Car industry: What's behind recent closures?

- Published

Honda UK is closing its Swindon plant by 2021, with the loss of about 3,500 jobs. Jaguar Land Rover and Nissan are also cutting production and jobs. So what's going on?

Honda is a big loss

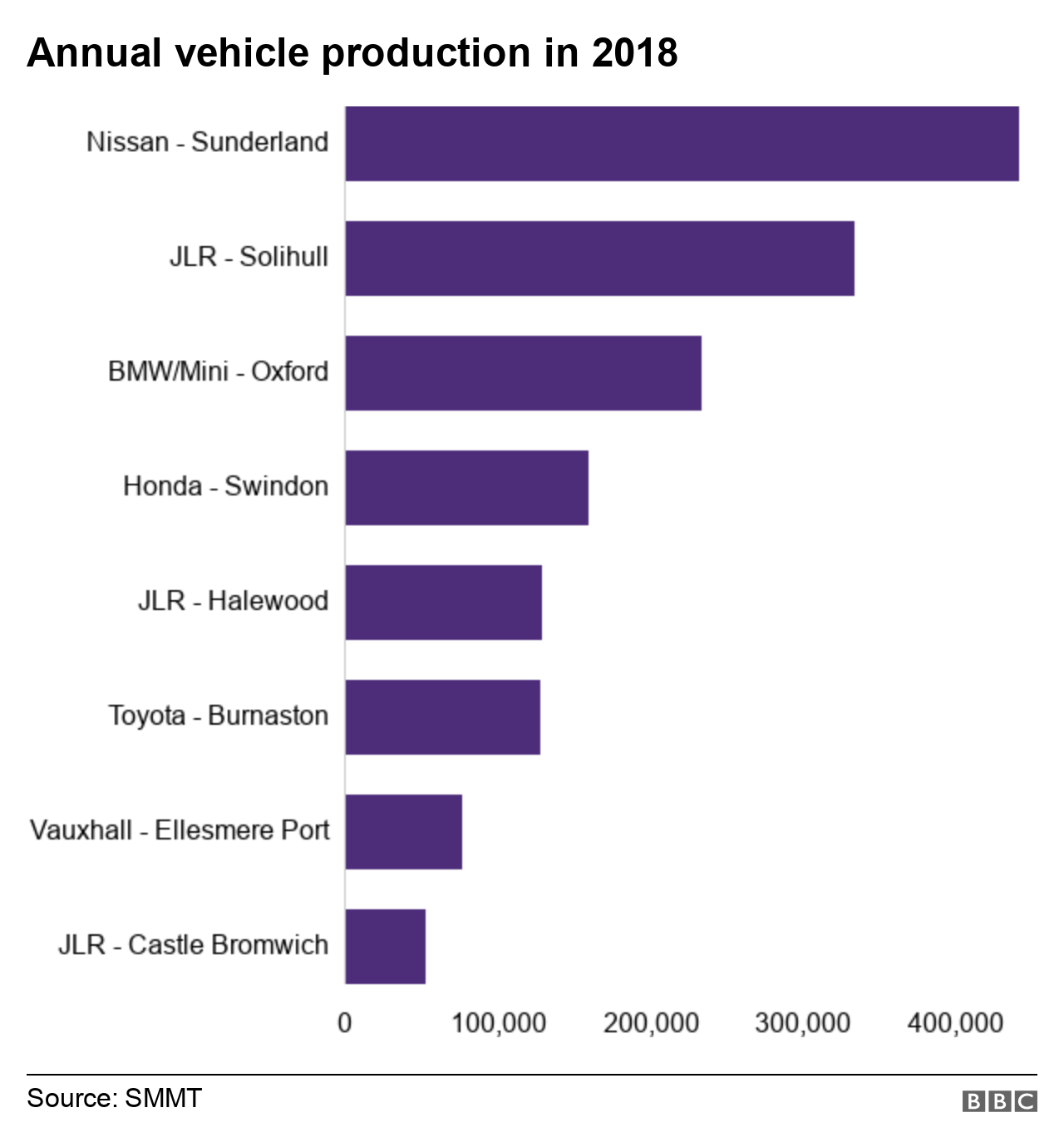

Honda's Swindon plant is the UK's fourth-largest car factory.

