German economic growth slowest for five years

- Published

- comments

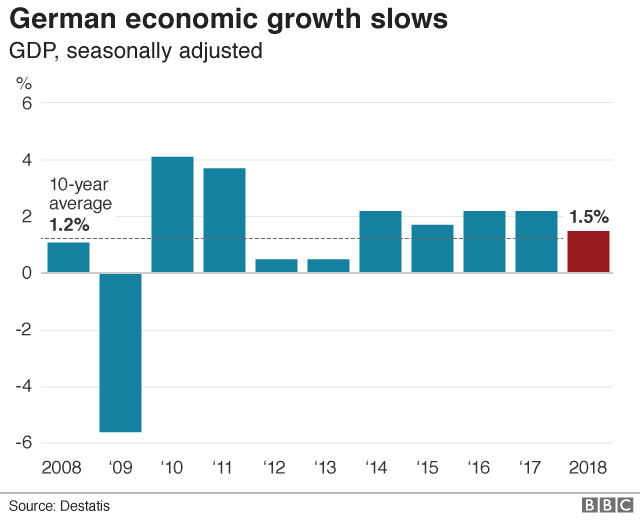

Germany's economy grew by 1.5% last year, its slowest rate since 2013, the latest official figures show.

Figures from the Federal Statistics Office, external showed Europe's largest economy slowed sharply as the year wore on.

A weaker global economy and problems in the car industry, caused by new pollution standards, have been cited as contributing to the slowdown.

At the start of 2018, the German economy had been expected to grow by 1.8%. Growth was 2.2% in 2017.

Germany's economy had shrunk in the third quarter of the year, by 0.2%, with global trade disputes blamed for the contraction.

There were fears that Germany was at risk of following that with another quarter of negative growth, something that would have put the country into recession.

The statistics office has not released fourth-quarter figures yet, as it does not have enough data to give an accurate reading.

But initial calculations by independent economists suggest the economy may have grown by about 0.2% in the final three months of the year.

Reasons for slower growth last year include a slowdown in the global economy and a weaker car sector, with German consumers less willing to buy new cars amid confusion over new emission standards.

In addition, low water levels, particularly in the Rhine, affected growth by holding back movement of some goods.

Analysis: Andrew Walker, World Service economics correspondent

So Germany probably avoided a recession last year, although further data publications might yet change that conclusion.

What is clear though is that the economy hit a weak patch in the second half of last year. It's not alone. The eurozone as whole slowed markedly in the third quarter of the year. Two large economies, Germany and Italy, contracted in that period, though Spain and France both managed reasonably firm growth.

Germany, as a leading exporter, is especially exposed to the global trade climate.

A slowdown in international commerce is a major part of Germany's loss of momentum and China is an important element in that story. It's Germany's third largest export market. A recent survey of German manufacturers found the steepest fall in export orders for six years and a number of firms reporting lower sales to China.

Germany's export orientation also makes it vulnerable to the tensions in global trade spilling out from the United States - the new tariffs on steel and aluminium and the conflict with China.

For Germany, and the eurozone more widely, there are certainly clouds on the horizon.

Germany may have dodged a recession, but a period of slower expansion looks likely.

It's worth adding that whatever other problems Germany might encounter, unemployment is currently very low.

Claus Vistesen, chief eurozone economist at Pantheon Macroeconomics, said the best guess was that the German economy had avoided recession, but the main story was still that the economy had lost pace, "thanks mainly to a slowdown in consumers' spending and exports".

"Looking ahead, we think consumption will pick up. Real wage growth is firm, and the recent plunge in growth of goods spending won't be sustained."

- Published11 January 2019

- Published4 September 2023

- Published13 December 2018

- Published14 November 2018