M&S and Debenhams report falling Christmas sales

- Published

- comments

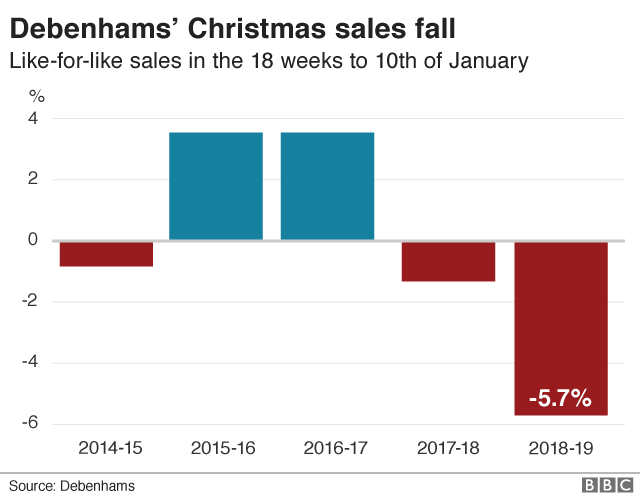

Debenhams has reported a sharp fall in sales during the crucial Christmas trading period.

Debenhams said customers had been seeking discounts and left their shopping late. It said sales fell 5.7% in the 18 weeks to 5 January.

Marks and Spencer also reported a fall in sales over Christmas, down 2.2%.

Tesco said sales were up, as did John Lewis. But John Lewis warned that staff might not receive bonuses for the first time since 1953.

Much of the focus is on Debenhams, which is closing 50 stores.

The department store chain, which employs around 25,000, said it had been cutting prices over the Christmas period and that might eat into profits in the first-half of the year.

Sergio Bucher, chief executive of Debenhams, said there had been fewer customers coming into his company's stores.

He confirmed that Debenhams is in talks with its lenders about its £520m credit line. Those talks were "constructive", he said.

The British Retail Consortium has said retail sales were flat in December, as UK businesses experienced their worst Christmas in a decade.

A number of other retailers have released trading statements:

Marks & Spencer saw its sales drop over the Christmas holiday period. Like-for-like sales, which strip out the impact of new stores, were down 2.2% in the 13 weeks to 29 December. Food sales fell 2.1% and its clothing and home sales division slid 2.4%.

Tesco appeared to buck the gloomy trend. It said trading over the Christmas period had been "strong". The company, which is the UK's biggest supermarket chain, said its like-for-like sales over Christmas in the core UK area were up 2.2% in the six weeks to 5 January.

John Lewis said sales in the seven-week Christmas period were 1.4% higher than for the same period last year. However, that may not be enough to secure a bonus for its staff this year, the firm added.

Halfords issued a profits warning after sales fell 1.7% for the 14 weeks to 4 January. The cycling and car maintenance company blamed mild winter weather in November and December, plus weak consumer confidence.

Sales at discount retailer B&M fell 1.6% in the 13 weeks to 29 December after a "disappointing" November.

Shoppers in Nottingham reveal whether they spent more or less this Christmas

Debenhams reported that like-for-like sales, which strip out changes to stores, over the 18 weeks to 5 January fell 5.7%.

In the shorter trading period, the six weeks to 5 January, like-for-like sales were down 3.4%.

The founder of Sports Direct Mike Ashley has been taking an increased interest in the struggling retailer.

Sports Direct already owns a near 30% stake in Debenhams and has offered a further £40m investment.

Debenhams rebuffed his approach, but said all options remain open.

In the meantime, Debenhams will postpone the possible sale of other parts of its business, including its successful operations in Denmark.

But the company did not rule out a Company Voluntary Arrangement, under which it could close more stores, cut rent bills and reorganise its debts.

Analysis: Christmas trading was tough

By Dominic O'Connell, business presenter, Today Programme

While we all get excited about the Christmas sales figures, they are not the whole story.

All the companies reporting have spoken about a tough trading environment with widespread discounting, which means turning sales into profits will be difficult - and that those that did not join the race for sales too enthusiastically may be better off in the long-term.

M&S may not have shot the lights out when it comes to sales growth, but it said it saw no reason to change its full-year profits forecast.

John Lewis, however warned that profits this year would not be as good as last, and that it might not pay out its traditional annual bonus to its staff. The last time it did not pay out was in 1953.

And Debenhams said it was in talks with its lenders, and was looking to bring "new sources of funding". It did not say where that money would come from, but it has already shunned an offer of support from Mike Ashley.

The Christmas trading period has simply reinforced what we already knew about the health of the High Street - that trading is tough, that those with decent online operations enjoy some degree of protection from that tough trading environment, and that the great High Street shakeout that has already claimed Maplins, Toys R Us and others may have only just begun.

In October, when Debenhams published full-year results, it reported a record annual loss and said it would close up to 50 of its 165 branches.

Some of its remaining stores are being refitted to boost trading.

Nine stores so far have been revamped, with Stevenage the best performer among them, the firm said.

Why shopping on the High Street needs to become an 'experience'

Mr Bucher said the improvement in the redesigned stores demonstrated his attempt to turn around the business was making progress.

"We have worked hard to deliver the best possible outcome in very uncertain times for retailers. We responded to a significant increase in promotional activity in the market, particularly in key seasonal categories, in order to remain competitive for our customers," he said.

Online sales rose 6% in the six-week Christmas trading period, after what Debenhams described as "slow start to the season". It said this meant there had been two-year online growth of over 20%.

- Published11 January 2019

- Published13 December 2018

- Published25 October 2018

- Published3 December 2018