Brexit: Car investment halves as industry hits 'red alert'

- Published

- comments

Investment in the UK car sector almost halved last year and output tumbled as Brexit fears put firms on "red alert", the industry's trade body said.

Inward investment fell 46.5% to £588.6m last year from £1.1bn in 2017, the Society of Motor Manufacturers and Traders (SMMT) says.

Production fell 9.1% to 1.52m vehicles, with output for the UK and for export falling 16.3% and 7.3% respectively.

Brexit uncertainty has "done enormous damage", said SMMT chief Mike Hawes.

But the impact so far on output, investment and jobs "is nothing compared with the permanent devastation caused by severing our frictionless trade links overnight, not just with the EU but with the many other global markets with which we currently trade freely," he added.

"With fewer than 60 days before we leave the EU and the risk of crashing out without a deal looking increasingly real, UK Automotive is on red alert," he said.

Politicians must do whatever it takes to avoid a no-deal, he said.

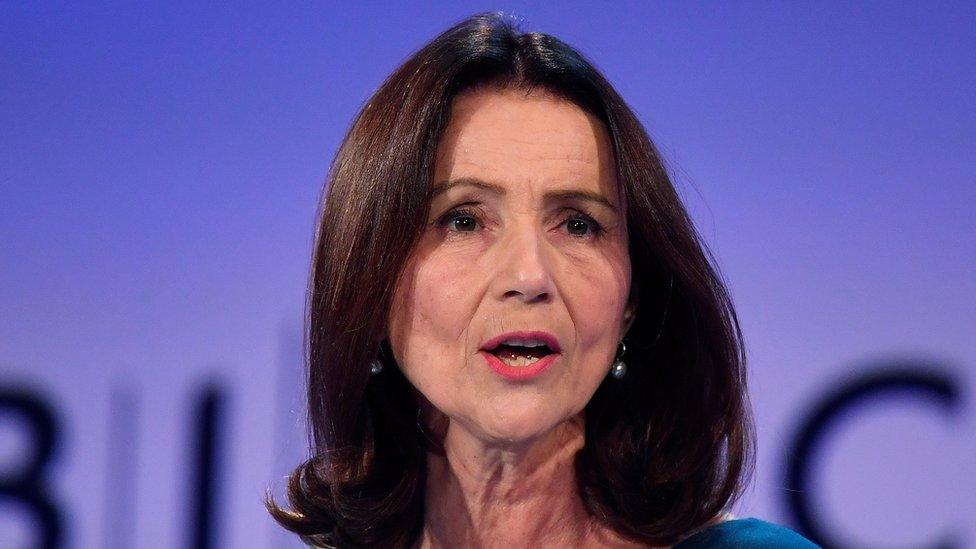

His gloomy prognosis follows strong warnings from other business groups on Wednesday. Carolyn Fairbairn, director-general of the CBI, said Tuesday's vote to renegotiate the UK's withdrawal deal "feels like a real throw of the dice".

Stephen Kelly, chief executive of Manufacturing Northern Ireland, told the BBC that firms there were "in despair and really confused" about what was going on.

Mr Hawes said that, despite the Commons vote on Tuesday evening, "nothing has changed".

A government spokesman said: "As we leave the European Union we will seek the broadest and deepest possible agreement that delivers the maximum possible benefits for both the UK and EU economies and maintains the strength of our world-leading automotive sector."

Analysis: Simon Jack, BBC business editor

Investment in the car industry comes in uneven lumps as old models are retired and new ones introduced over time. But even allowing for that, the plunge in new investment revealed this morning is stark.

In 2015, car manufacturers invested £2.5bn in the UK. Since then it has fallen ever year and in 2018 was just £589m.

Brexit uncertainty was not the only issue facing the sector - confusion over diesel policy, falling sales in China and production hold-ups due to new regulations also played a part.

But the SMMT was clear that Brexit presented what it calls "the most significant threat to the competitiveness of the UK automotive sector in a generation".

Manufacturing firms that rely on finely tuned pan-European supply chains have sounded the shrillest warnings about the dangers of a no-deal Brexit. These figures will do nothing to change that.

'Significant threat'

The 16.3% fall in production of cars destined for sale in the UK was driven by uncertainty over the future of diesels, regulatory changes, and falls in consumer and business sentiment, according to the SMMT.

However, exports to the EU fell by 9.6%, less steep than the fall in domestic production.

Overall, the EU still accounts for the vast majority of UK exports, 52.6% or 650,628 cars. Although exports to the US rose 5.3%, largely due to demand for premium models, Mr Hawes warned that this improvement could reverse if tariffs are imposed in post-Brexit tax changes.

Other key markets outside the EU would also be hurt, he said. Exports last year to Japan increased by 26% and by 23% to South Korea, but he pointed out that both countries were subject to preferential EU trade agreements.

Exports to China slumped 24.5%. Jaguar Land Rover (JLR), Britain's biggest carmaker, has already underlined the pain being felt from a sales slowdown in China.

JLR shutdown

Earlier this month JLR confirmed it was cutting 4,500 jobs, blaming Brexit uncertainty, a slump in diesel sales, and China's economic slowdown.

The carmaker also said it would extend its annual April shutdown by an extra week because of worries that just-in-time deliveries could be disrupted if Britain leaves the EU without a deal.

Mr Hawes pointed out that the fall in production last year followed a fall in 2017, which came after seven years of unprecedented growth as the sector emerged from recession.

"As a highly-integrated sector that has maximised the benefits of the European single market and customs union, a 'no-deal' Brexit is the most significant threat to the competitiveness of the UK automotive sector in a generation," he said.

- Published30 January 2019

- Published24 January 2019

- Published10 January 2019

- Published10 January 2019