Venezuela crisis: Will the US target oil exports?

- Published

Venezuela's oil industry is a key source of cash for the government

In its battle against the rule of Venezuelan President Nicolás Maduro, the United States has been trying to cripple the government's ability to secure funds and run the country - with sanctions that target officials, some sectors of the economy and its official cryptocurrency.

But so far it has not yet used what many call "the nuclear option" - a full oil embargo, targeting the industry that is responsible for 90% of the government's revenues.

Despite the rhetoric between Nicolás Maduro and President Donald Trump, refineries in the US are still buying Venezuelan petroleum. Venezuela's state company PDVSA even owns refineries in Texas through a subsidiary called CITGO.

But with the crisis escalating after Washington backed opposition leader Juan Guaidó's claim to the presidency last week, a new round of sanctions is expected in the coming days.

On Saturday, US Secretary of State Mike Pompeo failed to secure backing from the United Nations Security Council against Venezuela, as China and Russia are close Maduro allies.

Juan Guaidó has declared himself interim president

President Maduro backed down from his demand that US diplomats leave the country and said both countries now have a 30-day window to negotiate the new terms of their relationship.

Markets are watching now for what the US will do next. Despite its failure in the Security Council, the Trump administration has support from big regional players such as Brazil, Argentina and Colombia.

If it does finally move against Venezuelan oil, could that be the nail in the coffin of the country's oil industry, which has been in a crisis of its own for years? And what effect could that have for the rest of the world?

Markets nervous

A boom in US shale production has helped slash crude prices over the past four years, although they have recovered slightly.

But 2019 is shaping up to be a very challenging year for the commodity, and there is no clear indication on which way prices will move.

Oil is never a predictable affair, however, and there are many situations that could cause prices to spike. Production is very volatile in Nigeria and Libya. Iran is under a heavy US embargo. Russia and Saudi Arabia are cutting production.

Finally there are fears of a global slowdown in the economy which could see prices fall due to a drop in demand.

The crisis in Venezuela is another scenario watched closely by oil analysts.

Venezuelans have been fleeing the country as economic hardship worsens

There is a general sense in markets that Nicolás Maduro will not be removed from power in the near future and that tensions will keep on rising. Also most analysts discard the full "nuclear option", as that would have a devastating impact on the people of Venezuela, instead of just hitting the government.

One of the most likely scenarios discussed is a partial restriction of how much oil the US can buy from Venezuela.

That would hurt consumers in America and in the rest of the world. Prices would rise as refineries would have to buy their share of oil from more expensive sources. American refineries that buy from Venezuela would also be negatively affected.

But US restrictions would benefit Saudi Arabia, Mexico and Iraq - countries that also produce the same variety of heavy crude oil (Canada also produces heavy crude but it does not have logistic capability to increase its exports). These countries have been eating into Venezuela's market share for years.

World's largest reserves

Venezuela would be the biggest loser of all, of course.

The country has the world's largest proven oil reserves - even bigger than Saudi Arabia - but it is rapidly running out of money to prospect for crude and pump it out of the ground.

