What is Revolut?

- Published

British financial technology company Revolut has been in the news frequently in recent months.

The firm, which provides mobile app-based current accounts as an alternative to physical banks, has been referred by some as a "tech super star".

Why is Revolut so controversial?

What is Revolut?

Revolut offers a range of digital banking services in a mobile app targeted at young tech-savvy users, including:

Transferring money abroad in 29 currencies

A pre-paid debit card that enables cash machine withdrawals in 120 countries

A crypto-currency exchange allowing users to convert currencies into Bitcoin, Litecoin, Ethereum, Bitcoin Cash or XRP

Vaults for budgeting and saving money

Mobile phone and overseas medical insurance

With standard accounts, users get a free UK current account and a free euro IBAN account. There are no fees on exchanging in 24 currencies, up to £5,000 a month, and you can withdraw up to £200 a month from cash machines.

Revolut also offers monthly subscription plans with higher thresholds for no fees, as well as instant access to crypto-currencies, cash back, travel and concierge service.

Revolut's services are currently only available in Europe, but the firm has plans to expand into North America, Australia, Singapore and Hong Kong soon.

It was not a bank when it started, but Revolut announced in December that it had been granted an EU banking licence by the European Central Bank. It still aims to acquire a full UK banking licence.

It has already attained the status of a tech "unicorn" - a term used to describe private start-ups valued at more than $1bn (£740m).

Who founded Revolut?

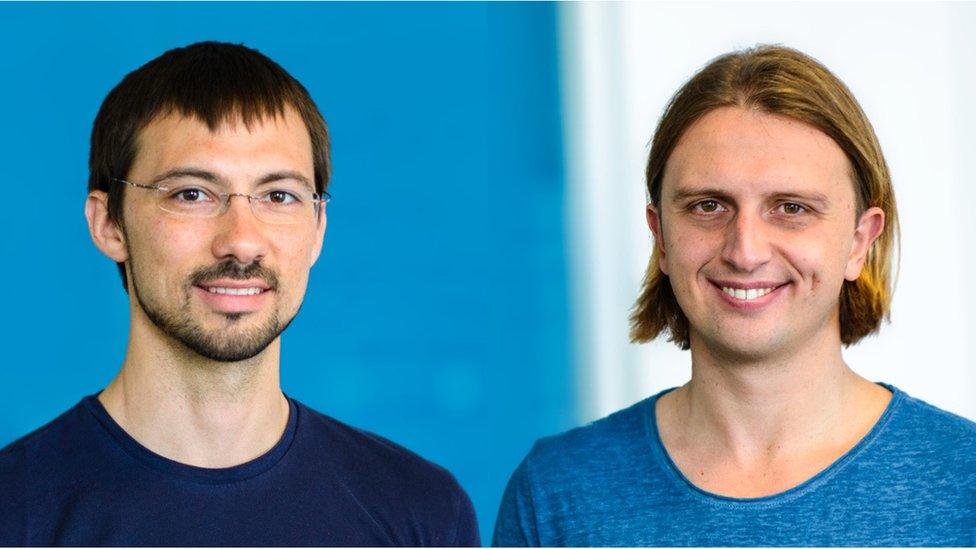

Revolut's founders Vlad Yatsenko and Nikolay Storonsky

Revolut was founded by Nikolay Storonsky and Vlad Yatsenko. Mr Storonsky is Russian-born, but carries a British passport and has lived in the UK since the age of 20.

Mr Yatsenko is Ukranian British, and has lived in the UK since 2010.

Mr Yatsenko and Mr Storonsky created start-up Revolut and launched it in July 2015 at the Level39 tech accelerator in Canary Wharf.

Prior to setting up Revolut, Mr Storonsky worked for Credit Suisse and Lehman Brothers, while Mr Yatsenko spent five years building financial systems for major investment banks.

The duo said that they started Revolut because they were frustrated with the fact that traditional banks were taking so long to introduce digital banking services for younger customers, who prefer to access most services through their smartphones.

Mr Yatsenko serves as Revolut's chief technology officer, while Mr Storonsky is chief executive of the firm.

How big is Revolut?

As of March, Revolut says it reached 4.5 million customers - 1.6 million customers are located in the UK alone.

Revolut is currently valued at $1.7bn (£1.3bn) from its most recent fundraising.

The three-year-old firm's growth has been impressive - its customer numbers trebled to 1.2 million in 2017, while revenues increased five fold to £12.8m.

In September, Revolut said 7,000 new accounts were being opened a day, and that it was processing $3bn in transactions a month.

Why has Revolut been in the headlines so much?

In February, Revolut launched an advertising campaign featuring an ad that highlighted the number of people who ordered a takeaway meal for one on Valentine's Day in 2018.

The ad, which asked, "You ok, hun?", sparked a backlash on Twitter. Revolut was accused of "shaming" single people and being both "intrusive" and "tone-deaf".

It then turned out that the ad - which said 12,750 people ordered a single takeaway meal on Valentine's Day - was using fictitious figures.

Several people complained to the Advertising Standards Authority (ASA) about the advert, but since it was outside the ASA's scope, it referred the matter to the FCA.

In February, the Telegraph, external said that in the summer of 2018, Revolut disabled a system designed to automatically halt transactions to individuals who matched against sanctions lists.

Sanctions lists contain the names of individuals whose assets have been frozen and include those connected with chemical weapons violations as well as members of the Islamic State.

The company's lawyers drafted a letter to the FCA about the change, but it was never sent.

This draft letter was later leaked to journalists.

In the letter, which the BBC has seen, Revolut lawyers stated that the company's head of compliance technology changed systems so that transactions that potentially matched against sanctions lists were not halted.

Instead the system flagged the transaction for inspection but still allowed it to go through.

Revolut told the BBC that: "At no point did Revolut stop checking transactions for sanctions compliance last year. Nor was there any failure in our sanctions screening procedures."

Why did Revolut's chief financial officer resign?

On 28 February, it was reported that Revolut's chief financial officer Peter O'Higgins was stepping down after spending three years with the company.

Mr Storonsky wrote in a blog post, external on 1 March that Mr O'Higgins had decided to step down because he felt that the business would "require someone with global retail banking experience" as Revolut applied to become a licensed bank in multiple jurisdictions.

Media reports at the time suggested that the timing of Mr O'Higgins' resignation was to do with the allegations made against it, but the company stoutly denies it.

"Any suggestion that Peter's resignation is in any way, shape or form connected to this roll-out is utterly false and damaging," wrote Mr Storonsky in his blog.

"Peter has since expressed to me that he has been hurt by this suggestion and sad that his departure has been tainted in this way."

What has the BBC discovered?

A BBC investigation has discovered that a Revolut employee made a complaint to the FCA in 2016, asking it to investigate the compliance of Revolut and the conduct of its chief executive.

The whistleblower told the BBC that Revolut's systems for flagging suspect payments were "utterly inadequate".

Revolut denied the allegation and told the BBC this was "the first time Revolut has been made aware of any such complaint, which appears to have been made by a former employee who left the company several years ago."

The BBC understands that in the past three years, Revolut has seen the departure of two chief risk officers, two money laundering reporting officers, a chief compliance officer and a chief finance officer, amongst other roles.

- Published2 April 2019

- Published8 February 2019

- Published4 February 2019