'None of us wants to go to jail… the food sucks and the sex is worse'

- Published

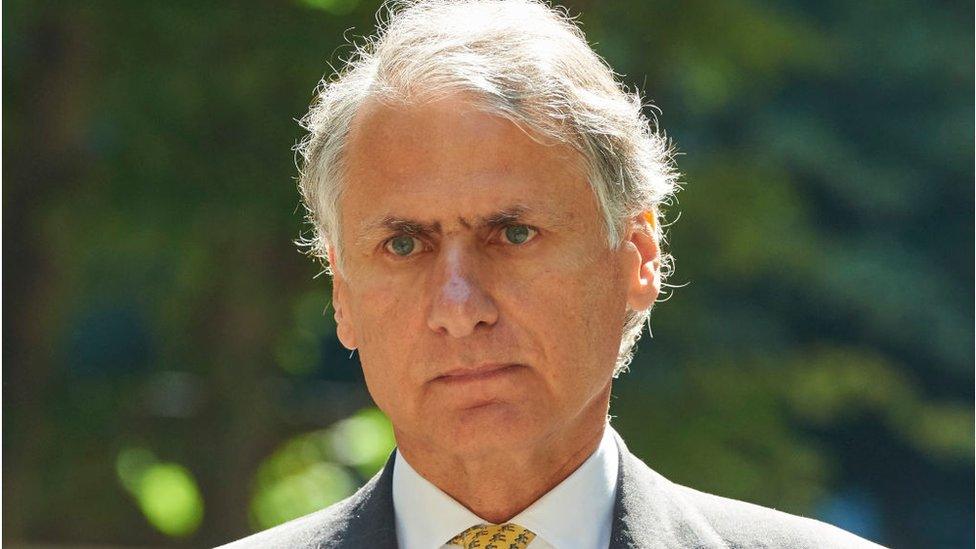

Barclays' Wealth Management chief executive Tom Kalaris

Barclays executives discussed going to jail in connection with a plan to raise emergency funds from the Gulf state of Qatar, a court has heard.

Prosecutors played a phone call from 11 June 2008, when Barclays was seeking to raise billions of pounds.

In it, Barclays' wealth management boss Tom Kalaris and European financial institutions head Richard Boath discussed the capital-raising plan.

"None of us wants to go to jail here," Mr Kalaris told Mr Boath.

Mr Boath replied: "That, I mean, it ain't worth it and apparently the food sucks, so, right. You know, that's the purpose of the call."

Mr Kalaris said: "Yeah. No the food sucks and the sex is worse, so."

Mr Boath: "[laughter] Absolutely."

False representations

The recording was played as part of the prosecutor's opening speech at the trial at Southwark Crown Court of former Barclays executives John Varley, Roger Jenkins, Tom Kalaris and Richard Boath for conspiracy to defraud.

The defendants are the first bank executives to be tried in the UK for actions taken during the global financial crisis of 2008.

In a case brought by the Serious Fraud Office (SFO), they are accused of making false representations when, in 2008, Barclays sought to raise funds from private investors, including the Gulf state of Qatar, to bolster its threadbare finances.

In the conversation, Tom Kalaris discusses a mechanism to allow the Qatari investors to be paid more in fees than other investors who between them were about to invest £4.4bn into Barclays.

Former Barclays chief executive John Varley

Group chief executive John Varley had said he could "live with" paying the Qataris up to 3.5% - more than twice the more normal 1.5% fee paid to other investors.

However, Barclays did not wish to pay all investors the same high fee, which would have been necessary, had the additional fee been disclosed.

So, prosecutors allege, it arranged a mechanism to pay higher fees, a side deal called an Advisory Services Agreement, that would pay £42m to the Qataris - additional fees that were not disclosed to other investors.

In a conversation at 15:51 on 11 June, Mr Kalaris said he had agreed that mechanism approval with Roger Jenkins, executive chairman at Barclays Capital, and had it cleared by Barclays Capital chief executive Bob Diamond, finance director Chris Lucas and compliance director Steve Morse.

Tom Kalaris: "Hi, I've sorted out a mechanism with Roger and I've got it cleared in principle by Bob, Chris, and Steve Morse."

Richard Boath: "Okay."

Legal referral

In the 11 June 2008 conversation, Mr Boath raised an objection that would require legal clearance. As part of its fundraising, Barclays would have to enter subscription agreements with private investors where it set out how much investors were being paid to make their investment.

In the wording of those agreements it stated: "Other than as disclosed… there are no further agreements entered into… no fees, commissions, costs, reimbursements or other amounts to the investors."

Mr Boath and Mr Kalaris were keen for Barclays' top lawyer, Mark Harding, to understand fully what was being proposed.

Mr Kalaris: "In the next 24 hours… we need to make sure that Harding is comfortable."

Mr Boath: "Harding's got to know, because I don't know anybody else... I know Judith's looking at it, but whatever we agree or whichever way we go, he's got..."

Mr Kalaris: "Harding will... Harding will review. Yes."

Mr Boath: "He's got to go directly to page 13 of the subscription agreement and get his head round it."

Mr Kalaris: "Yeah. Yeah. And so what I will do is I will call Harding..."

The defendants deny the charges.

The trial continues.

- Published23 January 2019

- Published23 January 2019