UK employment hits another record high

- Published

- comments

The number of people in work in the UK has continued to climb, with a record 32.6 million employed between October and December, the latest Office for National Statistics figures show. , external

Unemployment was little-changed in the three-month period at 1.36 million.

The jobless rate, remaining at 4%, is at its lowest since early 1975.

Weekly average earnings went up by 3.4% to £494.50 in the year to December - after adjusting for inflation, that is the highest level since March 2011.

The number of people in work between October and December was up 167,000 from the previous quarter and 444,000 higher than at the same time in 2017.

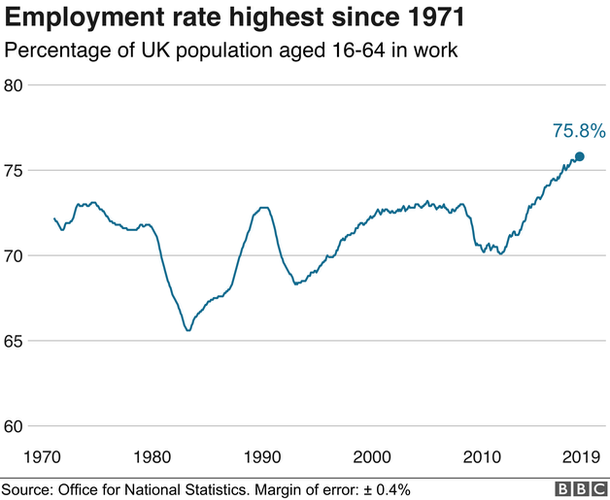

The employment rate - defined as the proportion of people aged from 16 to 64 who are working - was estimated at 75.8%, higher than the 75.2% from a year earlier and the joint-highest figure since comparable estimates began in 1971.

Employment Minister Alok Sharma said: "While the global economy is facing many challenges, particularly in sectors like manufacturing, these figures show the underlying resilience of our jobs market - once again delivering record employment levels."

ONS deputy head of labour market Matt Hughes said: "The labour market remains robust, with the employment rate remaining at a record high and vacancies reaching a new record level.

"The unemployment rate has also fallen, and for women has dropped below 4% for the first time ever."

However, Andrew Wishart, UK economist at Capital Economics, warned that next month's figures may not be so buoyant.

"The labour market data didn't reflect the slip in hiring surveys in December, with employment rising," he said.

"However, the surveys deteriorated more markedly in January, so a Brexit effect might start to weaken employment growth in the next batch of official data."

Analysis:

By Dharshini David, BBC economics correspondent

The jobs market remains in a robust shape despite the loss of momentum in the economy towards the end of last year - although the Brexit fog effect may be yet to register.

Continuing recent trends, the majority of those entering work were previously inactive (students, looking after home, long-term sick etc).

The demand for labour continues to bolster wage growth. Real wages increased by more than 1% per year, better on the whole than in recent years although about half the rate of the pre-crisis era.

So little sign of Brexit uncertainty hitting hiring so far - but demand in the labour market tends to lag significantly behind changes in output.

More recent employment surveys show a marked deterioration in January, so a Brexit effect might start to weaken employment growth in the next batch of official data.

And productivity - output per hour - was down by 0.2% in the fourth quarter of 2018 versus a year previously, as output rose more slowly than employment. The lack of progress in this area could weigh on wage growth in the longer term.

Skill shortages

Looking at the average earnings figures, Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: "With surplus labour extremely scarce and job vacancies rising to a new record high, workers are having more success in obtaining above-inflation pay increases.

"Looking ahead, we doubt that wage growth will slip below 3% this year."

Despite the wage increases and low unemployment figures, Suren Thiru, head of economics at the British Chambers of Commerce, did not think that struggling High Streets would benefit.

He said: "The uplift to consumer spending from the recent improvement in real pay growth is likely to be limited by weak consumer confidence and high household debt levels.

"The increase in the number of vacancies to a new record high confirms that labour and skills shortages are set to remain a significant a drag on business activity for some time to come, impeding UK growth and productivity."

- Published13 February 2019