Honda Civic hatchbacks are made there. The model was the third most widely produced car in the UK in 2017, according to the Society of Motor Manufacturers and Traders (SMMT)., external

The Swindon plant was established in 1985. But in recent years, it has operated at less than full capacity, citing falling demand from Europe. That caused Honda to suspend a production line with a capacity of 100,000 units in 2014.

Brexit uncertainty

Japanese car producers, including Nissan, have said that Brexit uncertainty is not helping them "plan for the future". Nissan recently opted to build the next X-Trail model in Japan, rather than in Sunderland.

But, Honda said that the plant closure in Swindon wasn't related to the UK's decision to leave the European Union. It said that restructuring would bring it closer to key markets such as China or the US.

In a statement, Business Secretary Greg Clark echoed that it was "a commercial decision" for the company.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Manufacturing companies rely on complex supply chains across Europe, allowing them to trade parts and produce cars "just in time" for deliveries.

Industry figures have suggested that any additional tariffs placed on car exports after Brexit could negatively affect business. A tariff is a tax paid on goods crossing borders.

They have also called for clarity for EU automotive workers in the UK. The SMMT estimates that 10% of people employed in the car industry are from elsewhere in the EU.

Back to Japan

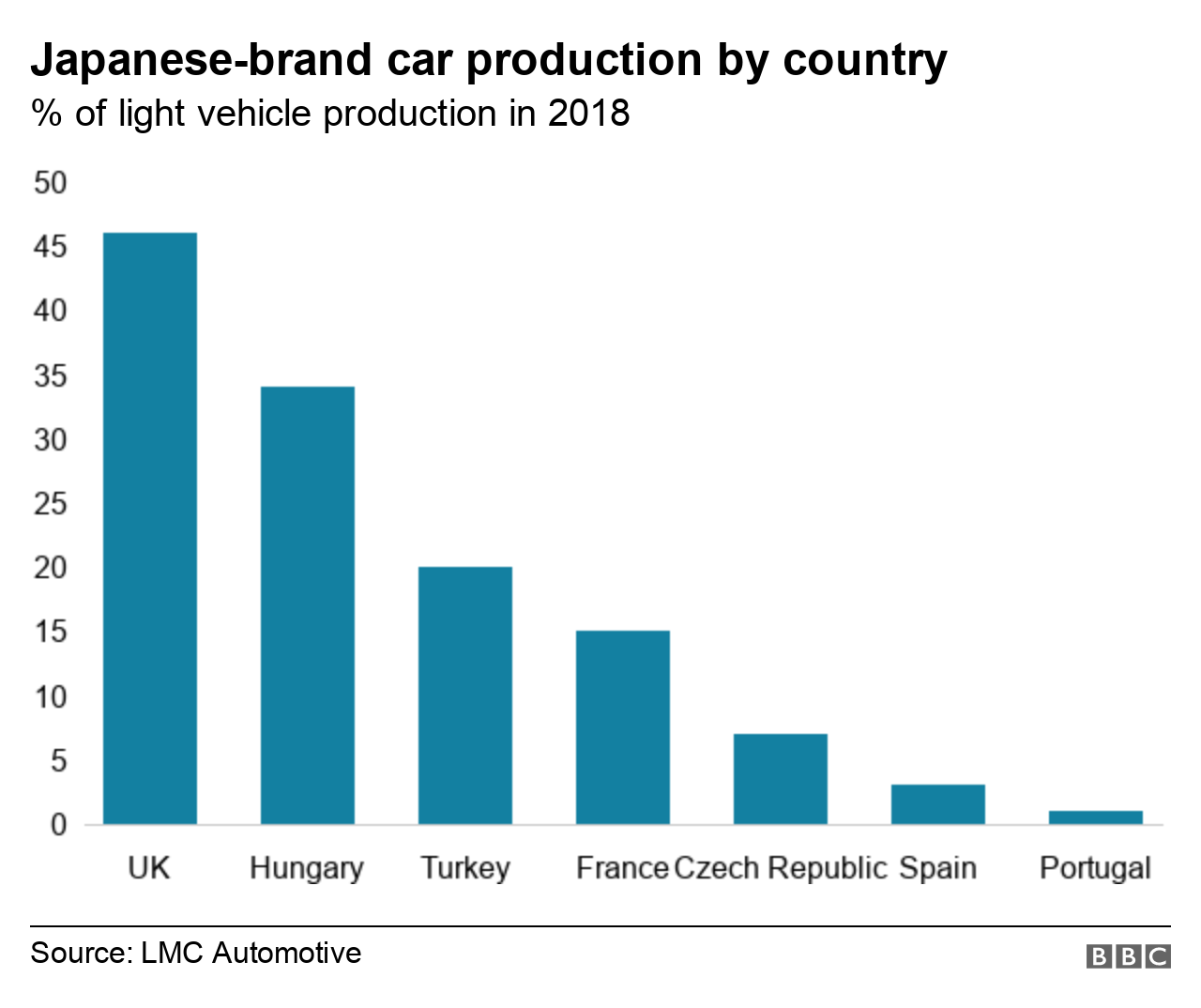

Another thing affecting car manufacturers is a new trade deal between the EU and Japan that came into force in February. It will see tariffs on cars exported from Japan to Europe reduced to zero over the next 10 years.

In a recent report, external, consulting firm LMC Automotive estimated that more than 730,000 cars built in the UK in 2018 were for Nissan, Toyota and Honda - nearly half of all light vehicles produced.

That could encourage Japanese companies, such as Honda, to redirect jobs and investment back home, leaving UK car manufacturing at risk.

The director of global production forecast at LMC also said that if the UK were to leave the EU without a deal, cars made in Japan could, under the new EU-Japan trade deal, end up costing less to import into the EU than those produced in the UK.

