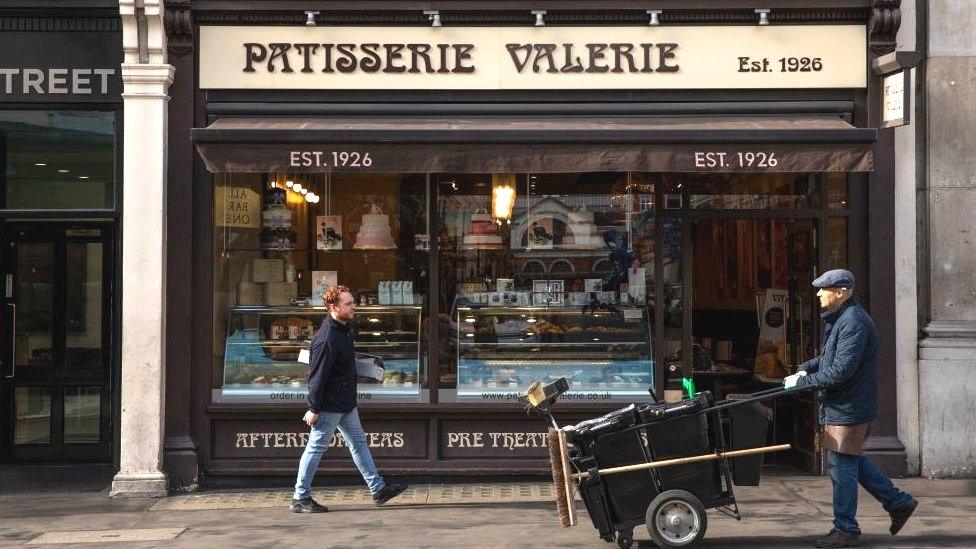

Patisserie Valerie seeks bank lifeline

- Published

Troubled cake chain Patisserie Valerie is facing a crucial few days after a deal with its banks expired on Friday.

The UK firm said in October it had uncovered "significant, and potentially fraudulent, accounting irregularities".

The company's biggest shareholder, Luke Johnson, is now in talks to extend its cash lifeline from HSBC and Barclays.

In a brief statement on Monday, the firm said it was "still in discussions with its bankers to extend the standstill of its bank facilities".

It added that it would issue an update when those discussions had concluded.

If the talks fail, there is a danger it could crash into administration, with KPMG having been appointed to review "all options" for the company's future.

That could put the future of some of the firm's 2,800 staff across its 200 cafes at risk.

As well as administration, other options could include a sale of the business, or a company voluntary arrangement - which might see shops closed and rents reduced as a means to help the company keep trading.

Another possibility could be a debt-for-equity swap with the firm's creditors.

'Significant manipulation'

If talks with the banks to extend the current "standstill" agreement - which protects the firm from action to recover debt - are unsuccessful, the financial institutions could ask for repayment of close to £10m.

Last week, Patisserie Valerie confirmed it had found "extensive" misstatement of its accounts and "very significant manipulation of the balance sheet and profit and loss accounts".

This includes thousands of false entries in its ledgers, the company said in a statement, external.

Profitability and cash flow had been overstated and were "materially below" figures announced in October, it said.

In October, it said those figures were likely to be £120m revenue for the year and earnings of £12m.

Some shareholders are aggrieved that the process has gone on so long. One of them, Chris Boxall of Fundamental Asset Management, told the BBC's Today programme that his firm had a "significant" stake in Patisserie Valerie.

"It's a very simple business to understand. It's three months on down the line now and we really don't know anything," he said.

'Devastating effects'

Multimillionaire chairman Mr Johnson put £20m of his own money into the firm to keep it afloat after the scandal first broke.

He was was repaid £10m after other shareholders later injected £15m in new funds.

Finance director Chris Marsh was arrested after having been suspended, and is still being investigated by the Serious Fraud Office and the Financial Reporting Council (FRC).

Also under investigation by the FRC are former Patisserie Valerie auditors Grant Thornton.

The Patisserie Valerie owners said last week that RSM had been appointed as auditors and KPMG had been taken on to help it "recover from the devastating effects" of the scandal.

It added that it had appointed a new chief executive and interim finance director, and that other new directorships and management appointments had been made after its October announcement.

- Published16 January 2019

- Published21 November 2018

- Published1 November 2018

- Published14 October 2018

- Published12 October 2018

- Published11 October 2018