Paperchase proposes store closures to cut costs

- Published

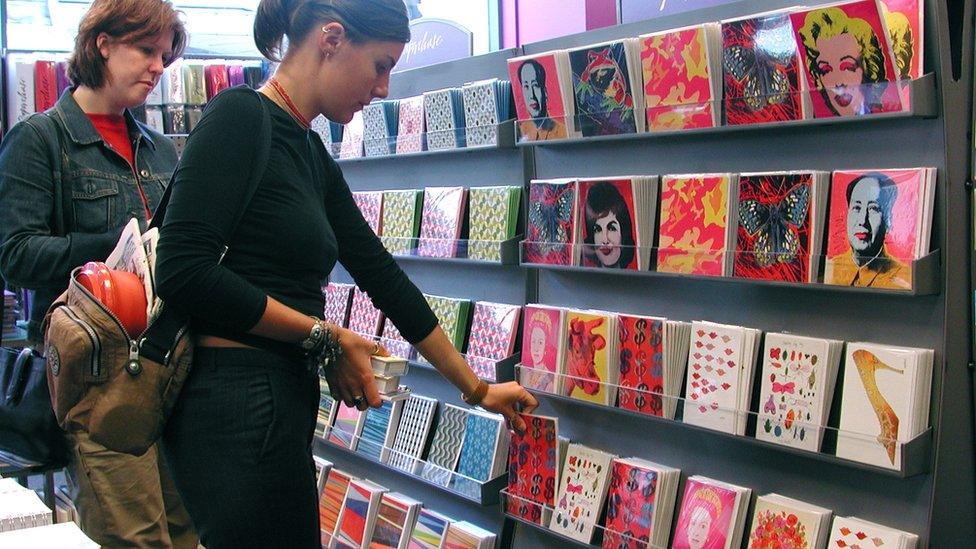

Stationer Paperchase has proposed a restructuring that involves the closure of five of its 145 stores.

Another 23 stores will be at risk as it tries to cut their rents by 50%.

The retailer is involved in a company voluntary arrangement (CVA) renegotiating terms with its creditors.

Paperchase has been hit by fewer customers, increased rents and business rates, and higher costs due to the fall in the value of the pound.

Pre-tax profits fell from just over £600,000 in 2017 to a loss of £6.3 million last year, according to accounts filed at Companies House, external.

However, turnover increased 6% thanks to growth in its online and international business.

The company is proposing linking some of its rents to store sales.

Paperchase's parent company Primary Capital called in advisers from KPMG to explore a potential CVA last month.

Will Wright, restructuring partner at KPMG and proposed supervisor of the CVA, said the deal gives the firm "the ability to rationalise its store portfolio by exiting stores that are unprofitable, secure rent reductions where stores are over-rented and implement turnover rents to reflect the highly seasonal nature of the business."

Creditors will vote on the proposals on 22 March. Paperchase needs to secure at least 75% creditor approval for the CVA to go ahead.

- Published29 December 2018

- Published17 November 2016

- Published20 November 2017