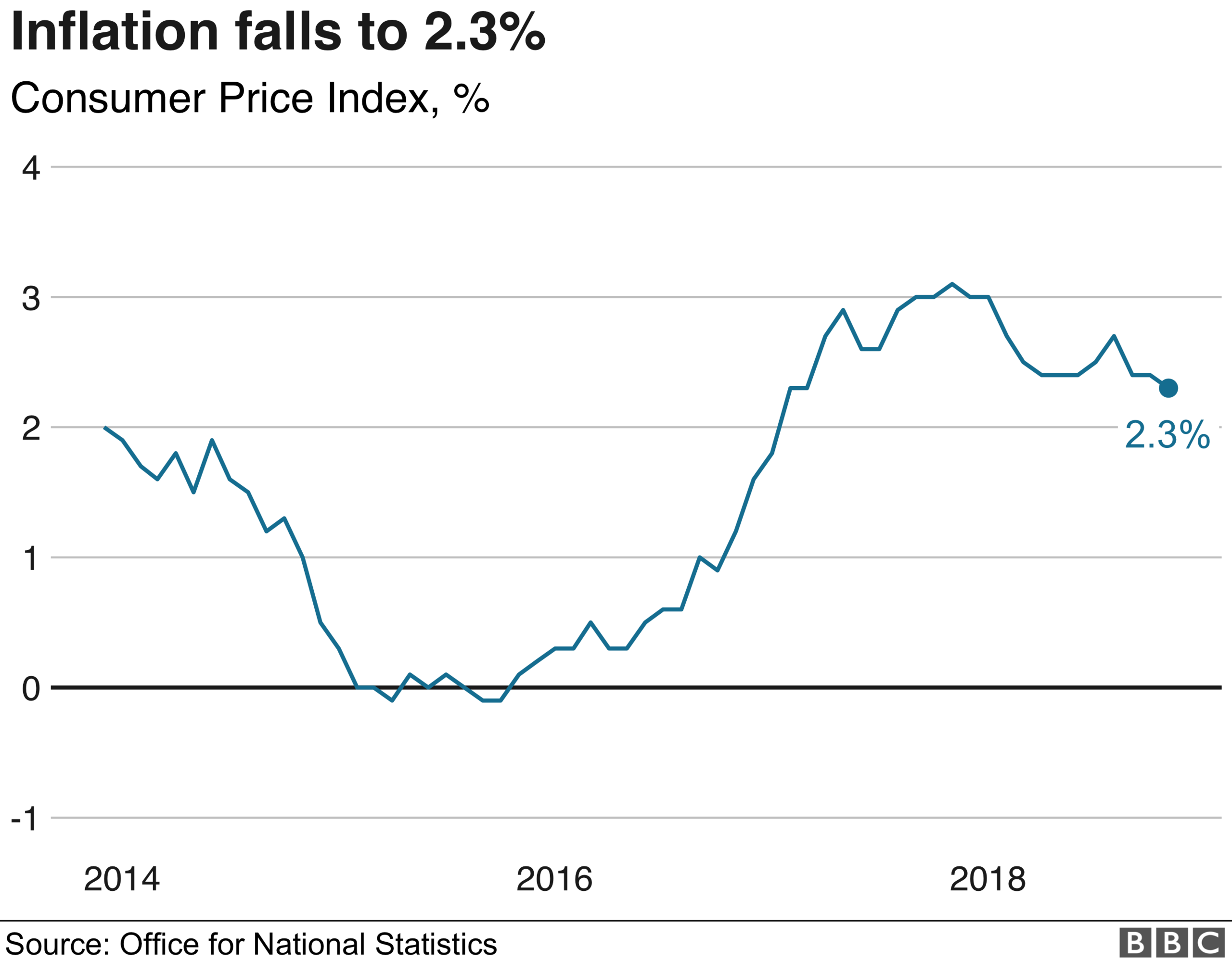

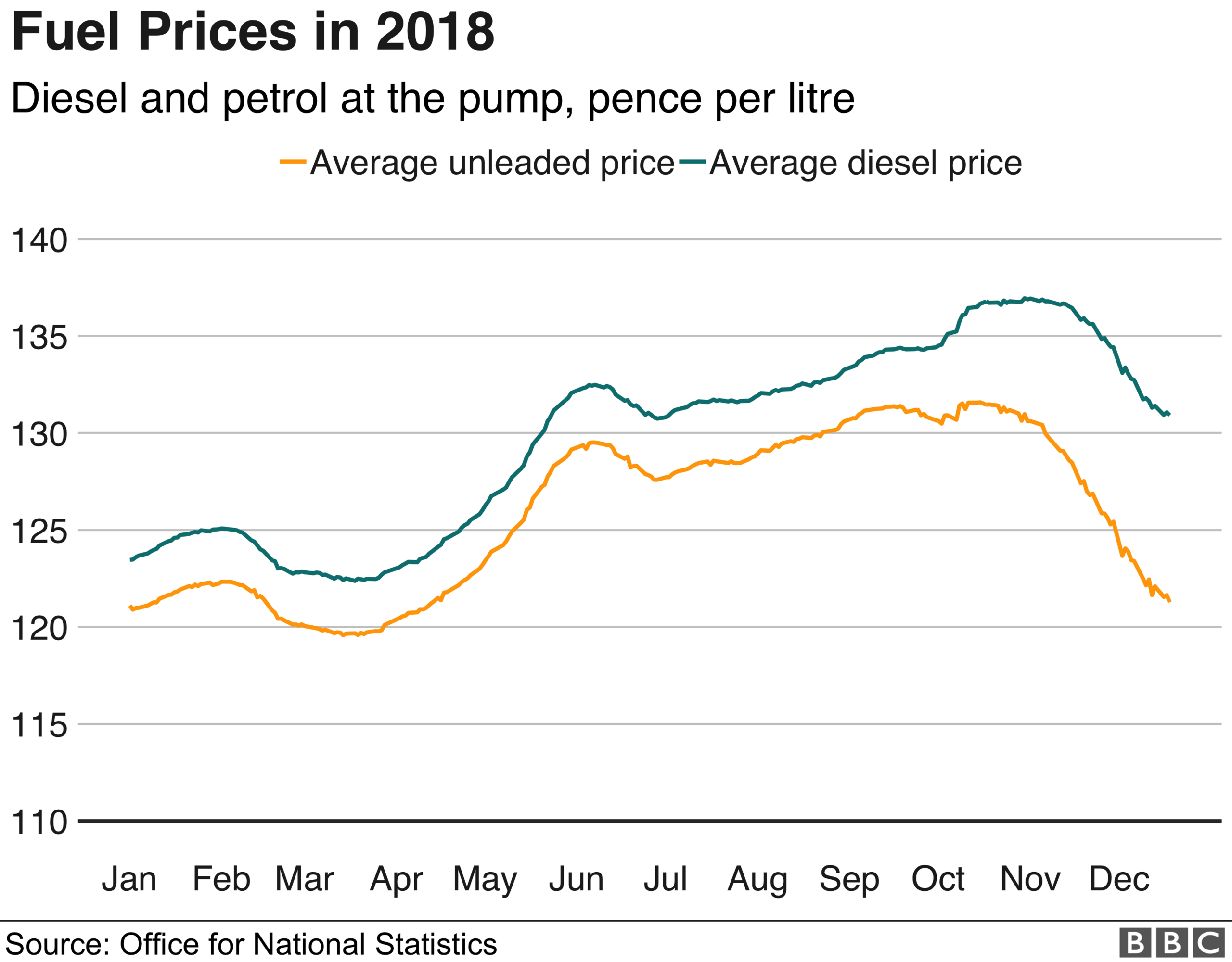

The UK inflation rate fell slightly to 2.3% in November, from 2.4% the previous month, driven mainly by a big fall in petrol prices.

The Consumer Prices Index (CPI) figure for the month was the lowest since March 2017, according to the Office for National Statistics (ONS).

Video games prices also fell, but those declines were partly offset by a rise in tobacco prices.

The inflation figure was in line with analysts' expectations.

ONS head of inflation Mike Hardie said: "Inflation was little changed as falling petrol prices, thanks to a substantial drop in the cost of crude oil, were offset by rises in tobacco prices following the duty changes announced in the Budget."

Apart from petrol, the biggest downward contribution to the inflation rate came from a variety of recreational and cultural goods and services, principally games, toys and hobbies, and cultural services.

In addition to tobacco products, upward pressure was seen in categories including accommodation services and passenger sea transport.

The latest inflation figures mean that pay growth is still outstripping inflation, with the most recent figures showing wages rising by 3.3%, excluding bonuses.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said inflation was set to fall sharply in the coming months, led by lower energy prices.

"Accordingly, CPI inflation still looks set to be below the [Bank of England's] 2% target right from the start of 2019 and to average just 1.8% over the course of the year," he said.

