Lyft valued at $24bn ahead of share market debut

- Published

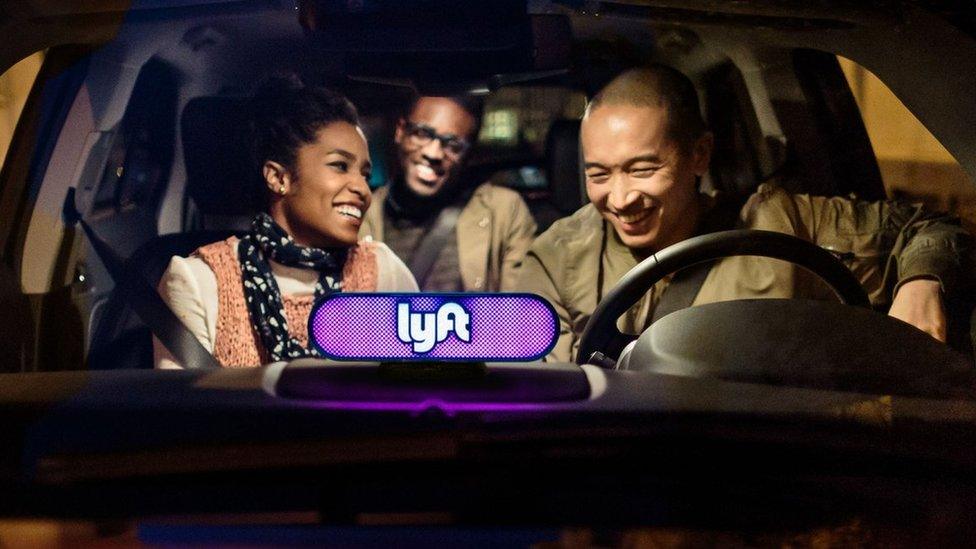

Watch: Lyft arrives at the US stock exchange

Shares in taxi-hailing firm Lyft have been priced at $72 amid strong demand, valuing the firm at $24.3bn (£18.6bn).

That makes it the largest company to go public since China's Alibaba in 2014. Lyft's shares will start trading on the tech-dominated Nasdaq index on Friday.

The flotation values the combined stake of founders Logan Green and John Zimmer at $1bn. Drivers will be given $1,000, to be taken as cash or shares.

Lyft's main rival, Uber, is expected to sell its shares publicly this year.

Technology-based firms Pinterest, Slack, and Postmates, are also scheduled to make their market debuts this year.

Earlier in the week, Lyft increased the indicative price range for its share offer to $70-$72 a share, up from $62-$68 previously.

Analysis:

By Michelle Fleury, New York business correspondent

Lyft's stock sale is a big moment for the tech industry.

Shares in the ride-hailing company were priced at $72 a piece. This was at the high end of expectations. It suggests a strong appetite from investors ahead of the company's first day of trading as a public company.

For a firm that is not yet profitable, it provides validation of its business model, one that has established it as the number two player in the US.

Wall Street is clearly eager to take part in the massive growth in the ride-sharing industry. That bodes well for Lyft's rival, Uber, which looks set to make its debut soon on the New York Stock Exchange.

But there are risks, including regulatory uncertainty as well as the fierce competition likely to emerge as the autonomous vehicle market develops.

And given its dual-class share structure (Lyft is keeping voting control), investors are buying a little piece of a company in which they will have almost no say.

Logan Green - who co-founded Lyft with John Zimmer

Lyft was launched in 2012 by technology entrepreneurs Mr Zimmer and Mr Green, three years after Uber was founded.

It remains the smaller company, with a limited international presence. Uber is expected to be valued at about $120bn when it goes public.

However, Lyft's profile has risen over the last few years, as its larger rival has been hit by controversy surrounding its aggressive corporate culture and data collection practices.

Lyft now accounts for about 39% of the ride-share market in the US, up from about 22% in 2016, the company says.

Its revenues doubled in 2018 to reach $2.2bn, compared with $1.1bn in 2017, according to its filing with the US Securities and Exchange Commission.

However, its losses also increased. The company lost $911m in 2018, up from $688m in 2017.

Gervais Williams, senior executive director at investment group Miton, told the BBC's Today programme that 30 years ago only about one-fifth of companies floating on the market were unprofitable, but now it is about four-fifths.

He said it showed that investors wanted to be involved in companies that are building market share, but he worries "they don't have sustainability" and investors' attitudes could change quite quickly if there is a downturn.

- Published6 December 2018

- Published26 January 2018

- Published15 May 2017

- Published1 March 2019