The battle between cash and mobile payments in Africa

- Published

How money is handled in Kenya and Nigeria

Nigeria might be Africa's largest economy, but when it comes to financial matters, people typically favour cash payments over technology.

Despite high mobile penetration, only 6% of the population uses mobile phones to make financial transactions.

And 60% of Nigerians still do not have a bank account, so they don't have access to digital services on offer.

In contrast, 73% of the population in Kenya have a mobile payment account.

Paga, one of Nigeria's biggest mobile money operators, operates multiple kiosks in Lagos, particularly in neighbourhoods where the nearest bank or working cash machine is simply too far away.

Every day, streams of customers visit the kiosks to pay their bills and transfer money by handing over cash, instead of using Paga's mobile app.

Cash transactions continue to dominate, partly driven by a huge informal sector excluded from financial services.

Although many people in Nigeria now have a mobile phone, some say they don't trust the technology.

They fear that if the device is stolen, their money will be too, so they prefer to handle all transactions in person.

Opposition from banks

According to Paga, another reason for Nigeria's cash dependency is that banks and telecoms providers don't want technology start-ups moving in on their turf.

Plus, until 2017, regulations meant that you couldn't transfer amounts over $10 without submitting a paper document.

"The mobile operators in Nigeria were blocking us from actually having access to their networks because they wanted to be the ones to offer mobile money," Paga's founder chief executive Tayo Oviosu told the BBC.

"In 2017, we finally got access, and I think the story of mobile money is going to pick up over the next few years."

Meanwhile in Kenya, 45 million mobile money accounts were registered by the end of 2018, according to the Central Bank of Kenya.

The leading mobile money wallet service there is M-Pesa, which was set up in 2007.

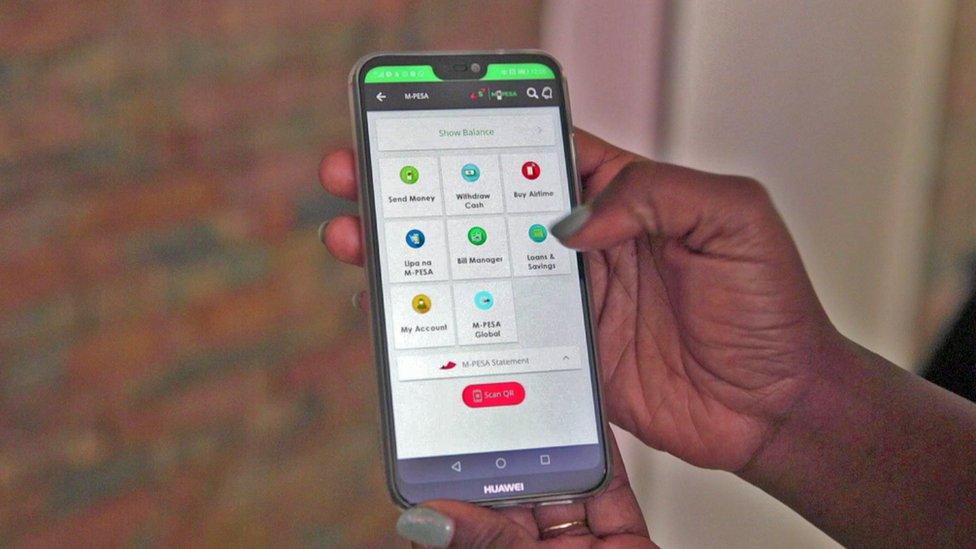

In Kenya, 21 million people are using Safaricom's M-Pesa mobile payments app

People use the service to send money from their mobile phone to other account holders, as well as to pay bills and take out loans.

According to M-Pesa's creator Safaricom, the service now has over 21 million active users carrying out more than 17 million transactions a day.

The telecoms provider, owned by Vodafone, now wants to offer M-Pesa to the rest of the continent, but there is resistance to mobile payments from some African nations.

"The reason you find it has failed [in some African countries] is that the banks are really good at lobbying against competition," Safaricom's chief executive Bob Collymore told the BBC.

"It's a bit short-sighted, because if you look at Kenya, the banks that really work are the ones that work with M-Pesa.

"We don't really see ourselves in competition with banks, we see ourselves in competition with cash."

- Published31 January 2019

- Published31 January 2019