Black Friday steals Christmas shoppers

- Published

- comments

UK retail sales fell by more than expected in December after consumers brought forward their Christmas shopping to November, the Office for National Statistics has said.

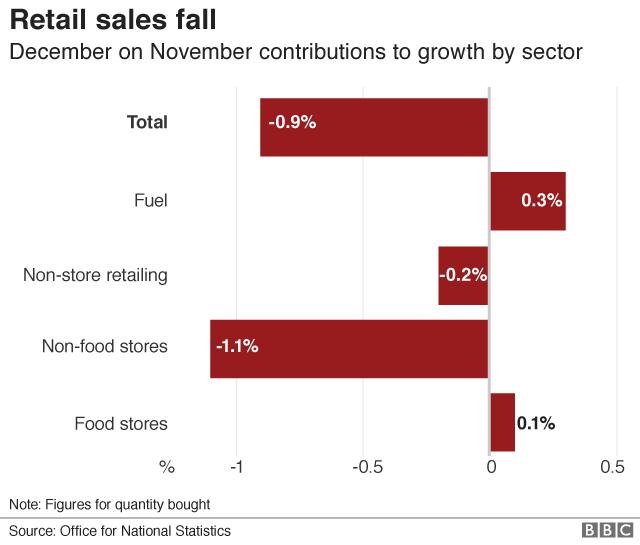

Sales volumes fell by 0.9%,, external more than the 0.8% forecast by economists.

It comes after a 1.3% rise in November - revised from 1.4% by the ONS - when Black Friday sales lured shoppers.

The British Retail Consortium has said retailers had their worst Christmas in a decade.

Rhian Murphy, head of retail sales at the ONS, said: "Following the increased growth in November, where shoppers snapped up more Black Friday offers as they continue to bring forward their Christmas shopping, retail sales weakened in December".

It is the biggest monthly drop since May 2017, and the December fall meant that retail sales were down 0.2% in the fourth quarter of the year - the largest three-month fall since March.

"Retail sales fell back slightly in the last three months of 2018 with only petrol stations seeing significant growth," Ms Murphy said.

All sectors except food stores and fuel stores saw sales decline in December, the ONS said.

A number of retailers - such as Halfords, Marks and Spencer, Debenhams and Mothercare - have reported a fall in sales over the Christmas period.

Compared with a year earlier, the quantity of sales in December rose 3%.

Ian Geddes, head of retail at Deloitte, said: "Christmas arrived late for retailers, but it wasn't cancelled.

"December's figures clearly show some of the effects of heavy discounting from retailers, both in the run-up to Christmas where the average pre-Christmas discount reached 48%, and Boxing Day sales thereafter".

Analysis: Changing shopping patterns

By Dharshini David, BBC economics correspondent

Heading to the High Street - real or virtual - ahead of Christmas is unavoidable. But with consumer spending accounting for the largest part of our GDP, economists need to look beyond that festive surge, to gauge whether or not activity is expanding at a healthy clip. That's why the ONS seasonally adjust the figures they produce, try to strip them of the "noise" of the seasonal present and turkey-buying sprees.

But the picture is clouded by our changing shopping habits, in particular the rise of Black Friday. That appears to be shifting Christmas spending earlier. That the ONS figures showed a monthly rise in the amount of 1.3% in November, followed by a drop of 0.9% in December has had some analysts claiming that the ONS' adjustment process hasn't kept up - one, perhaps unfairly, labelled the numbers "useless".

However, sales figures can jump around at the best of time, so looking at one figure in isolation is unwise. Taking November and December together, sales were up by a subdued 0.3% - confirming individual reports from retailers' that Christmas failed to deliver. And with the amount of goods sold falling by 0.2% in the last three months of 2018, there can be little doubt that consumer spending has lost momentum.

Brexit uncertainty

Economists were cautious about the prospects of a pick-up in spending at the start of the year, unless a deal over Brexit can be clinched.

Thomas Pugh, UK economist at Capital Economics, said: "Unless a Brexit deal is signed soon, there is unlikely to be much of a rebound in [the first three months of] 2019.

"That said, if a no-deal Brexit is avoided, consumers should be in a good position to ramp up spending in the second half of the year."

While earnings growth is on upward trend, consumer confidence in December was at its lowest level since mid 2013, said Howard Archer, economist at the EY Item Club.

"A major concern for retailers will be that already cautious consumers further limit their spending in the near term at least due to the heightened uncertainties over Brexit," he said.

- Published11 January 2019

- Published10 January 2019

- Published20 December 2018