Falling Chinese demand

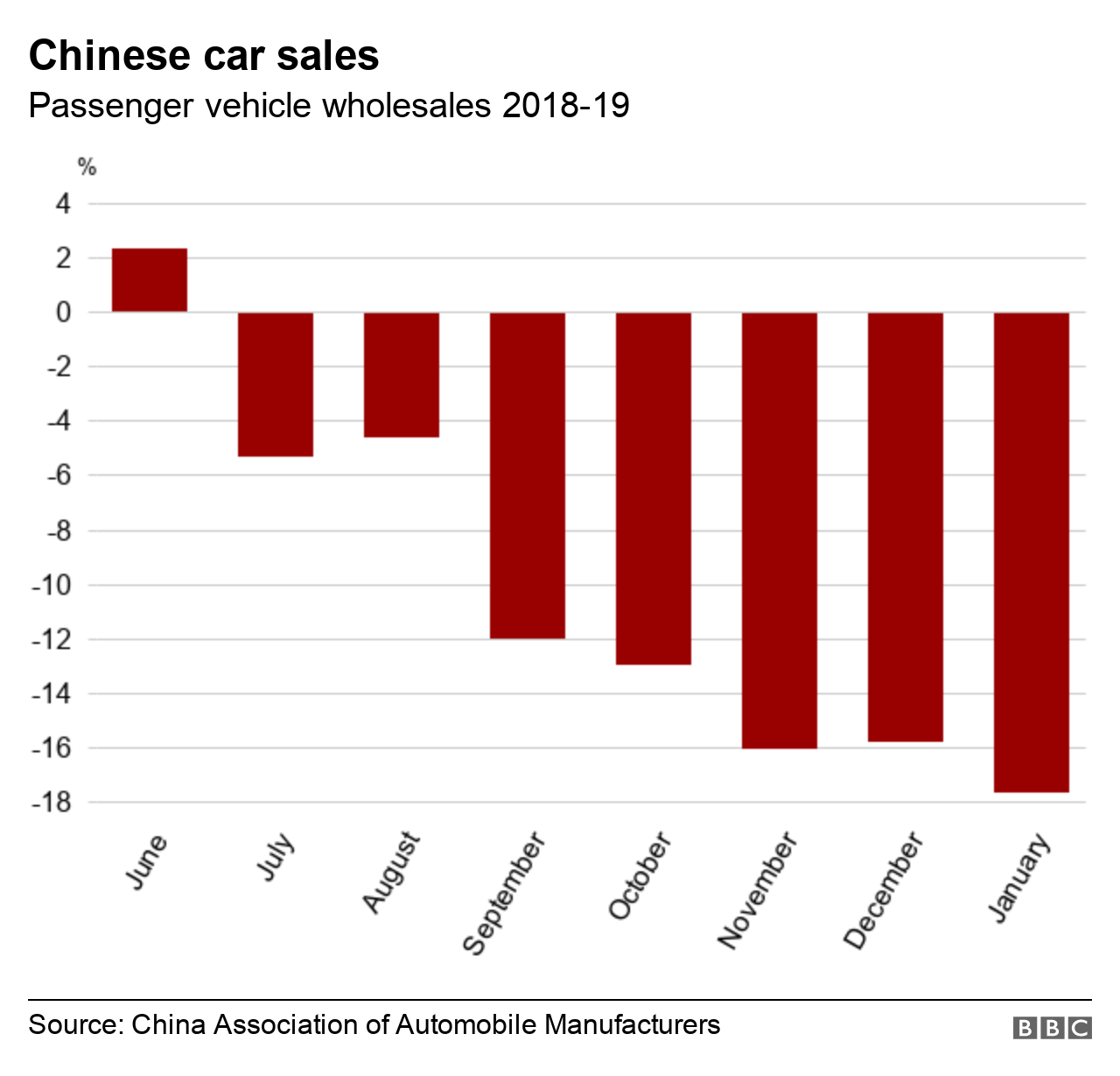

Indian-owned Jaguar Land Rover (JLR) confirmed in January that it would be cutting 4,500 jobs, with most coming from its UK workforce.

It said that it was facing a different challenge in the Asian market: a sales slowdown in China.

Passenger vehicle wholesales fell by 17.7% year-on-year to 2.02 million units, according to the latest figures from China's Association of Automobile Manufacturers.

For 2018 as a whole, sales dropped by 4.1% - the first annual decrease since the early 1990s.

Analysts have said US-China trade tensions could also make 2019 a challenging year for car companies.

The two countries have been locked in an escalating trade war, imposing duties on billions of dollars worth of one another's goods.