However, he added that he still expected the Bank's Monetary Policy Committee (MPC) to raise interest rates further in 2019, "as the Committee believes that interest rates still are well below neutral levels and that no spare capacity exists.

"As such, we continue to expect the MPC to increase Bank Rate to 1.25% by the end of next year, from 0.75% currently."

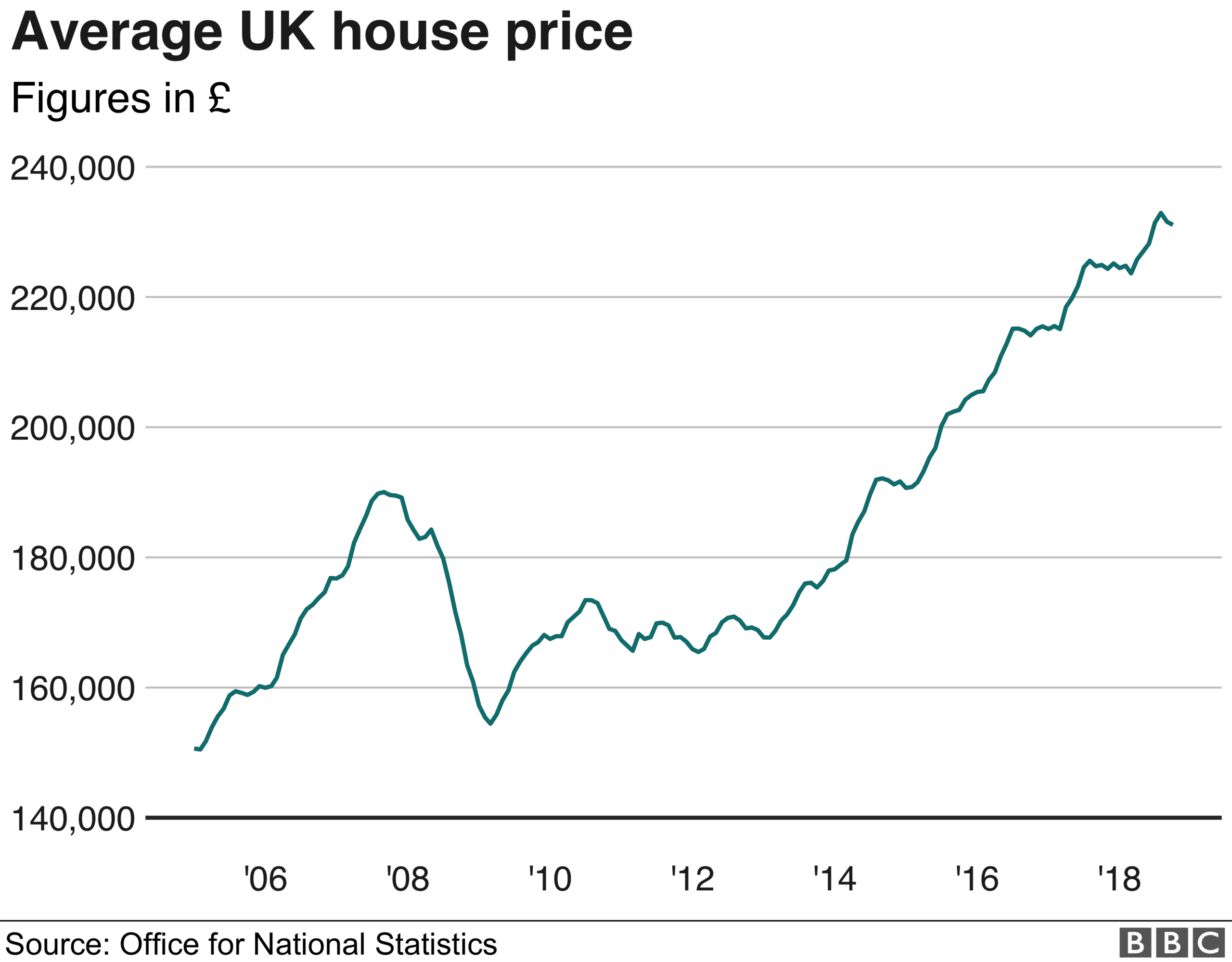

Separate ONS figures showed the average price of a house in the UK rising at its slowest rate since July 2013, up 2.7% on the year.

Mr Hardie said: "House price growth continued to slow with the smallest annual rise seen in over five years, led by price falls across London."

- Published13 November 2018