Insolvencies 'highest for seven years'

- Published

- comments

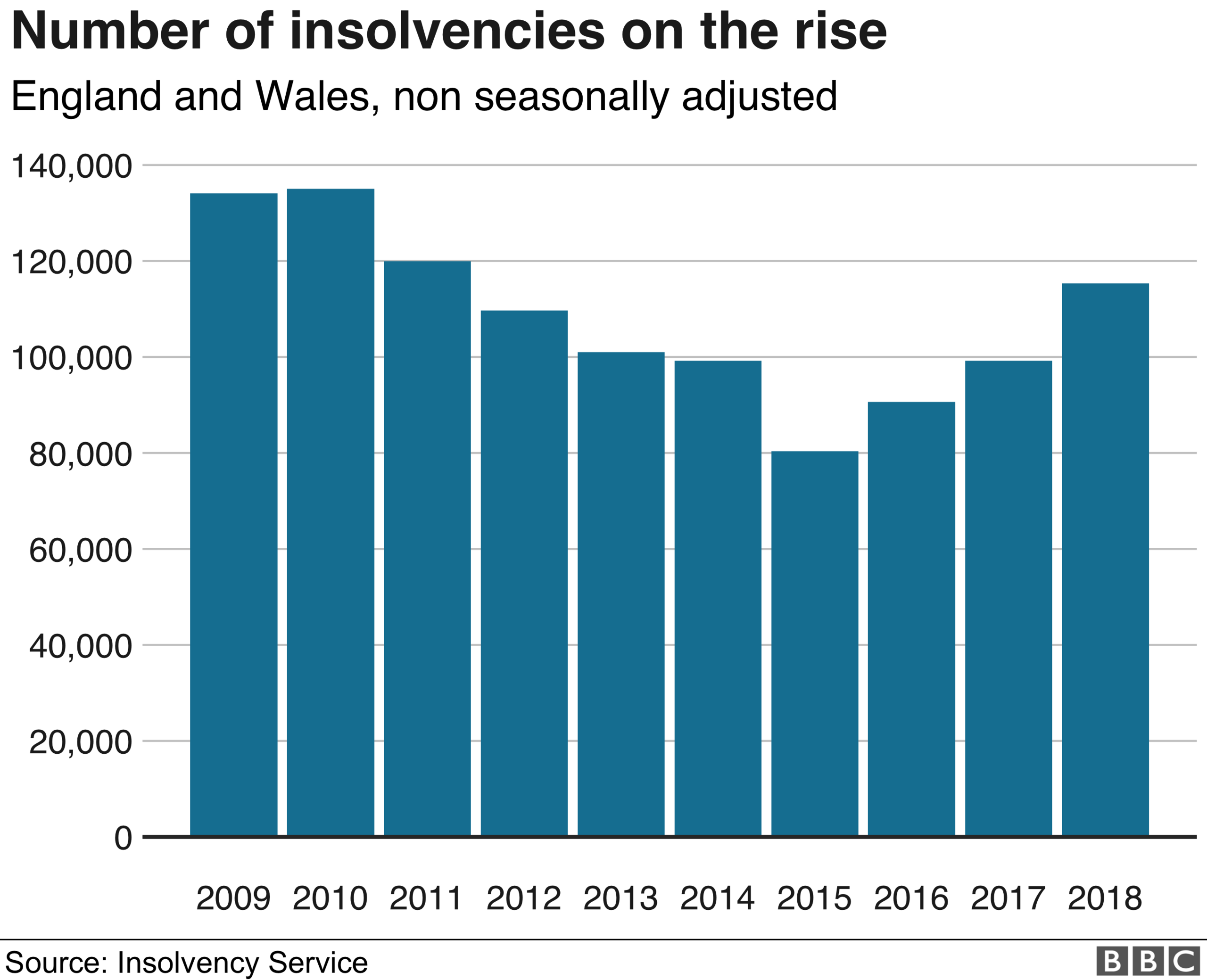

The number of people in England and Wales going insolvent due to unmanageable debt hit a seven-year high in 2018, figures show.

Personal insolvencies totalled 115,299, a 16.2% rise on 2017, the Insolvency Service said.

The rise was driven by the use of Individual Voluntary Arrangements (IVAs), which hit a record level.

IVAs are a way to avoid full-blown bankruptcy and the measure means an individual's main assets are protected.

There were 71,034 IVAs last year, an increase of 19.9% on 2017.

There has been concern among debt charities and others that people have been taking out IVAs who do not need them.

"The market for IVAs is dominated by a small number of service providers who are very market savvy and do not wait for people in debt to come to them - they advertise widely and have relationships with other debt advisors who feed them 'hot leads'," said Mark Sands, partner at advisory firm Quantuma.

There were also increases in Debt Relief Orders last year (up 11.2% compared with 2017), and bankruptcies (up 9.8%).

As a result one in 401 adults in England and Wales became insolvent in 2018, compared with one in 466 during 2017.

Types of insolvency

Bankruptcy: This is the most serious option, which involves an official receiver being appointed to sell off your assets to pay your debts. If you own a house or a car you may lose them.

The bankruptcy will affect your credit record for at least six years. But after one year all your debts will be written off. The procedure currently costs £680, but you can pay in instalments.

Individual Voluntary Arrangement: Under an IVA, an insolvency practitioner will help you strike a deal with your creditors, which allows you to pay off your debts over a fixed period - say five years. Once approved, all interest on unsecured debt is frozen.

There is less stigma with an IVA, and a greater chance of you keeping your home.

Debt Relief Order: This form of insolvency, introduced in 2009, is the easiest of all. Your debts must not exceed £20,000. If your application is accepted, your debts will be frozen for one year, then written off. A DRO costs £90.

Insolvency in Scotland: If you live in Scotland, bankruptcy is known legally as sequestration. However there are three alternatives: A Debt Arrangement Scheme, A Debt Management Plan, or a Trust Deed. Further details can be found here, external.

- Published16 October 2017

- Published13 November 2018

- Published21 November 2018

- Published16 October 2017