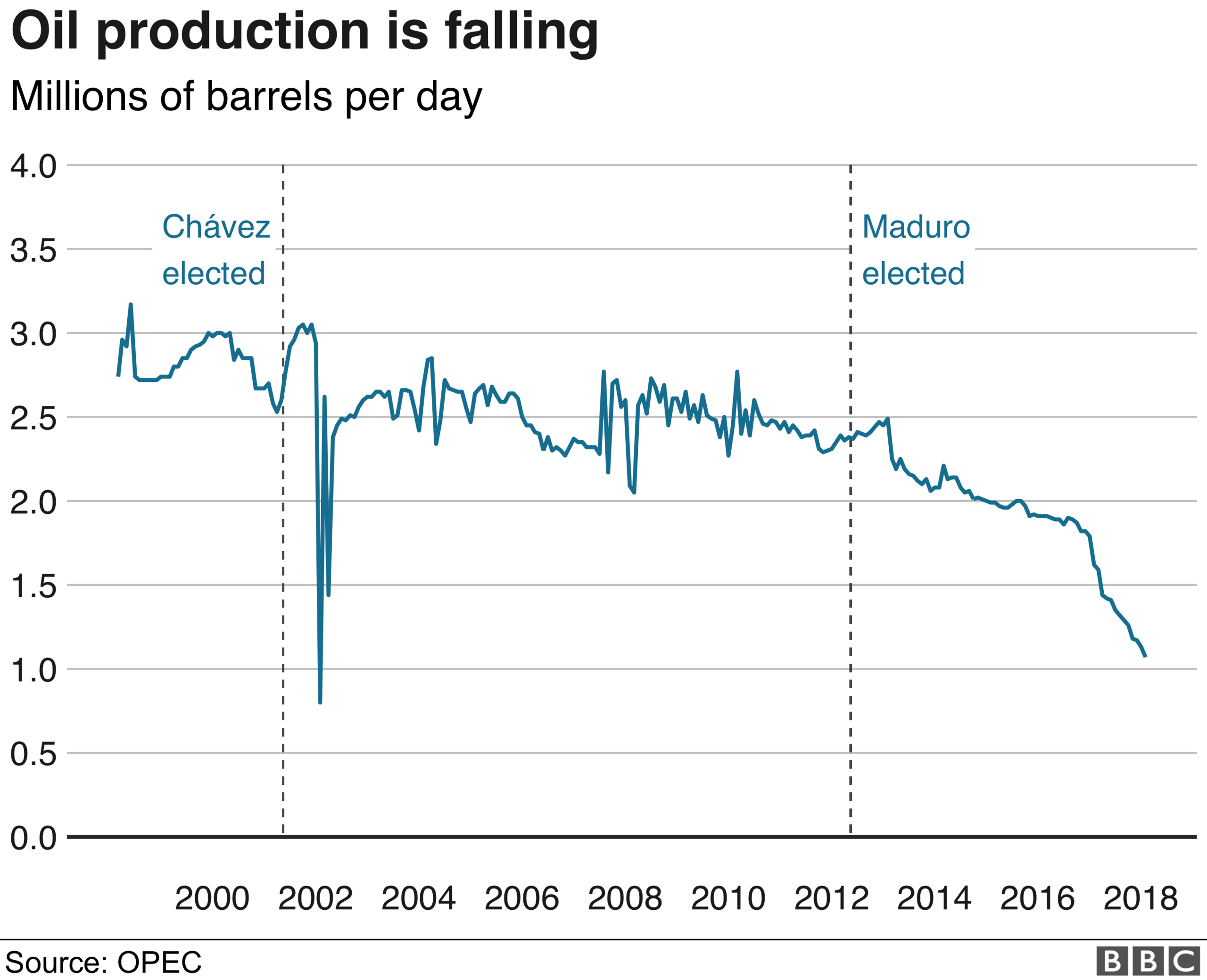

In the late 1990s, Venezuela was producing more than three million barrels of oil per day. Output today is hovering above the one million mark, according to experts.

Even without any international sanctions Venezuela's oil production will decline dramatically this year because of the lack of investment.

The rate of decline in production has been more intense in recent months.

Helima Croft, from RBC Capital Markets, forecasts that output this year will drop by 300,000 to 500,000 barrels per day without any sanctions.

Restrictions from Washington would accelerate the decline. Venezuela would be able to re-route part of its production to other buying nations, like China, but it wouldn't be able to pass on all of its excess oil to markets not aligned with the US.

'Fleeing in droves'

Venezuela is still seen as an oil powerhouse, especially because it is a producer of heavy crude, which is a variety not widely available in the world.

But the severity of its economic crisis may be changing that.

"It will require billions in investment to repair the infrastructure and kick start a recovery. The talented technocrats that once made PDVSA one of the premier national oil companies continue to flee in droves," she told the BBC.

"Even if a reformist government comes to power, the international community will have to launch a major reconstruction and rehabilitation effort to get the country back up on its feet."

President Nicolás Maduro has resisted calls to stand down

The IMF now publishes separate indicators for Venezuela in its Latin American analysis. The economy there has become such an outlier that it makes no sense to compare it to other countries.

This year Venezuela's GDP is expected to reach a new low: the economy will be half the size of what it was in 2013.

Last year the government tried again to use oil to solve its economic woes. It ended subsidies, raised the price of fuel domestically and ramped up its campaign to use a cryptocurrency allegedly pegged to barrels of oil.

Still it failed to contain inflation, which is thought to have crossed the million per cent mark, and did not end its shortages of food and medicine.

It's hard to imagine life getting any harder for people in Venezuela. Now with fresh sanctions on the cards, it just may.

- Published27 January 2019

- Published4 February 2019

- Published12 August 2021