Kingfisher boss to go as profits fall further

- Published

The boss of struggling DIY group, Kingfisher, which owns B&Q and Screwfix, is to step down amid worsening profits.

Veronique Laury, who had been overseeing a turnaround plan, will leave the company, although no date was given for her departure.

Profits fell 13% over the last year, with the firm's French chain, Castorama, dragging down sales.

The firm also announced it would close all 19 Screwfix outlets in Germany.

It said it was considering the closure of 15 further stores across the group.

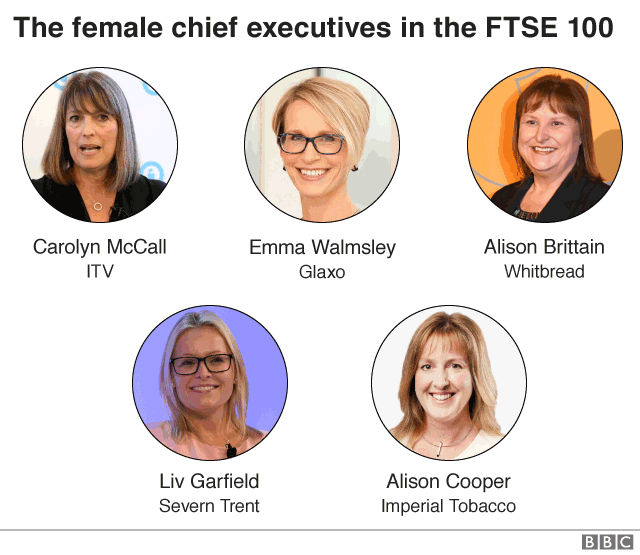

Kingfisher said Ms Laury would remain at the firm until a successor was found. She has been in the role since December 2014. Her departure will leave only five other female chief executives in the FTSE 100.

Ms Laury's turnaround strategy for the group, dubbed "One Kingfisher", is set to cost £800m over five years.

It involves unifying product ranges across brands, boosting e-commerce and seeking efficiency savings.

However, doubts were raised over Ms Laury's future at the DIY group after sales continued to flag three years into the new strategy. The group's shares have fallen 27% over the last year.

Ms Laury said: "Leading the transformation has been so exciting but also very challenging.

"As the transformation approaches its final year, I believe it is right for someone else to lead the next phase of the One Kingfisher journey."

Kingfisher, which also owns the Castorama and Brico Dépôt chains in France, said sales at existing stores, known as like-for-like sales, fell 1.6% over the year, although overall sales were 0.3% up.

But while overall sales at B&Q fell 2.8%, the group's other UK-based chain, Screwfix, has performed strongly, with a 10% rise in sales. While B&Q targets home DIY enthusiasts, Screwfix caters to trade customers, such as plumbers and electricians.

Neil Wilson, analyst at Markets.com, said that while Screwfix's success was down to its specialist trade desks, B&Q was facing a Brexit-related impact on consumer confidence, reducing spending on big purchases.

"It's a tough game to be in and perhaps, with the slowdown in the secondary housing market, people are not replacing kitchen and bathroom suites as often," he added.

Julie Palmer, partner at Begbies Traynor, said: "The contrast between B&Q's 'stack them high' retail policy and Screwfix's one-to-one service with expert advice from the sales assistants is marked. This approach appears to have created a very loyal customer base."

Brico Dépôt's positive record in France and Poland was offset by the French chain Castorama, which continued to underperform.

In November, the firm announced it was pulling out of Russia, Spain and Portugal altogether, as part of the plan to simplify the business.

Underlying profit fell 13% to £693m. But when costs including £111m for store closures were included, profits were 52.8% lower for the year to the end of January.

Kingfisher said it would continue to expand the Screwfix chain, increasing its store target from 700 to about 800 outlets. The brand will be launched in Ireland this year.

Ms Palmer said the results gave "little hope to investors", pointing to "tumultuous market conditions" and civil unrest in France.

"The group will now be facing growing pressure to hold on to its prized assets, B&Q and Screwfix, which have seen vultures circling for some time," she added.

- Published16 August 2018

- Published28 January 2019