Flybe rescued by Virgin and Stobart

- Published

- comments

Flybe is being bought for £2.2m by a consortium including Virgin Atlantic and Stobart Group.

It will operate under the Virgin Atlantic brand, marking a return by Virgin to domestic flights, following a failed attempt five years ago.

Based in Exeter, Flybe carries around eight million passengers a year from airports such as Southampton, Cardiff and Aberdeen, to the UK and Europe.

The deal needs shareholder approval, but is already backed by the board.

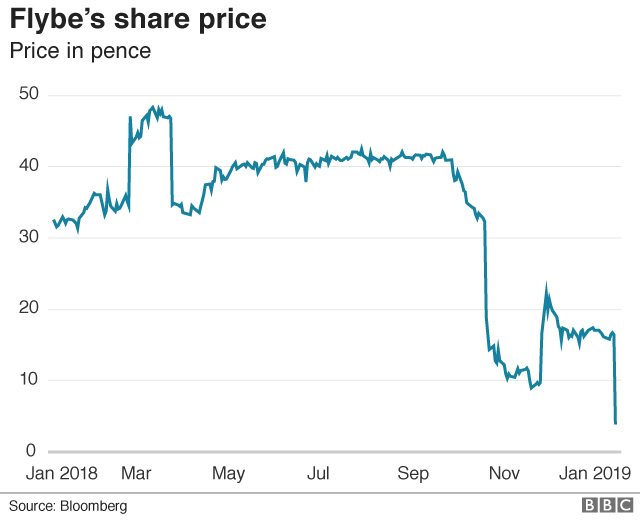

The move comes after Flybe's profits warning in October .

Shareholders in Flybe will receive just 1p a share and the consortium, which also includes venture capital firm Cyrus, will inject £100m.

Christine Ourmières-Widener, Flybe's chief executive, said the industry has been suffering from higher fuel costs, currency fluctuations and "significant uncertainties" presented by Brexit.

"We have been affected by all of these factors which have put pressure on short-term financial performance," she said.

To support the on-going operations of the airline, the consortium, known as Connect Airways, will initially lend £20m to Flybe.

A further £80m will be invested in Flybe, which describes itself as Europe's largest regional airline.

Connect Airways will also buy Stobart Group's regional airline and aircraft leasing business.

The group said it would "create a fully-fledged UK network carrier" - an opportunity for Virgin, which currently focuses on long-haul, to expand in the UK.

Sir Richard's last attempt to launch a regional UK airline failed

Virgin, founded by Sir Richard Branson, abandoned attempts to run domestic flights in 2014 through its Little Red airline.

Virgin Atlantic is now a joint venture with Delta Airlines.

Warwick Brady, chief executive of Stobart Group, said it would also be an opportunity to get more passengers to fly from Southend airport, which it owns, along with Carlisle airport.

John Strickland, director at JLS Consulting, said: "It's still a difficult part of the airline market to operate in. The regional segment is the hardest, because it is short flights where passengers are price sensitive and there's competition with rail and road."

But getting a big cash injection should help the financial performance of Flybe and maintain routes, he said.

The 1p-a-share offer is well below the 295p at which they were floated in 2010 and the levels around 30p at which they were trading before October's profits warning.

Flybe's rescue comes after the collapse of Monarch Airlines and Primera Air.

- Published16 November 2018

- Published23 November 2018