Bullring owner Hammerson plans sell-offs amid losses

- Published

- comments

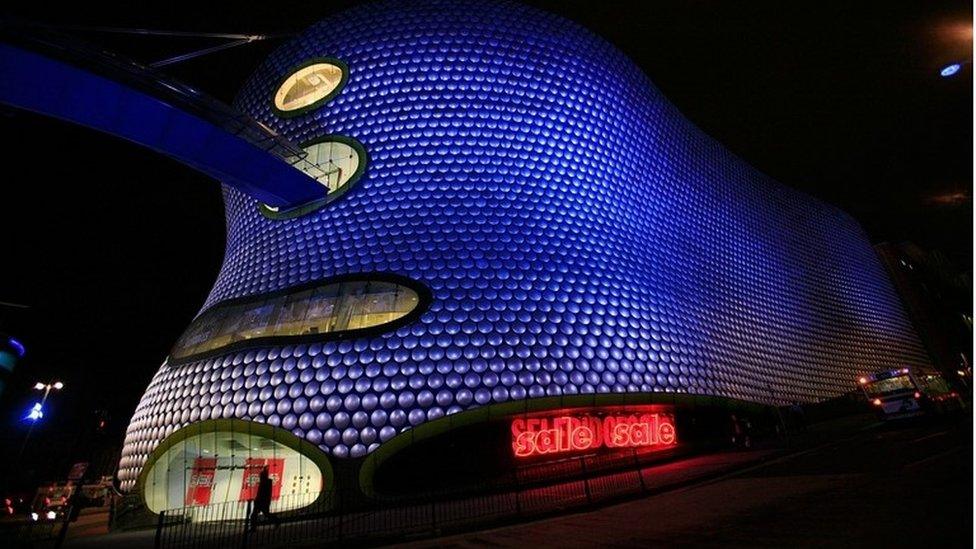

Selfridges at Birmingham's Bullring shopping centre

Shopping centre owner Hammerson, owner of Birmingham's Bullring, has reported an annual loss and says it will sell off more assets as it tries to cut its debt burden.

The firm, which also owns the Bicester Village designer outlet and London's Brent Cross centre, is targeting more than £500m of disposals for 2019.

The announcement came as it unveiled its 2018 results, showing a pre-tax loss of £266.7m.

In 2017, it made a £413m profit.

Contributing factors included a £79.9m loss on the sale of properties and a £161.4m loss on the revaluation of properties that it still holds.

Chief executive David Atkins said 2018 had been "a tough year, particularly in the UK", after a number of high-profile retailers went into administration.

"Tenant failures, the structural shift in retail and a more considered consumer created a difficult operating environment, putting pressure on property values."

Shareholder value

Hammerson said net rental income had fallen by 1.3% at its UK flagship destinations and by 4.3% at retail parks.

The value of its portfolio shrank by 5.9% to £9.94bn. Its properties fell in value by an average of 4% during 2018, including a reduction in UK values of 11%.

Its latest sell-off plan comes on the back of asset disposals worth £570m in 2018.

Hammerson said its board had been in discussion with key shareholders and had entered into a "relationship agreement" with activist investor Elliott Advisors, which holds a significant stake in the company.

Elliott issued a statement welcoming Hammerson's moves, which include a decision to recruit two additional independent non-executive directors.

Elliott said: "This increased focus on strategic disposals, as marked by updated targets for 2019 and a current pipeline of potential sales of over £900m, signals a positive development in the company's progress, and its ability to ensure that its portfolio of high-quality assets delivers compelling value for all shareholders."

Analysts at Liberum Capital praised management's "open-minded" approach to increasing the level of sell-offs, but warned that getting a decent price for "non-core assets" might prove difficult in the current climate.

"The trading backdrop for retail remains challenging, with valuation declines accelerating, and this is likely to continue to weigh on Hammerson returns," it added.

- Published21 February 2019

- Published19 February 2019

- Published18 April 2018