Slack Technologies prepares for flotation

- Published

Brit Cal Henderson is a co-founder of Slack Technologies

Slack Technologies, a messaging service used by companies across the world, is officially gearing up for a public stock listing.

The firm said it had filed a confidential notice, external with the Securities and Exchange Commission.

In one of the year's most anticipated flotations, Slack could be seeking a $10bn valuation.

Set up in 2013, the San Francisco-based firm's founders include Brit Cal Henderson.

Slack has expanded rapidly as a form of office communication intended to reduce the flow of email.

The firm had about 85,000 paying customers, external as of January, up more than 50% in a year.

It also counts more than 10 million daily active users and said more than half of its users are based outside of the US.

Customers include companies such as Starbucks, Panasonic and SAP. The BBC also uses the service.

Slack's leadership team also worked on the photo sharing website Flickr.

To date, Slack has raised more than $1.2bn, including , external$427m in August, external, backed by firms that included Dragoneer Investment Group and General Atlantic.

At the time, the investment valued the company at more than $7bn.

Unconventional IPO

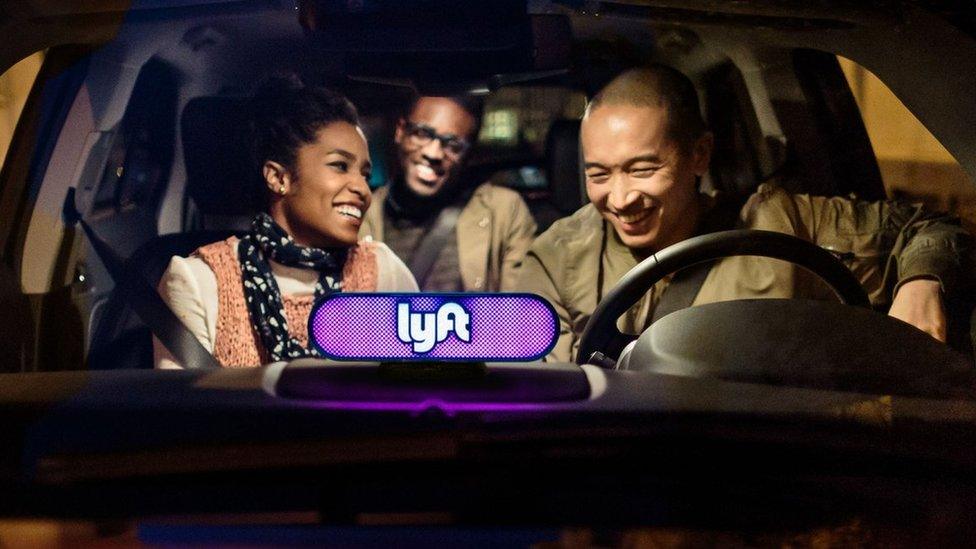

Slack is one of several high-profile tech companies, including Uber and Lyft, looking to go public this year.

The firm is reportedly planning to list shares directly on a stock exchange, rather than issue new stock to investors to raise money as it would in a more traditional launch process.

The move allows early investors to sell their shares; it can also reduce some of the costs associated with a launch.

The music-streaming service Spotify used a similar procedure last year when it listed on the New York Stock Exchange.

- Published6 December 2018

- Published15 November 2018

- Published21 September 2016