Shift away from diesel

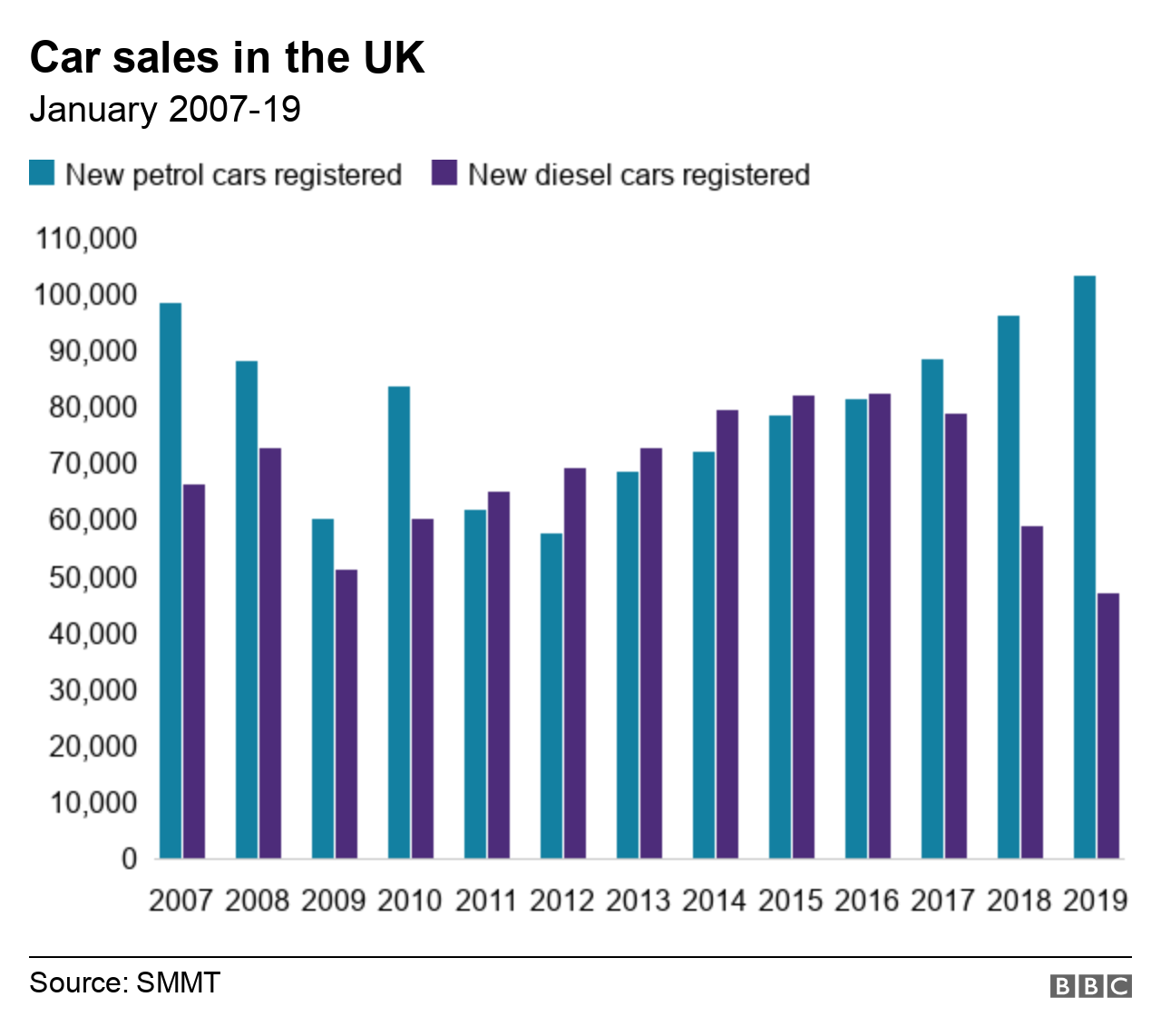

In 2018, sales of new diesel cars in the UK fell by nearly 30%, according to the SMMT, external.

The government had previously introduced tax breaks on diesel cars, when Gordon Brown was chancellor, but sales have been falling since 2016.

Prof David Bailey, from Aston University, in Birmingham, said that fewer diesel cars were being purchased for two main reasons: the environment and consumer confusion.

The Volkswagen "diesel-gate" scandal showed that many diesel cars were producing higher levels of nitrogen oxides (NOx) on the road than in laboratory tests. Nitrogen oxides are associated with breathing difficulties.

Diesel cars typically produce less CO2 than petrol vehicles. But with an increased focus on air quality in urban areas and on NOx as a contributor to pollution in cities, diesel is facing a backlash.

In the UK, diesel cars that fail to meet the latest emissions standards now face an extra charge, while a number of European countries, including the UK, have announced bans on both new diesel and petrol vehicles in the future.

With doubts over the resale value of diesel cars, taxation and where they might be able to be driven, Prof Bailey added, consumer confusion had dragged on sales.

Electric revolution?

Honda said the decision to close its Swindon manufacturing plant was down to changes in the car industry and the need to launch electric and hybrid vehicles.

The global stock of electric cars rose to more than three million in 2017, up from 14,260 in 2010, according to the International Energy Agency, external.

Jim Holder, editorial director of What Car? magazine, told BBC News the UK played a "relatively small part" in their production.

A quick history of the British car industry, by economist Dan Coffey

JLR builds the hybrid Range Rover at its factory in Solihull, West Midlands, while Toyota produces hybrid versions of the Corolla at its plant in Burnaston, Derbyshire.

Nissan manufactures the Leaf electric car at its plant in Sunderland. It was the best selling electric vehicle in Europe in 2018, with 40,000 made in Sunderland and sold across the continent.

But, relatively low sales of the vehicles in the UK, the fall in the value of the pound and cuts to government grants for buyers could make manufacturers build electric cars elsewhere, Mr Holder said.

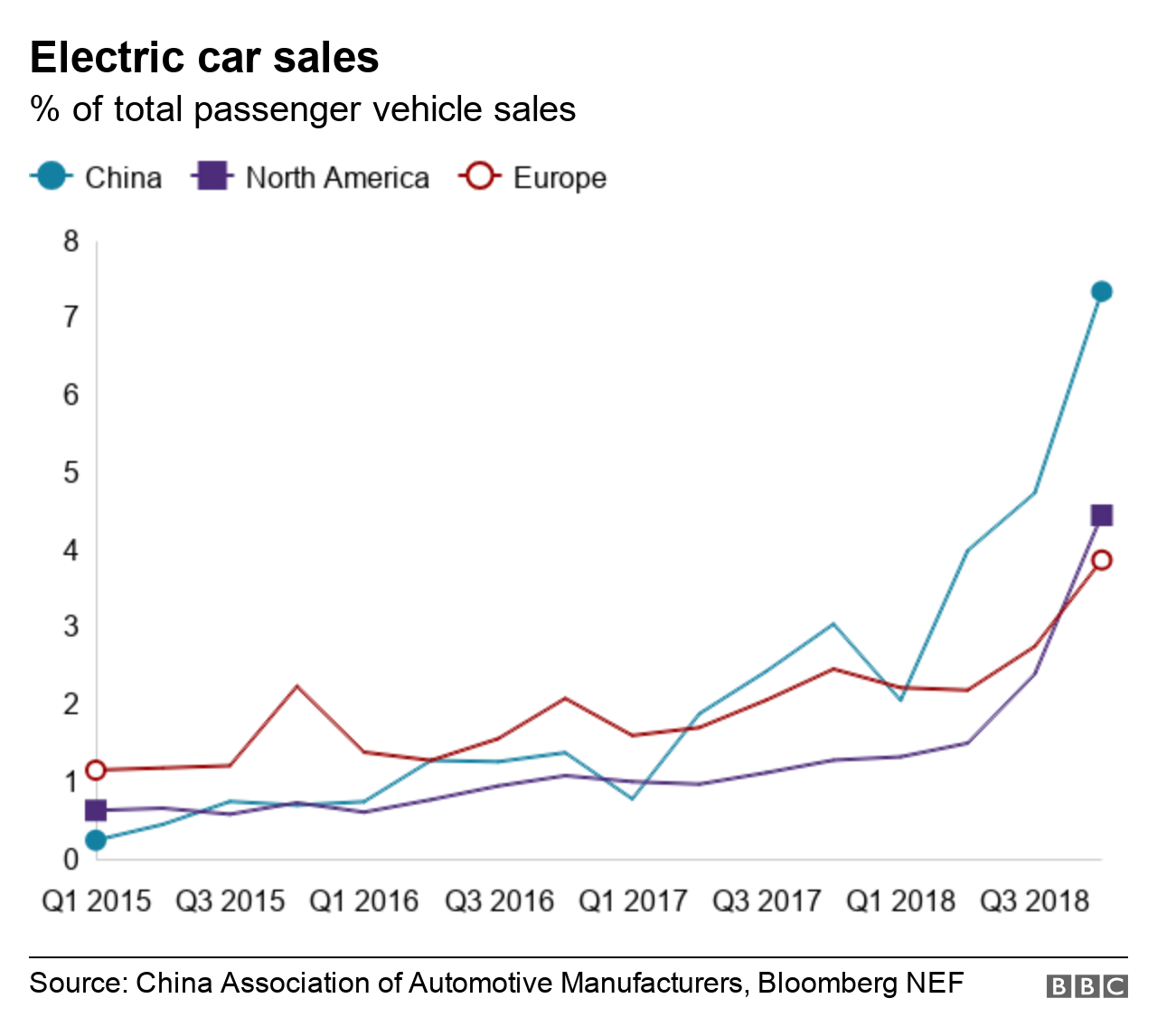

China is generally seen as the world leader in electric vehicle production, as well as the largest market for cars.

The Chinese government has encouraged production. And rules introduced in 2019 banned setting up companies that make only combustion-engine cars.

The new guidelines also mean major manufacturers could be punished for failing to meet quotas for zero-emission and low-emission cars.

In September 2018, Prime Minister Theresa May pledged, external £106m for research and development in zero-emission vehicles, new batteries and low-carbon technology.

But consumer take-up of plug-in cars is now falling behind the EU average, according to the latest figures from the European Automobile Manufacturers' Association, external.

The government has said it wants to make the UK "the best place in the world" to own an electric vehicle.

However, in 2018, it ended grants for new plug-in hybrids and the subsidy for purely electric cars was reduced from £4,500 to £3,500.

In a recent report, external, the chair of Parliament's Business Select Committee Rachel Reeves criticised the decision to remove subsidies for less polluting cars, as well as the lack of charging points in the UK.

And with relatively high purchase costs and many unknown factors surrounding the UK's charging infrastructure, motorists may need more persuasion to make the switch.

- Published22 February 2019

- Published16 February 2019

- Published19 February 2019

- Published18 February 2019